Deere F2Q23 - Company Comment

We look at Deere’s fiscal 2Q23 earnings as DE shows impressive revenue growth and margin expansion.

“Deere keeps harvesting cash.”

Deere seems to operate in its own zone as the industry leader in agricultural equipment and provides a critical source of finance to the farm belt.

Strong revenue growth, healthy margins, and rock-solid parent balance sheet make Deere a relatively easy call on credit quality even if the equity side of the ledger is struggling to frame the cyclical outlook in a challenged global market where commodities always face major moving parts.

Operating cash flow of the Equipment operations exceeds Net Debt, and Net Debt levels at the Equipment unit since 2020 have stayed in a reasonable range despite ticking higher with the buyback-heavy capital allocation program.

Deere & Co (DE) posted F1Q23 numbers that came in even stronger than expected and raised 2023 guidance for its bottom line to $9.25 bn to $9.5 bn. That net income exceeds total debt and materially excess net debt at the equipment operations. The stock price is still nervous about a fade in 2H23 with sequential declines expected after a banner 1H23, but DE maintains a stable to improving credit profile even as it continues to reward shareholders through buybacks (dividend yield is a skimpy 1.4% as of Friday). Equipment operating cash flow is expected to be in the $10 bn to $10.5 bn range or also in excess of equipment debt.

The impressive top line and segment profitability offer a reminder of how Deere pushed through the 2008-2009 credit crisis and pandemic of 2020 without missing a beat in its ability to execute on its long-term strategic priorities. The company has demonstrated it can access capital at will across the cycles and even in troubled markets to support its financial services operations while sustaining its capex programs. The financial services operation is critical to the customer base and is a core part of DE’s role as an anchor in the ag sector.

The farm belt is in a healthy place right now in terms of equipment demand and farm income after some rough patches when tariff wars ran headlong into COVID problems. Among the themes in the market is a favorable replacement cycle and healthy commodity prices given global supply-demand factors. Farm income could potentially have its second-best year, and input costs such as fuel and fertilizer carry much more weight in the ag cost picture and dwarfs interest rate impacts.

Demographics (more mouths to feed) remain a tailwind factor. Replacement cycles can be fragile, however, with debt ceiling threats and geopolitical and trade clashes that often reverberate back onto the US ag sector (e.g., China and tariff conflicts of recent years). For now, Ag volumes and equipment pricing power are strong.

DE’s segment operating margins as detailed herein tell a clearly positive story about DE’s financial prospects. The role of the John Deere Capital unit in funding its customer base from supplies to equipment is easy to overlook as a strategic advantage and core part of its ability to beat the competition over the decades (including some competitors that have consolidated and fallen by the wayside over time). DE keeps executing and growing and 2Q23 and 1H23 numbers continue that history across cycles.

The supplier chain and production efficiency has improved materially, and DE indicated that the traditional seasonal pattern of the customer base is returning (the “planting, growing, and harvesting” thing). The color in the Q&A on the commodities markets was that “2 of the 4 largest export markets for corn” were severely constrained. They indicated that bumper crops in Russia and Brazil in grain were “not enough to offset…severe losses in Argentina and Ukraine.” The USDA forecast for corn and soybean prices were cited as strong.

What is the equity market saying?

We always like to watch what the equity market is thinking of such major bellwethers in absolute terms and relative to the peer group. The big machinery and equipment companies have struggled to get the market away from the idea that the “big boys” have peaked and are vulnerable from here after a solid multiyear run. Global pressures are still high in Europe and Asia around potential trade disruptions down the line. Russia and Ukraine (“the breadbasket of Europe”) have obvious issues. Volatility is not new to commodities, but for now the news has been good.

Below we frame DE vs. CAT and CNHI since the start of 2019 as the Fed was easing and the US cycle was struggling. That came ahead of the nightmare of COVID that arrived in early 2020. Since then, the political landscape has been reshaped in the US with potential macro shocks. Meanwhile, the largest land war in Europe since 1945 has weighed on various commodity prices and input costs for the farm belt and major ag sector nations.

