Service Corp International 1Q23: Company Comment

We revisit Service Corp fundamentals as reflected in 1Q23 numbers as SCI is quite healthy even after a pandemic.

“Say it isn’t so, Joe.”

We update the steady and solid financial trend lines for SCI after a stressful and challenging COVID period, where the company rose to the occasion and adapted to events.

With a market cap of over $10 bn and total debt over $4 bn across HY bonds, and a multi-billion term loan and revolver, this company sits in a lot of portfolios and loan books.

In credit, SCI remains a stable core BB holding for those looking for more diverse cyclical exposures.

In this commentary, we update the operating and financial profile of Service Corp International (SCI). SCI remains under-researched overall given its distinctive business mix (there is no “II All Star” category for funeral homes and cemeteries), but the company delivers oceans of disclosure to tell its story and has always been active on the road show and investor meeting circuit.

SCI’s bonds are in the mid/lower tier of the BB index even if a good case could be made for higher ratings. SCI has a clean bond maturity schedule out through 2027 with the highest coupon at 5.125% on the 2029 bonds. The company also recently extended its term loan and revolver from 2024 to 2028.

The 2030-2031 bonds trade well inside the BB tier composite, so the market sees the strength in the name. SCI presents less cyclical risk to go with some longer-term stability tied into the demographic profile of the customer base. That includes the “circle of life” effect for the baby boomer generation that is expected to pick up pace beyond the mid-decade. The broader peer group of comps could be loosely defined as “consumer discretionary” (with the notable exception of the direct recipient of the service package), so that is a useful frame of reference other than the broad market.

The overall financial metrics profile and business line risk presents a lower risk profile than the mid/low BB tier ratings. The structural risks are less favorable with the absence of subsidiary guarantees on the bonds. The unsecured nature of the bank lines are explainable by the subsidiary guarantees which give structural seniority to the loans.

The new $2.175 bn credit agreement reached in Jan 2023 replaced the former agreement ($1.65 billion with a May 2024 maturity). The new deal came with an upsizing of the total including a $675 million term loan and $1.5 bn facility (vs. the $1 bn revolver lined up in May 2019). The new deal in Jan 2023 saw easing of covenants with a hike in the leverage limit to 5.0x along with a removal of the interest coverage floor (see balance sheet section below).

Clearly the banks are comfortable with the risk profile looking ahead into uncertain economic times. We are also comfortable with the positioning of SCI based on more than a few years of watching this company grow and get past some rough patches.

