Regional Banks: Mornings After, Market Reactions, and Consumer Finance

Excerpts from Footnotes and Flashbacks: Week Ending April 23, 2023

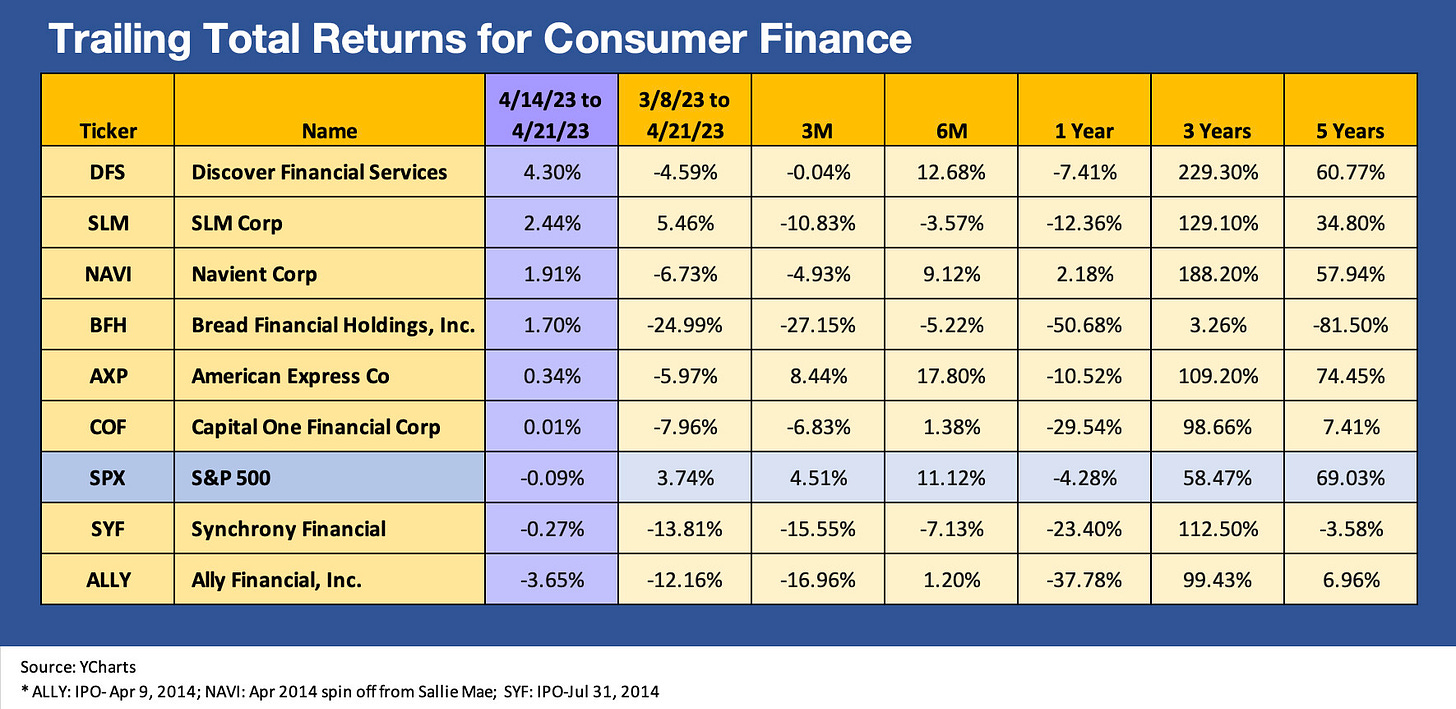

For the MICRO section this week, we thought it was worth looking at how the equity markets reacted to the waves of earnings reports from the major banks, the regional banks, and consumer finance operators who have reported so far for the March quarter. Below we look at the trailing time horizons from the past week with so many reporting. We highlight the post-March 8 period (note: SVB self-immolated on March 9 and did not open for trading March 10 ahead of being seized). We also include the usual trailing time horizons.

The Regional Bank drama still shows what a beating the markets took in the above table. We line up in descending order of returns for the stocks since last Friday to give weight to the rebound week as numerous companies reported another week of flows that could be watched and as the sense of panic eased with time. The week ran the gamut in returns with WAL rallying the most by far with PacWest next followed by First Republic.

The post-3/8/23 column shows the residual damage for the names on the list, and the damage is still massive. While the color from some earnings calls and disclosure was that the deposit run had been mitigated by activist regulators and liquidity lines, the reality of materially higher cost of funds and interest margin squeezes were important unavoidable takeaways the bank analysts will be sorting out. They will be trying to gauge what type of retrenchment in risks and buildups in liquidity will be needed in this new post-SVB push-button withdrawal world.

Some of the Consumer Finance operators have common features with the regional banks in their funding pressures and high level of cyclical exposure and consumer credit quality, so we also generated a similar comp table for the consumer peers. We see a lot of negative numbers since the SVB crisis catalyst. This past week we see the market was not all that excited by the macro overviews offered in the earnings reports.

Weaker asset quality expectations and tighter interest margins were common topics for the main lenders. We were curious about what Ally had to say, and their delinquency and charge-off numbers were reasonable with respect to asset quality metrics.

The mix of names on this consumer finance list is generally more swept up in the issue of consumer credit quality and the cyclical direction of asset quality for auto loans, credit cards, and student loans. We thought the equity performance presented an interesting frame of reference for how horrid the regional bank stock return numbers were since SVB.