FedEx F4Q23: Company Comment

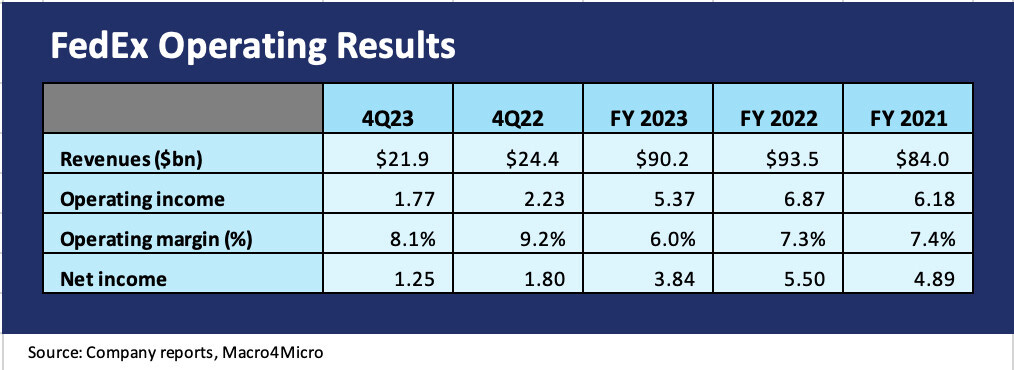

We look at FedEx F4Q23 as it frames a flattish outlook ahead and details cost cutting and shareholder enhancement.

FDX sends underwhelming signals on broader economic growth in its guidance but underscores its ability to size its cost structure accordingly.

The ability to take costs out under its DRIVE program and Network 2.0 plan allows for rationalization of fleet and broader leaning of its operations even if the top line prospects modestly disappointed equity markets.

FDX in theory can drive higher cash flow and earnings through the next few years on zero revenue growth based on cost reduction and efficiencies, and that is a decent starting point for credit stability when framed against its shareholder reward ambitions.

FedEx is always a good name to watch as a cyclical bellwether with its multitiered exposure to global and regional freight and logistics services. Economic activity translates into freight, and what FDX is saying shows little optimism on volume. In some cases, FedEx has scaled back as a matter of mix and its effort to seek more profitable volumes.

The good news for bondholders is that FDX is a name that is asset rich, operates as a systemic linchpin in the economy, and has demonstrated its ability to weather cataclysmic downturns, bank systemic stress, global trade battles, and oil spikes that literally feed into its circulatory system. We see the current mid BBB tier composite as a reasonable floor for credit quality given the balance of track record, market position, and its flexibility to move the needle on costs.

FDX has weathered more than a few doomsday bear scenarios over the years on market structure (no one will ever send a document again, Amazon will ship everything forever, etc.). The business model works and it keeps evolving. The ability to assign surcharges so freely over the years speaks to the market position of FDX and a version of pricing power that is not shared by many.

The post-COVID period may have generated more pricing power than normal on supplier chain problems, but the ability to pass on fuel costs has been a common feature of past cycles for FDX during refined product spikes. Fuel cost is not the main event right now, and the risks are more about volume and weaker unit pricing. The fear of adverse cyclical shifts is the wildcard in volume and pricing at this point.

The free cash flow (as defined by the company) before shareholder rewards will not be enough to meet the buyback and dividend plans, so the series of continuing restructuring programs are critical in sustaining its financial profile. That has been reflected in the FDX stock market recovery after it tanked in the fall. The ability to take $4 bn in costs out by 2025 and another $2 bn by 2027 are realistic for a company of this scale and its operating history across so many challenging macro backdrops.