DE equity has pushed through that tumultuous period from 2019 with a superior stock performance vs. the cap goods leaders. In simplistic terms DE is more about Ag but is also a player in Construction and Forestry. CAT is more about Construction. CNHI is more about Ag but also in Construction.

We did not include the S&P 500 in the chart above to reduce the visual clutter, but the SPX weighed in at +80% across this time frame, which was modestly below CAT at 88% and ahead of CNHI at 63%. The recent fade as we detail in the time horizon table further below does not negate the strong running intermediate term performance on a mix of very supportive interest rates in 2020-early 2022 and a solid replacement cycle that is continuing. The fear of “peak cycle” demand and earnings we often hear is weighing on some of these bellwethers at this point despite very strong running numbers.

The ag cycle marches more to its own beat relative to construction equipment and commercial vehicles in the cap goods mix. Ag equipment is not immune to financial turmoil and geopolitics, but DE has a very good track record across some wild periods in the markets. There is plenty of history across time to reinforce DE’s position as a financial fortress in the credit markets, and the last few years offers a reminder. At the very least, DE has the ability to take decisive action to provide liquidity support to its financial services operations and in turn offer alternatives to customers in working capital and equipment financing (including leasing and retail/wholesale credit).

The simplistic view of DE fundamentals and business risk in ag equipment has some easy catchphrases such as “ya gotta eat” and “ya gotta plant and harvest.” The fiscal year and midyear dates of Deere (Oct FY) offer a reminder of the significance of planting, growing, and harvesting seasons to the largest ag equipment company in the world. In contrast, you don’t have to build an office and you can delay a truck purchase. The “eating thing” is always a priority.

DE is an important macro story name to watch as a massive downstream buyer of supplier chain materials and components. As a major OEM serving dealer networks, DE brings important multiplier effects from freight and logistics to distribution networks and related finance and insurance providers. The USDA estimated that the ag sector generates over 5% of US GDP if one includes related businesses. The industries bring much more to GDP than what is supplied just by the ag commodity values of the output.

The Ag sector’s macro impact is another good reason to watch DE in broader economic context as a window into that world. In other words, the DE numbers are a “No” vote for now on recession expectations – unless the debt ceiling crazies say “let’em eat hay.”

Deere, after a multidecade path to dominance, exercises pricing power…

Those of us who started in credit markets on the back end of the International Harvester restructuring and watched the ongoing realignment of the global ag equipment sector over the years, DE has proven to be the dominant player across the timeline. International Harvester’s collapse was before the “International” brand gave rise to stand-alone Navistar as a truck company in the mid-1980s (note: NAV was also later rolled into a European consolidator in the form of TRATON).

The ag operation of Harvester was folded into the then-conglomerate Tenneco on the way to Case and Ford’s New Holland business all eventually ending up under the European banner of Fiat and then CNHI (split off from Fiat Industrial in 2013). Through it all, Deere was the regular winner in the global oligopoly that saw fewer players come out the other side.

The above chart shows the trailing stock return posted by the capital goods peer group that we track. We see a mix of machinery and equipment with global leaders in construction (CAT) and ag equipment (DE, AGCO, CNHI) as well as major engine and power gen manufacturers (CMI). PACCAR is a premium heavy duty truck player in North America in a world led by the global European players.

As strong as DE’s revenue and earnings numbers are in 2023, DE’s stock return sits on the bottom YTD with not much space between DE, AGCO, CNHI, CAT, and CMI. The capital-intensive cyclical story is not riding any sector rotation waves. The 3, 5, and 10-year frame of reference is impressive for DE, but the market is still in the cyclical wrestling match looking ahead.

The 2023 performance of these companies has been weak vs. the broad market given the justifiable worries about where the global cycle might be headed with the wildcards of geopolitical tension and the House GOP threatening to send the UST into default and torch the global markets. PACCAR has some European exposure but lives by the North American Class 8 truck cycle. PCAR has a very strong balance sheet and a proven history of financial resilience to the point of being unrivaled in the space for consistency of performance and financial health.