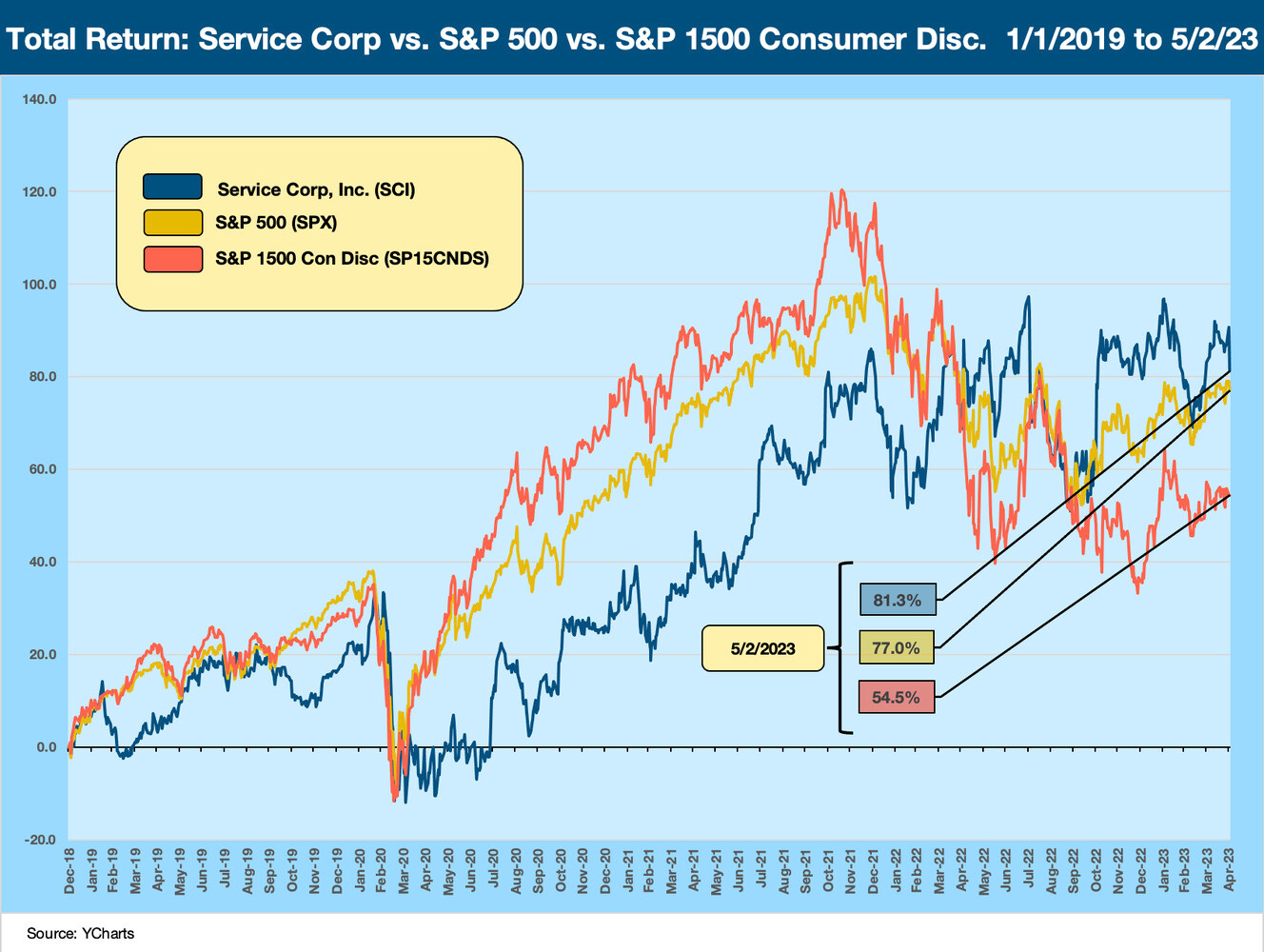

The stock performances we lay out in the charts below tells an impressive story, the OAS bond levels are below the composite BB index, and positive actions by lenders on the bank lines all should be a source of reassurance on the way into uncertain times.

Given the stock chart above since the start of the post-2009 expansion, there is obviously a lot going right in a company that is essentially a peer group of one in its size bracket. Whether by income statement or balance sheet, there is no one like it in the fragmented funeral industry. There is no direct industry comp for a company with SCI’s active trading profile and refinancing activity in the debt and loan markets. The company qualifies as a Midcap 400 index member positioned in the upper tier based on market cap. SCI has five HY bonds in the index totaling just under $3bn.

For a more recent timeline, we include the above chart showing the SCI performance since 2019 across COVID and how the SCI risk perception in the market trended across 2020 and into 2021.

The big worry about SCI during the worst of the pandemic was around how the company could operate in the midst of shutdowns for nonessential services. No one wants to think back to that 2020 period, but the inability of families to even visit the sick and dying in the hospitals tells a brutal story. Public gatherings (wakes/funerals) in the immediate aftermath of the death was not an option. We see that stretch of material underperformance for SCI equity in that early pandemic period.

The adjustment of services options saw SCI go into heavy innovation mode, but the vaccine and regional pushback on closures took over the volume story after fall 2020. For the 9-month period through YTD 3Q20 just ahead of the vaccine, SCI was still able to post up 26% operating margins on a revenue line for three quarters that saw Funeral and Cemetery revenues rise despite the obstacles to many services. The 2Q20 period, when the peak of the panic was on, funeral revenues were essentially flat YoY and operating margins rose. Cemetery revenues rose and margins were essentially flat.