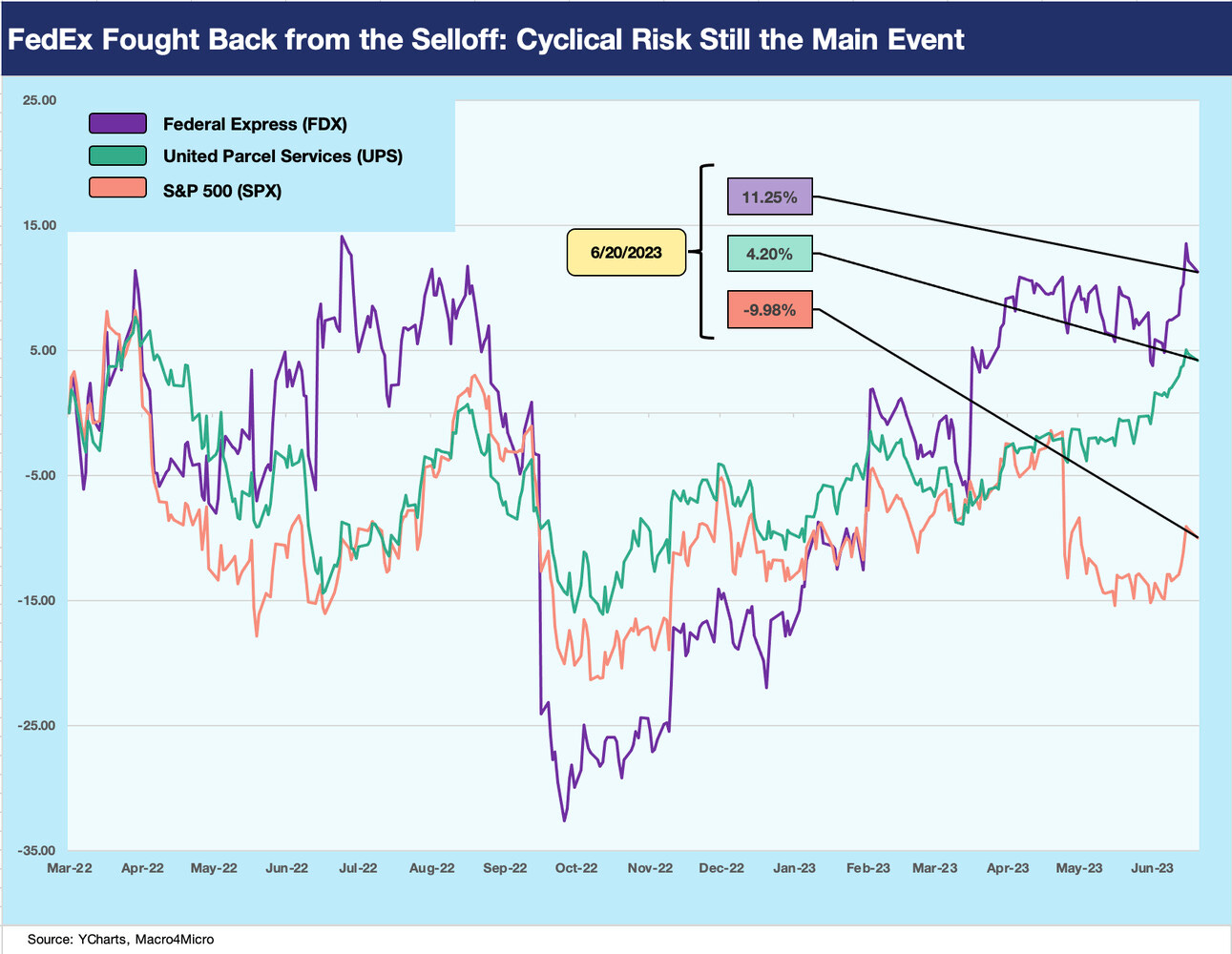

The running stock return charts above frames FDX vs. UPS and the S&P 500 since March 2022 and the end of ZIRP that month. As the crow flies from March 2022 and the start of the hiking and cyclical neurosis set in, FDX has had a wild ride. The company has outperformed UPS and the S&P 500 as it countered some disappointing setbacks after its investor day in mid-2022.

FDX is getting back on track as it wades into a multiyear cost-cutting plan and reorganization of its network strategy. UPS is the other big name in the cyclical “bellwether duo.” FDX is turning in better YTD stock return numbers despite the question marks around what the inverted UST curve is saying. We plan to keep watching both as they are useful as cyclical indicators.

