Rails and Freight: Cyclical Signals Show Mixed Sentiment

Excerpt from Footnotes and Flashbacks: Week Ending January 27, 2023

The market often looks to the rails and truckers for a read on the fundamental economic backdrop. That was an old-school approach in watching the “Transports” as market signals. After all the supplier chain noise of recent years, it may be making a comeback. There are numerous direct lines (pricing power and volume) that offer more direct input into the market realities. Volume and tonnage are the big parts of the story along with which parts of the freight mix (ag, coal, autos, etc.) are doing better than others.

There are also indirect signals the sector sends around contractual commitments to volume and freight rates (vs. spot rates) with shippers. The confidence ahead of or during renewals can give the market some qualitative flavor that shows up in guidance (whether qualitative or hard numbers). There are worries now that softening demand, adjustments to inventory levels, and pricing pressure could upset the theme of stability that many are hoping for in 2023. The story still has to play out a bit more.

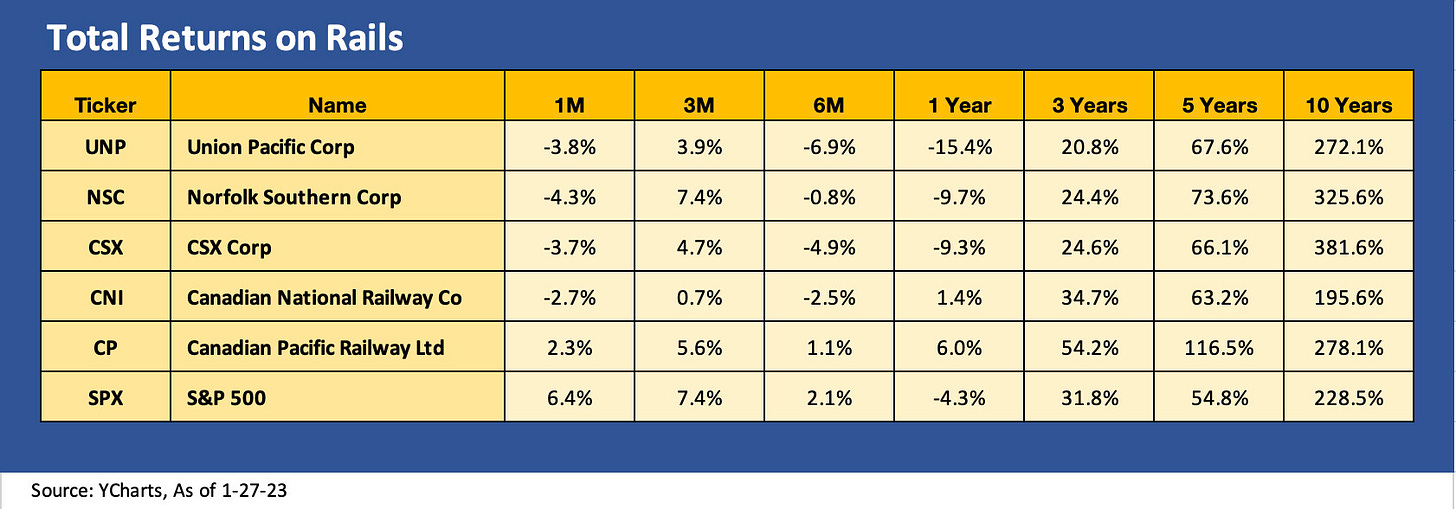

The past week saw such bellwether names as Union Pacific, Norfolk Southern, and CSX in rails and Knight-Swift in trucking weigh in. The overall flavor for rails in equities so far has been less favorable than for the truckers and diversified logistics services. NSC took a beating on its earnings day since the revenue outlook leaned towards volume headwinds. UNP, CSX, and CNI also reported. The rails were dragged down. Canadian Pacific reports this week.

The chatter around the equity circuit appears to be that the major rails could have a rare down earnings year for the group. That said, even flat volumes and some cost pressures that cannot be recovered in pricing and service improvements does not imply a recession. The rails overall seemed to deliver color that was in the stagnant growth camp but not flashing red. Weakness in home construction further out in the year and expectations of low auto production rates with some signs of an industrial fade (see Capacity Utilization: The Fade Begins 1-18-23) don’t add up to good news even if they don’t call for declines in volume.