That painful period did not derail families and friends from celebrating lives even if at a lag. The variations of offerings ran the gamut from video and online services to drive-throughs in various locations. In many cases the services were delayed, and many had been paid for via trust and insurance products used by SCI. We will leave the insurance and trust products and related revenue recognition questions to a bigger Credit Profile on the company at a later date.

We have looked at the range of trust and insurance and accounting topics in past lives, and we have watched the company on and off since the 1980s when it was a Lehman client. We then later followed SCI around the end of the late 1990s credit cycle as the company’s overexpansion on a global scale set off a lot of credit volatility. That was before SCI retrenched to a US-centric operation.

SCI then went on the steady upward rise in value shown in the earlier post-2009 stock chart. We were covering the company during the pandemic (while working remotely) and during the later 1990s on the way into the swoon that saw SCI stock dip below $2 after SCI booked almost $2 bn in charges. SCI has had its house in order ever since.

SCI by the numbers…

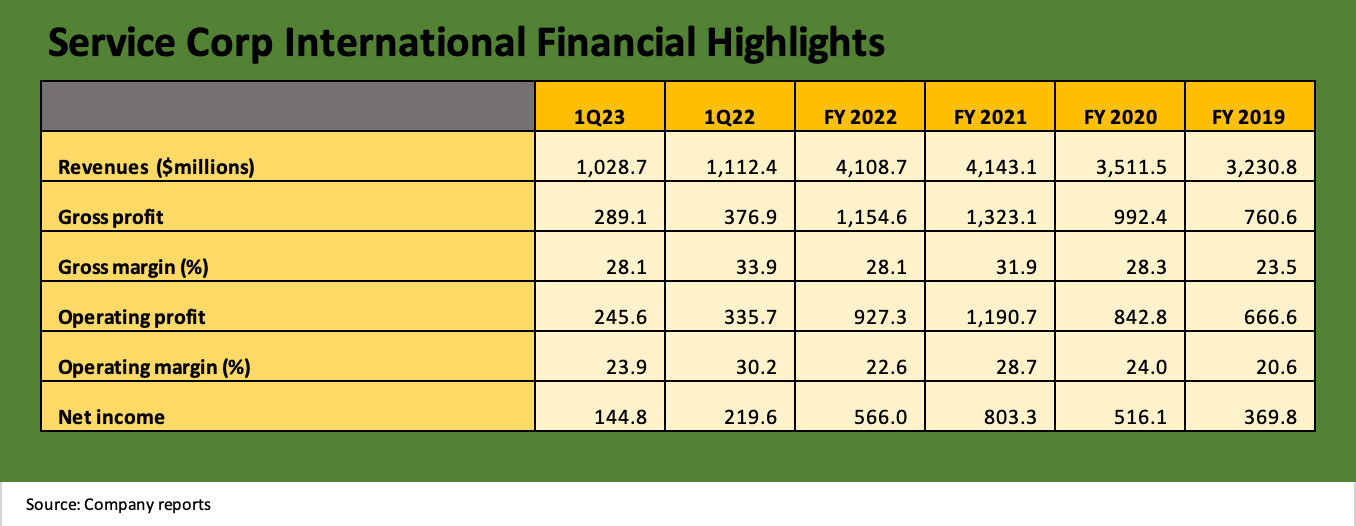

In the following series of tables, we look at the consolidated financial numbers of SCI and dig into the operating lines of its two major segments – Funerals and Cemeteries. The main takeaway from the company is the slow and steady, consistent growth and high margins. These strengths offer a lot of flexibility around share buybacks and recurring, small bolt-on acquisitions of funeral home operations or cemetery assets to its core funeral and cemetery segments. The first three tables below focus on the income statement and segments and the last two on the cash flow line items and balance sheet.

The above table details the trend line in revenues and margins for SCI across a period that saw a deadly pandemic and extremely volatile markets. Some explainable distortions across the pandemic provide some color on the 1Q22 numbers and the decline into 1Q23. The 1Q22 quarter still was impacted by the high rate of lingering pandemic activity.

We looked back at 1Q19 line items as well across the consolidated and segment results. While we did not break out 1Q19 numbers here, the comparison we did shows the material growth from 1Q19 to 1Q23. Total Cemetery revenues for 1Q23 came in at +37% vs. 1Q19 while gross profit was +62%. Funerals came in at +24% for revenues and +42% for gross profit.