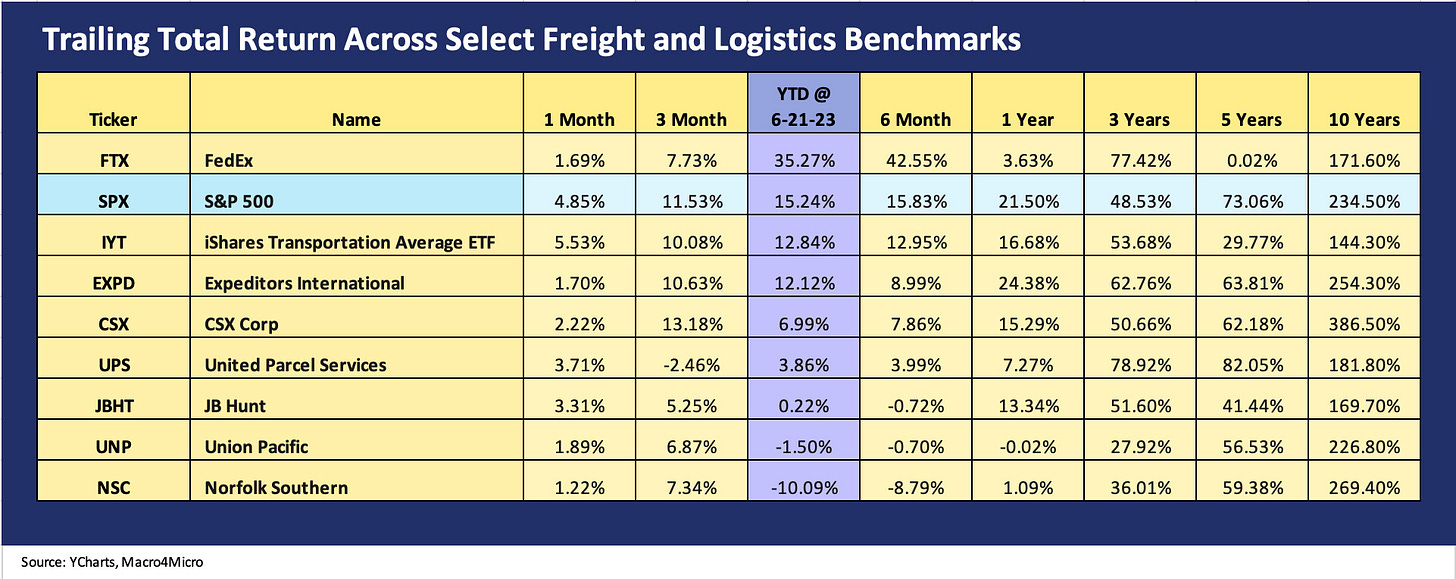

The above stock return table breaks out the details on FDX vs. a peer group of freight players as FDX mounts a comeback. FDX has a more volatile record across time and has seen more than a few bumps during those time horizons (note 1Y and 5Y horizon vs. peers). Along the way, the challenge of building out a global network (e.g., TNT acquisition and European consolidation) and dealing with a pandemic was no picnic. The global challenge arguably is more demanding for FDX than that peer group given its business mix.

Freight as a sector is intrinsically cyclical but also has its share of secular threats tied to matters such as trade policy. That said, the threats to FDX prospects are not much different than many major global operators. Trade conflict and geopolitics threatens volume, recession debates are the usual top-down risk, and the typical consumer sector questions show up across many industries in portfolio context. Stress testing FDX for some of those risks are worth framing against a wide array of companies on the same items. A recession will inflict pain on most.

Within the universe of major freight names, FDX is more exposed to international risks, and it is hard to see how those go lower and could in fact go materially higher in Asia, which is an important FDX market. Geopolitics and recession risks (international and domestic) are the obvious threats to volume and forward guidance. Europe has more than its share of cyclical questions and recurring geopolitical risks as well.