DE by the numbers…

As we detail below, favorable price and volume variances are rolling into 30+% revenue growth for the quarter overall. DE is posting very strong sales growth that comes with healthy double-digit margins that roll up to 24% operating margins for the Equipment operations.

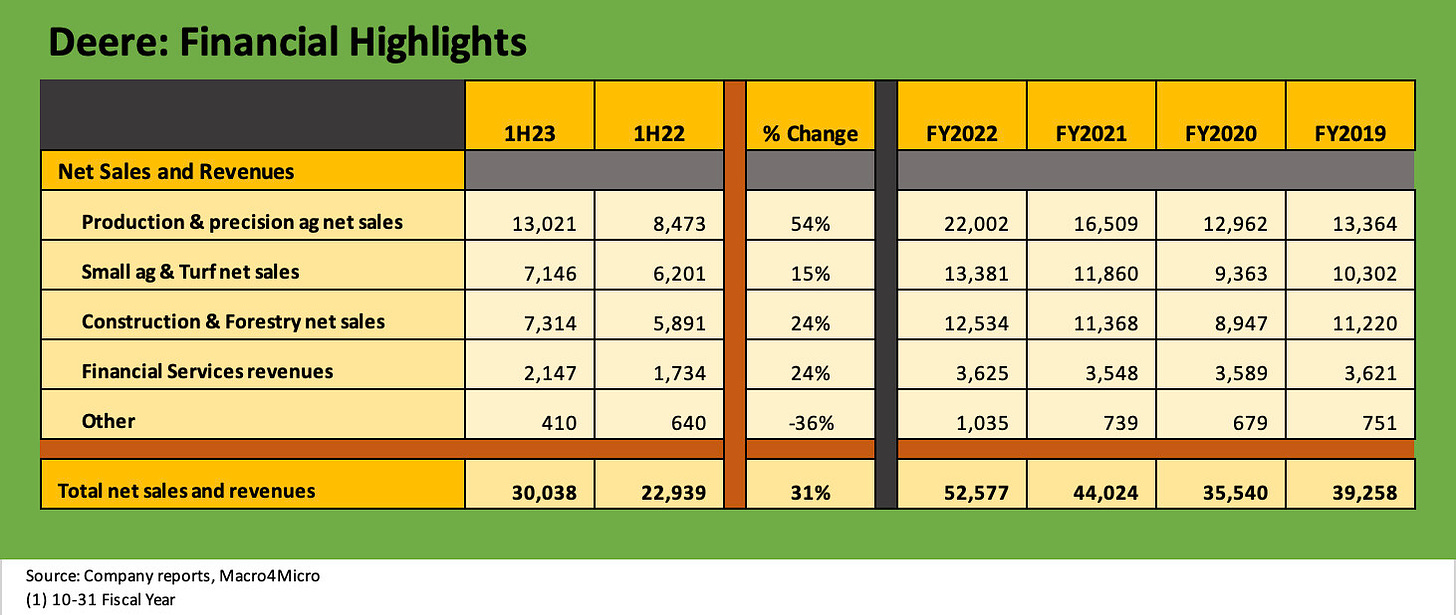

Segment results show the 31% revenue growth in 1H23 following the increase of over 19% in FY 2022 and almost 24% in FY 2021 after the setbacks of 2020 on lower activity during COVID. The most impressive growth in 1H23 was in the largest segment, Production & Precision Agriculture. That operating segment saw +54% growth in 1H23 and +53% for 2Q23. DE is expecting FY 2023 to be +20% in net sales for Production & Precision operations with 25% to 26% operating margin. That in turn signals a slowing rate of growth for the year and back half sequential revenue declines but stable high margins sequentially.