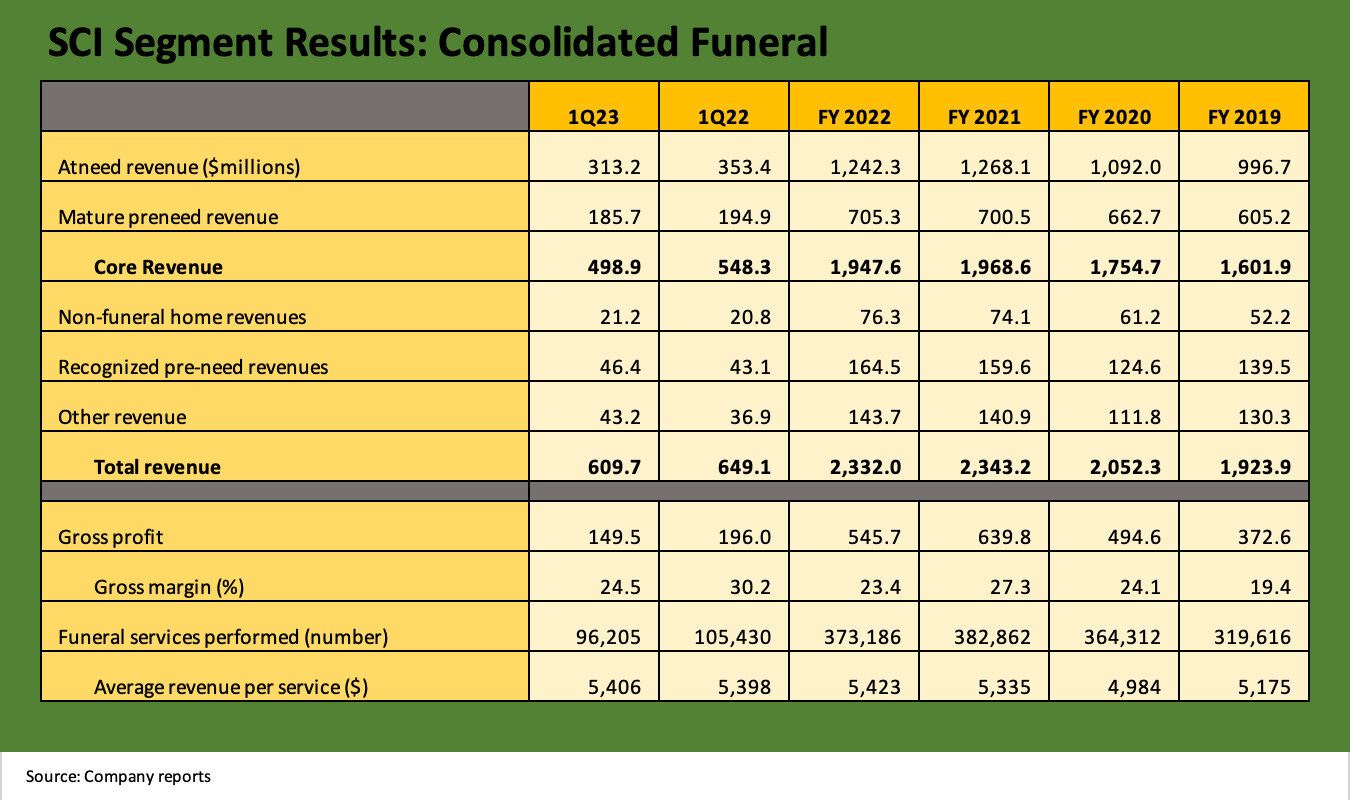

The above table breaks out the annual funeral operations segment since 2019 and into the interim comparison of 1Q23 and 1Q22. The business is not that mysterious in that it is a “price x volume” business with an asterisk for the product mix (high end, high price celebrations vs. a simple cremation, etc.). The peak margins in 2021 make some sense with the vaccines available and re-openings underway, gatherings possible, and the death fallout from COVID still high as the Delta variant rolled in during 2021. SCI also presents comparable data since the company is always active in adding facilities.