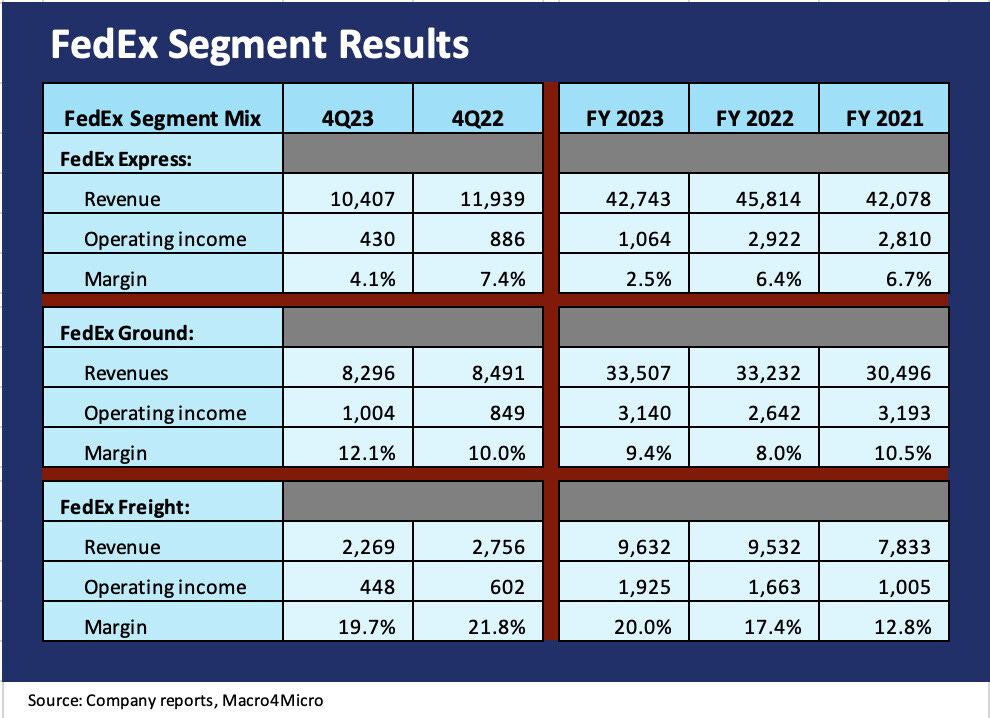

As noted in the chart above, segment results were mixed for the quarter. Only Ground posted higher margins for 4Q23 although for the full year Ground and Freight saw wider margins. The benefits of mix and cost reductions were evident in Ground, where lower revenues in 4Q23 saw higher margins. Volume declines hurt Freight revenue and earnings, but the margin impact was muted as favorable mix and unit revenue mitigated the downside margin impact. Overall, management cited volume declines and “sequential moderation in yields” across its segments.

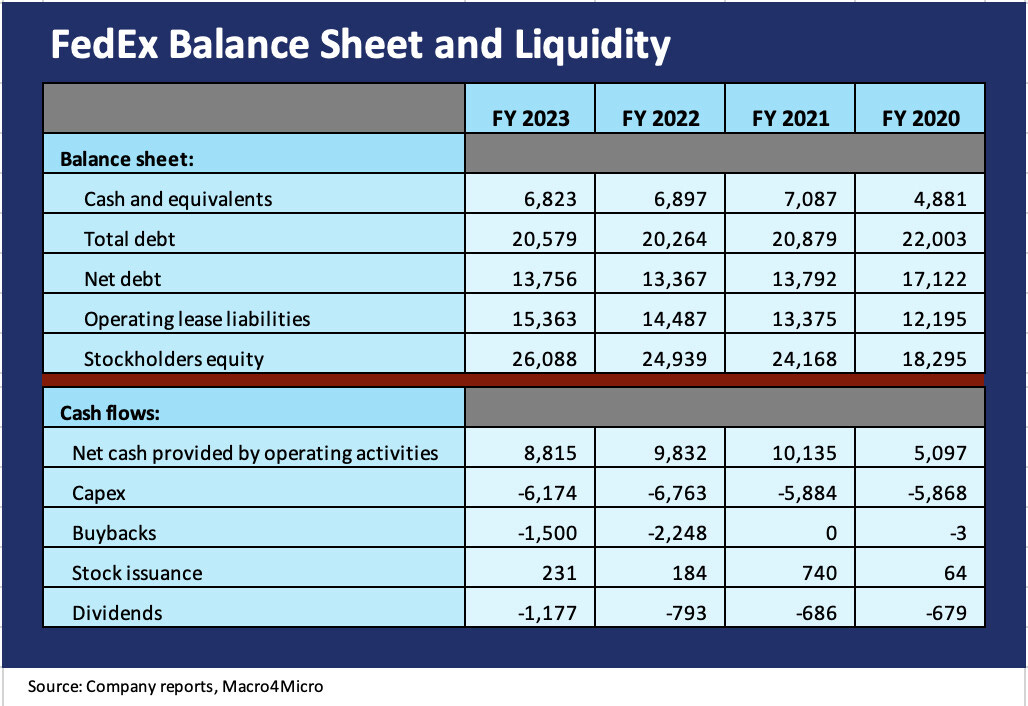

FDX balance sheet metrics have held in well enough since the pandemic, but debt levels would have been pressed in 2024 in the absence of the cost cutting programs to free up billions in cash flow to meet their shareholder ambitions. The considerable efforts of FDX dedicated to communicating the restructuring programs have so far regained some shareholder trust.

The scale of the cost benefits detailed in the programs and on the 4Q23 call are important in avoiding threats to credit quality. The $2 bn share repurchase program would have been pressing their luck on credit quality if the cash flow accretive cost reduction programs were not underway. FDX expects another $1.8 bn in savings in 2024 set against flat to low single digit revenue growth. The plan to buy back $2 bn in stock and pay out over 30% of earnings in dividends needs FDX to hit the mark on cost cutting or leverage will creep higher.