Retail Sales: Consumer Watch on the Front Burner

We look at the retail sales as the market stays locked in on any hints of consumer mood swings.

The market will stay fixated on any hint of the consumer sector flagging as we head into the fall with student loans, government shutdowns, and UAW headlines potentially bringing multiplier effects.

Retail sales numbers remained solid enough even if there was some distortion from gas stations on refined product prices due to OPEC+ supply actions during the back end of peak driving season.

The market has had to contend with the price swings during this inflation cycle as the retail sales numbers get reported on a nominal basis, but the sequential trends come out of the consumer pockets in current dollars, so that is very “real” in the literal sense of the term.

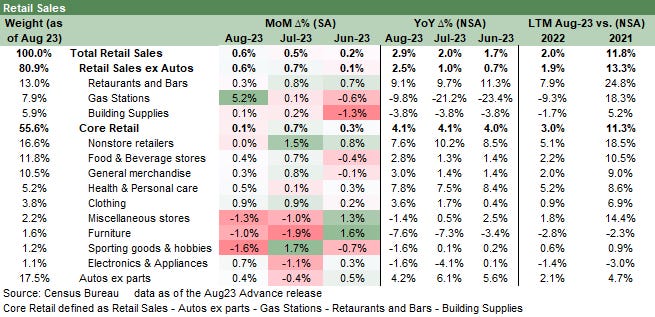

The above chart details the sequential, YoY, and LTM details in retail sales. Sales turning in a positive month were strong enough to not alarm the “consumer watchers” but the cycle debate justifiably will be locked in on where the consumer sector and personal consumption line could be trending from here. The focus on signals from rising delinquencies, topping payroll counts (and rising unemployment) will arm debaters in their to-and-fro on soft landing vs. hard landing scenarios into 2024. Student loans always come up while the government shutdown and frozen (catatonic?) functionality in Washington will affect some consumer psyches more than others.

The reality is that a record payroll count and decent wage trends give ammo to the fundamental bulls. The other side is the logic of an eventual, inevitable slide in the ability of consumers to sustain a high rate of spending and rising household leverage without some setbacks. That takes a lot of optimism around consumer resilience. The risk of a spending fade and tighter credit is rising after such a heady period, and that will favor some defensiveness.

Autos and gasoline…

Autos and what the consumer puts in the tank are a big part of retail sales and especially in the summer driving season, but we will be bracing and watching for what comes out of the potential UAW strike in coming days across the dealers and in terms of the knock-on effects across other products.

We have seen some wild and protracted UAW strikes over the years with the epic clash of Caterpillar and the UAW in the early 1990s as one that still leaves stinging memories among the old hands of the UAW. There was a protracted strike with Deere in the 1980s that lasted months after a farm belt crisis. Generally, the UAW could strike deals in past cycles, and the legacy Detroit 3 would often fold.

We will look at some past UAW dynamics in a separate commentary, but the worst of strikes can come with turning points in secular industry trends. For CAT and Deere, it was the poor fit of pattern bargaining for two companies that were moving in very different directions. In this current market, the transition to EVs and the changes in the highest value-added part of the EV supplier chain (i.e., non-union battery ventures and non-UAW or non-US metals/mining workers) makes for a pivotal contract round for the US UAW.

These disruptions could flow into distortions in used vehicles and impact quite a few consumers if the effects in turn reverberate across the supplier chain and supporting services industries (from finance to freight and logistics). Layoffs (or fear of layoffs) and fallout across other industries can set off alarms for many households.

Tomorrow brings consumer sentiment, but the drama of a major UAW strike could also bring more political noise given the union vs. non-union themes across some key states. It is an opportunity for the pro-union forces in Washington to pick a fight with their eyes on legacy Detroit 3 states (e.g., Michigan, Wisconsin, Ohio, etc.). Steelworkers will also feel the heat in the face of any protracted auto production disruptions.