For those less familiar with the history of SCI acquisition activity, SCI is regularly adding facilities and the local brand names are retained. The branding of “Dignity Memorial” is highly visible and leveraged for their growing online presence and sales force, but the traditions and community recognition has well recognized value. All one has to do is “google” Dignity Memorial and check out what is in your area. For example, SCI owns some upscale Manhattan funeral homes where many do not even know SCI owns them. The reality is that most consumers do not know the Service Corp brand but instead know the local name. The branding cuts across ethnicities, religions, and languages down to the local level.

These acquisitions are a form of capex and include some capex on the other side of the deal. For many sellers, this is about estate planning and cashing in on some established brand value while continuing to be employed or simply stepping back. It is a system and a strategy that has been proven across time. The economic logic with supplier chain and investments in facilities/cemeteries is intuitive. They also can leverage the sales force and digital tools.

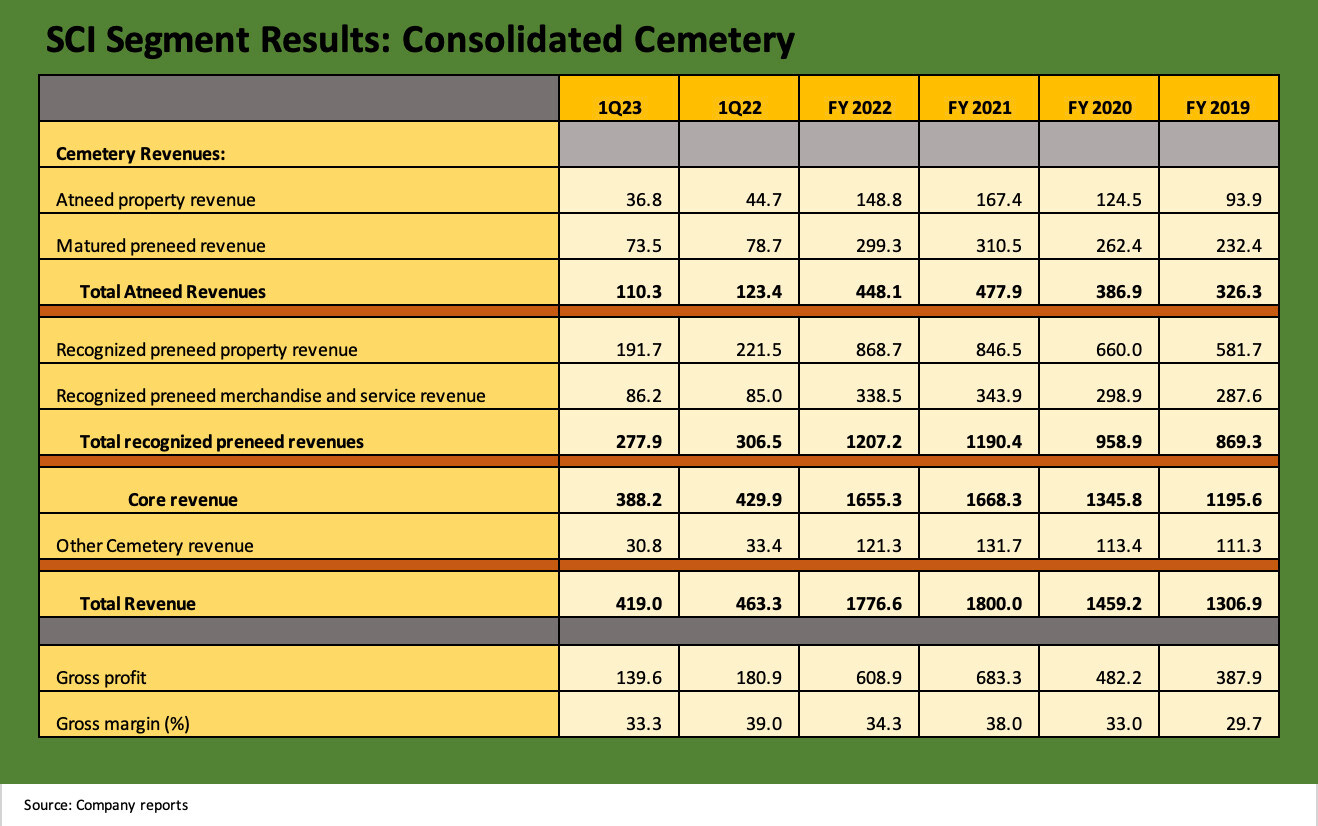

The segment tables above and below frame the revenue and profit lines for cemetery operations. The cemetery operations tend to be key drivers of GAAP revenue and profitability since the sale can be recognized before the plot is put into service. Segment margins are higher than funerals. The capital intensity is high as we frame further below. SCI saw peak Cemetery profit results in FY 2021. The good news for SCI shareholders and lenders/bondholders (and bad news for some future customer) is the long term trend is steadily higher.

