Retail Sales: The Consumer is Not Suffering Yet

We look at yet another strong retail sales month just short of Sept and stronger than Oct.

A day after a bullish FOMC session and dot plot catalyst for the markets, the Retail Sales release weighs in somewhat like the Sept 2023 numbers that had roiled the UST market.

The Fed’s forecast is going to rule sentiment more than the next indicator on consumer behavior, but the retail sales numbers and recent inflation expectations bullishness are giving Goldilocks a lot of screen time.

For the retail sales release, the ex-autos and ex-gasoline metric takes some of the noise out of the nominal dollar swings.

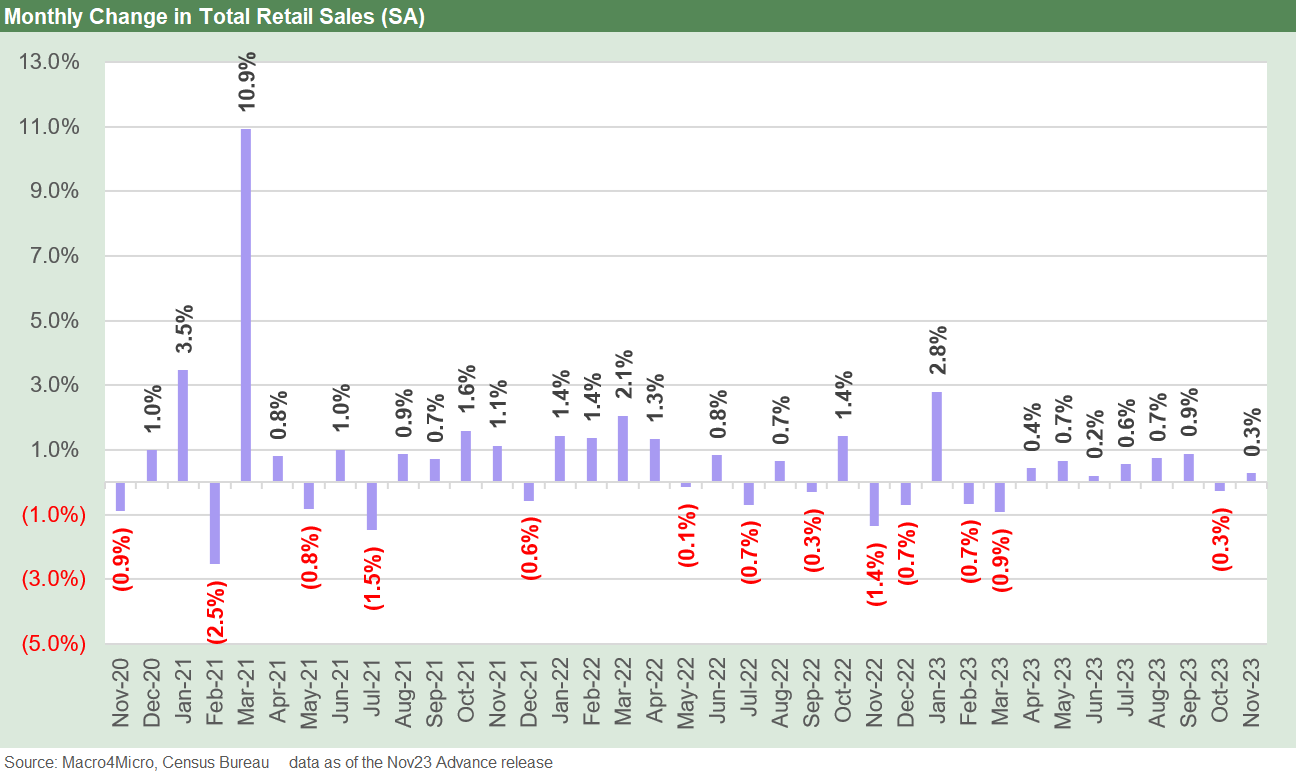

The above chart highlights a well-above consensus set of retail sales numbers as the consumer keeps sending signals for a solid PCE line in 4Q23 and some additional hope for the holiday results. The headline number of +0.3% is well below Sept but plays well against a sad October.

The Core Retail numbers are below the hotter Sept but show a favorable move from Oct. The same is the case with the important ex-Autos numbers at +0.5% vs. -1.2% in Oct. We see the gasoline drop in the nominal stats, and we address that below in an “ex-autos, ex-gasoline” slice of the numbers.

The above chart plots the monthly total retail sales numbers across a few wild years from the pent-up post-COVID binge-shopping for goods through the tightening cycle. Then came the inflation anxiety of 2022 on the way to some shoring up of consumer confidence and a shift to services and the steady “experiential” deployment for many consumers’ credit cards.

The above chart plots the same timeline for ex-autos, ex-gasoline to smooth the effects of the supplier chain impact on autos and the Russia-Ukraine impact on oil and downstream refined products. The year 2022 was a recession-like year for autos on supply chain issues with a nice volume rebound in 2023.

Gasoline was a dominant headline of 2022 as well and that has been turning in dramatic fashion in recent months just ahead of the holiday season and winter (that home heating use matters in some regions more than others for household health).

The main takeaway is that most consumers are not bloody or beaten and most certainly unbowed. Those shoppers watching their credit card lines getting too close for comfort may end up bloody and beaten later, but it is hard to see much bowing before then.