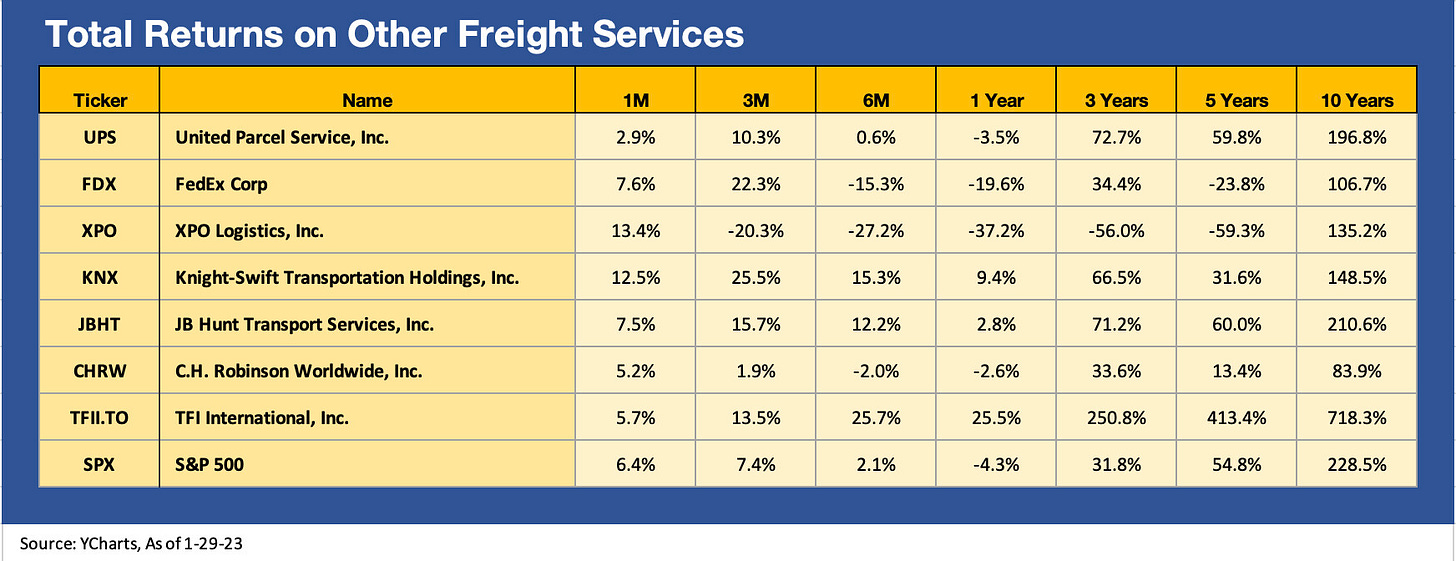

The other freight and logistics operators ex-rail show some relative optimism compared to the rails in their stock trends. We saw decent numbers and guidance this past week from Knight-Swift and the prior week from J.B. Hunt. This coming week we have UPS and C.H. Robinson (CHRW) teed up to release earnings with TFI International the following week. The 1-month stock returns have been mostly negative for the rails (CP an exception) but positive for the truckers and logistics services suppliers. The truckers and services operators also outperformed the broader market benchmarks.

Many freight and trucking services providers were badly disrupted by the supplier chain turmoil along with the entire sector, but the pricing power was very much on display across numerous subsectors of freight as the scramble was on to get delivery and moving goods from Point A to Point B and C.

A big part of the inflation story was freight costs, and the old rule of “one man’s expense/capex is another man’s revenue” applies. The complexity of the logistics from producer/manufacturer to transport hub to port, from port to hub to warehouses to customer, made the whole process into a Gordian Knot that US infrastructure and the regulatory framework could not deal with.

If we look back at the trailing 3-year time horizon to just before COVID slammed the market, the relative performance of the leading truckers (and related logistical services providers) is impressive vs. the overall market. These companies vary in business mix and relative asset intensity, but they are driven by many of the same variables tied to cycles, trade flows, freight mix, and the volumes relative to capacity that sets pricing power and unit costs.

The ability to navigate the disruptions seen in recent years even with a shortage of drivers and myriad supplier chain disruptions (port congestion, COVID lockdowns, etc.) told a good story about this sector’s resilience. In some cases, such as XPO, the company has its own distinctive set of issues and story lines around spin-offs to reward shareholders, but that is a story for another day.