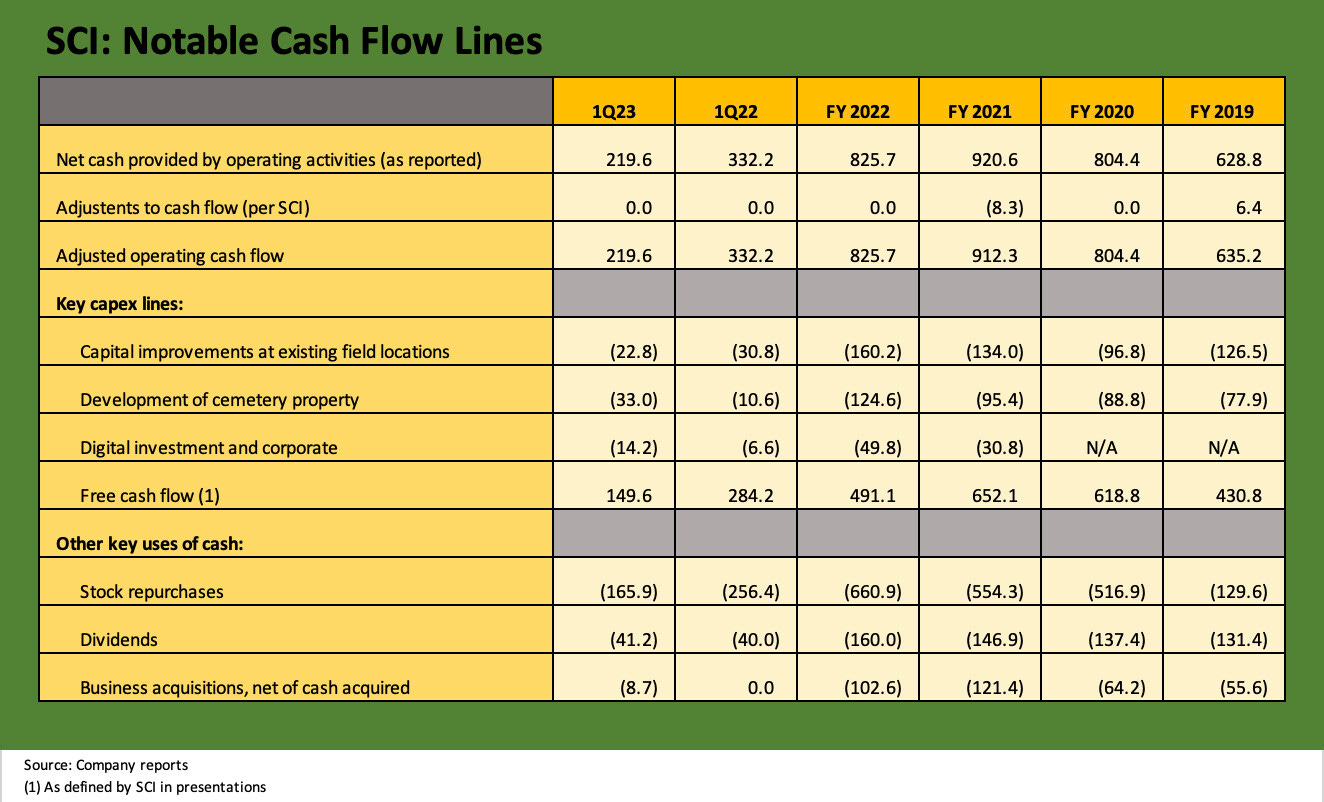

The above table frames adjusted operating cash flow (lifted from the financial statements) plus some minor adjustments as defined by SCI as they routinely maintain and develop facilities and cemetery properties. We then deduct some of the line items used by SCI in their definition of free cash flow. Those lines are more about maintenance capex and fine tuning. The corporate and digital line item that we break out in the chart is newer and speaks to SCI’s very well developed sales and marketing efforts and adapting to new customer strategies.

As someone who has covered a lot of capex intensive cyclical manufacturers over the years, the capex intensity of the funeral home business stands out. For the past four fiscal years, Capex % Revenues has averaged around 7.5% and hit 9% in 2022 as they ramped up investment after the pandemic. SCI can do this since they have high margins. As the solid Operating Cash Flow and stable leverage highlight, the ability to take care of shareholder rewards while running accretive capex plans and acquisitions is clear in the numbers.

From a practical standpoint, SCIs cash deployment toward small acquisitions is a regular part of life just as we see in some other fragmented consolidating industries (auto dealers). We often see private small operations cash out or engage in estate planning (“the kids” do not aways want to go into the funeral business). SCI is a steady and reliable buyer of assets at a haircut that they will in turn generate into a higher multiple operation on the other side of the deal.

The last table looks at the debt history and the credit agreement covenant compliance across the years. SCI discloses these in the financials along the way. We include the leverage test that was recently raised to 5.0x with the new credit agreement from Jan 2023 ($1.5 bn revolver + $675 mn term loan due Jan 2028). The old test was 4.75x. Both the old deal and new had exceptions for qualified acquisitions.

We only include the interest coverage covenant for information purposes since the interest coverage floor was dropped from the new credit agreement. As one can see in the table, they never came close on the interest coverage and did not reach a 4 handle at FY year end dates on the leverage.