Small Ag & Turf expects 5% revenue growth for the year and 15.5% to 16.5% operating margins. That implies 1H23 slowing and some slight margin compression sequentially. The remaining equipment operation, Construction & Forestry, sees +15% sales growth for 2023.

Below we plot the segment operating profit and operating margins. The runaway winner has been the largest operation in Production & Precision Ag with the high rate of sales growth cited earlier translating into margins in 1H23 of almost 26% vs. 16% in 1H22. Those margin levels are expected to hold up for the full year even with some sequential softening in revenues. The 18% operating margins in Small Ag & Turf and the 20% for Construction & Forestry also mark multiyear highs in the table. The Financial Services results were cut by the accounting correction on dealer incentives that we discuss in the balance sheet section below.

Balance sheet highlights…

The table below details the main debt lines for equipment and financial services. We broke out the balance sheet line items into a simple category format, but there is a lot more to the DE financial unit story around the liability structures. John Deere Capital has intrinsic financial flexibility given the ability to securitize or share liquidity with a strong, asset rich, and very liquid parent company if needed under any cyclical downside scenarios. The equipment operation has bolstered liquidity in 2020 but kept net debt levels within a reasonable range over the periods shown.

The above chart breaks out the main debt line items across the Equipment operations and Financial Services operations. Looking at net debt of the equipment operations in the context of $109 bn in market cap underscores the asset protection and low leverage for Equipment. That is a very strong balance sheet relative to the asset values or the operating cash flow of the company. The FY 2022 net cash provided by operating activities exceeded net debt, so the balance sheet is not a problem in any way at the parent.

The financial unit subsidiary is basically run as a matched book with excess asset protection in the form of receivables and equipment under operating leases. The book value of stockholder’s equity of the financial unit of around $6.9 billion gives some sense of scale as to the excess asset coverage.

DE’s finance unit is an active user of commercial paper and unsecured notes/bonds as well as securitization markets. As is often the case with captive finance units, the JDC unit has material intercompany transactions with and payables to the parent company.

DE could easily pay down more debt at will, but DE has been aggressive in its shareholder rewards with buybacks up to $2.54 bn in 1H23 or more than double the $1.22 bn during 1H23. The running buyback tally across FY 2021, FY 2022, and 1H23 is around $8.7 bn, so DE is balancing its priorities as one would expect. In the context of a major company with around $109 bn in market cap at last check, that level of share repurchase is not overly generous in proportionate terms.

The $2.5 bn of stock buybacks executed YTD annualized out to over half Equipment operation debt, so that is a reminder of how much flexibility DE boasts around its balance sheet management given its inherent earnings power and liquidity strengths. Those buybacks would have paid down debt, but that is the balancing act. Dividends are up modestly in 2023 with DE seeking a 25% to 35% payout ratio vs. mid-cycle earnings. Buybacks are the primary cash deployment swing factor for shareholders.

The bulk of the DE debt and securitization are tied into the company’s financial services operations. The John Deere Capital operation remain quite strong with very low credit losses in the portfolio. We also see low reserves set against potential losses at around 0.4%.

A portfolio drilldown on DE Capital operations is for another day, but a review of the customer and dealer exposures in the financials have not flagged material risks to credit quality. We do not yet have the 10Q and the breakdown on the movements of the allowance for losses from 2Q23, but we reviewed the 1Q23 and FY 2022 moving parts. The balance of allowances net of provisions, write-offs and recoveries have been within a reasonable range. Management cited very strong credit quality metrics on the 2Q23 earnings call and cited low write-offs as a % of the portfolio and forecasted only 17 bps for that metric in 2023.

The financial services unit is facing the same interest margin squeeze as all lenders and funding operations across the captive universe as well as independent lenders and bank and finance operators. It is the reality of the UST curve and Fed tightening.

As an aside, the $135 mn hit to earnings in 2Q23 at DE was tied to an accounting “correction” of how the company treated financing incentives for dealers. The issue was around expense measurement timing, and DE pointed out that correction has nothing to do with market conditions or credit quality.