We should highlight that a sub-4x handle on leverage for such a high free cash flow generator would be worthy of higher credit ratings. The EV multiple valuation some street stock players see as appropriate is in low teens. That stands out against a 3x handle leverage metric or even a 4-handle level.

One off-market variable with SCI is that there are no subsidiary guarantees on the bonds while the bank loans are unsecured but have the comfort of the subsidiary guarantees. An unsecured bank line is a compliment by the banks to the credit quality at the subsidiary-guarantee level even if they are at the top of the capital structure food chain.

That unsecured and guarantor loan structure has always struck us as odd for a HY name since they might have cleaned up all the bank lines and termed out all the bonds in the risk boom. They would be sitting on at least high BB unsecured ratings with a shot at IG ratings like in “the old days.”

The assumption is their approach has worked masterfully across some tumultuous times and their share price and credit market access has not been a problem. They have locked in low coupons and have very favorable financial flexibility. So why change? Hard to argue with that.

There is a lot to look at in the nuances of the company’s interplay with trust assets, insurance policies, preneed receivables, and the liability side of those lines (deferred revenues, trusts’ corpus, etc). We have commented on those in reports in the past (not this forum), but those details are for a more expansive report. Those line items have withstood the test of time, intensive regulation, and wild swings in capital market conditions. Through it all, SCI just gets bigger and stays very healthy.

At last 10K date, around 16% for funeral + cemetery in North America. There is not much to buy in their space in size, and it is still very fragmented. They bought the Loewen legacy entity back in 2006 (#2 Alderwoods). They are very tightly regulated on antitrust and monitored on that at the state and local level since that is where the pricing power would be. People are often surprised how tightly they are regulated in numerous aspects (antitrust, trusts, insurance etc.). They keep on buying "mom and pops" or very small operations every year (estate planning etc. ). Some states don't let you own both funeral and cemeteries. They keep buying back stock etc. It's a money machine.

Glenn, any sense of SCI's market share and how much more they could consolidate without antitrust concerns? Thanks