Freight and Logistics: Industry Comment

We frame some of the macro trends in Freight & Logistics as that sector gets overdue attention as a crucial indicator

Very Short Form

In today’s comment, I look at some bellwether freight and logistics players who reported last week. After so much focus on supplier chains and how they have influenced inflation effects, it’s a good place to start.

In this type of process, I am trying to glean information on pricing, demand and expectations for the cycle. The exercise is simple enough: read the press release, scan the slides where relevant and read the transcript. (Thank God for transcripts. They are available from multiple vendors. I have flashbacks to the days of mini-tape recorders on multiple phone squawks and the threat of a dead battery.)

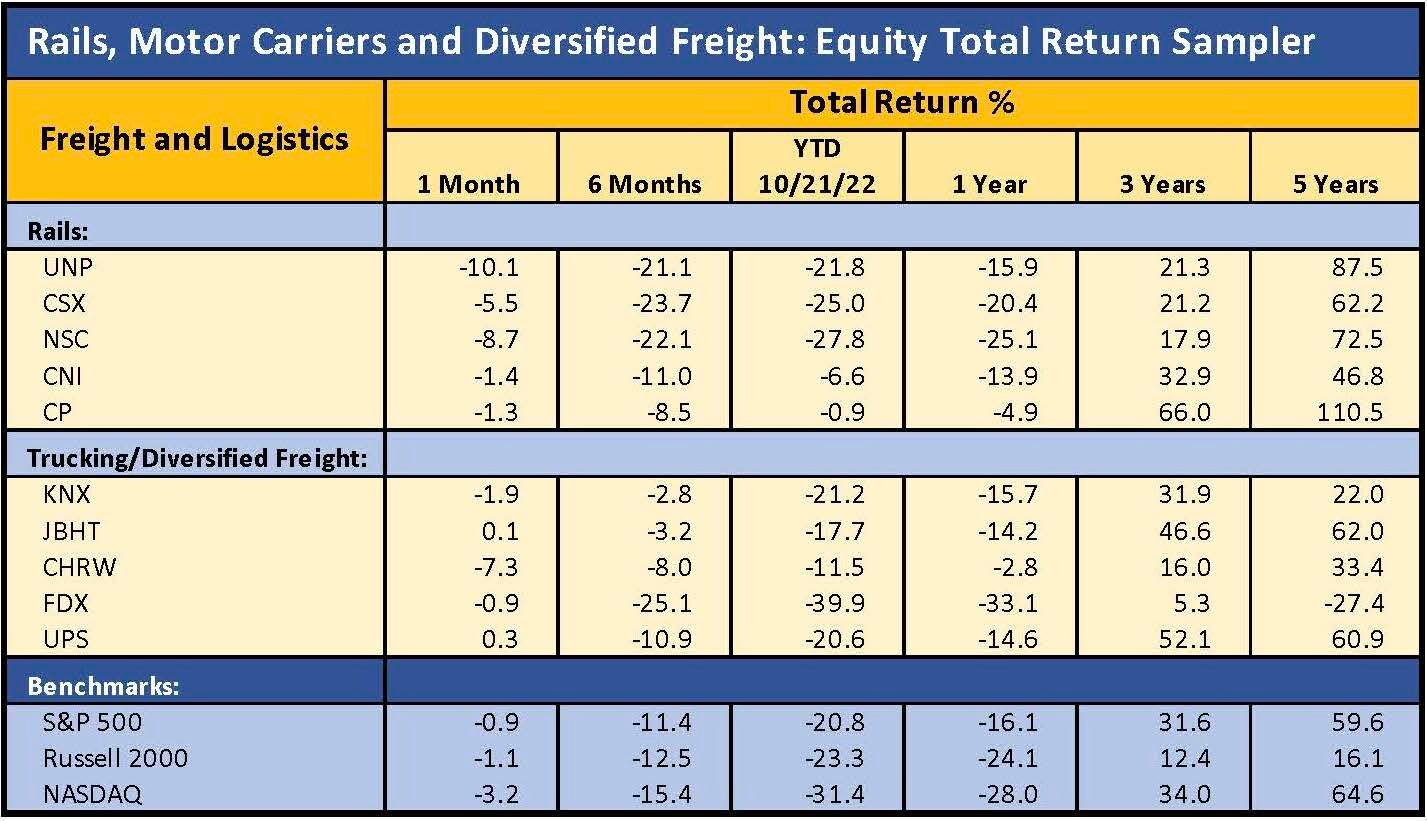

Reports from rails and truckers so far this season send signals of a slowdown in demand coming on faster than expected by the industry prior to 2022. Though several more major rails are scheduled to report this week (CNI, CP, NSC), last week’s reports offered some tangible facts and insightful opinions (see quotes from management teams below). Comments from truckers (Knight-Swift, J.B. Hunt) and major rails (Union Pacific and CSX) highlight that despite inflation, pricing power in key business lines remains solid. With a potential recession on the horizon, the equity table below highlights the expectation of economic pain ahead for some freight bellwethers. Despite headwinds for freight operators more dependent on spot rates in segments such as LTL trucking, clear statements by management teams around pricing power to recover costs should still be alarming for those expecting inflation to ease quickly.

The storyline for freight and logistics players is nuanced…

Revenue trend lines for these subsectors and their major players show resilience despite the likely path to softer fundamentals. At present, skyrocketing fuel surcharges are almost an afterthought as these costs are seamlessly passed through to customers and hence flow into company revenue lines (and customer expense lines). Fuel surcharges will likely remain high. Stress in the energy markets in Europe is very much a fact of life and the recent OPEC production cuts (or any other actions) are not expected to ease in the near to intermediate term. Further, questions around export restrictions for refined products is always lurking as a major variable. The Biden policy questions are fluid, and the post-election period could offer some opportunities to get aggressive. While pricing power remains strong for the moment in transport broadly, a slowing in price increases will be seen ahead vs. 2021 and early 2022. If the supplier chains start to melt down on any fresh disturbances, e.g. in China, COVID, or Europe, this slowdown could be accelerated.

Clearly, demand is buttressed by the 50-year low in unemployment even if the volume in the basket needs to shrink in the “price vs. volume” tradeoff. The market still sees solid tonnage from industrial sectors as well as volumes related to the infrastructure bill, as we covered in the capacity utilization commentary last week. As highlighted by CSX, key trends signal future strong sources of demand: significant investment in automotive capacity (Southeast US), the rise of EV, and electrification (battery) needs broadly.

Freight and logistics role in inflation…

It’s been said, “one man’s revenue is often another man’s expense.” Soaring revenues and earnings along the freight and logistics services chain underscore the industry’s role in inflationary forces in the US and global economy. As stated above, fuel surcharges are seen as a standard part of the costs that simply roll into pricing as a separate menu item. The market has seen fuel surcharge spikes before, but structural imbalances caused by the supply-demand whipsaw of COVID have resulted in record levels not seen in the post-tech era, i.e. since the 1980s.

Since the 1980s and until COVID, the data-driven and interconnected/interdependent nature of production-shipping-inventory-customer-inventory management processes evolved dramatically to optimize inventory levels with lean manufacturing and services. This approach may warrant review in many industries as the need for inventory “insurance policies” with much higher average inventory days grows. The problem is that in 2023 this may not be possible in certain subsectors given current demand, e.g. semiconductors. In the aftermath of COVID and with China strains, shifts toward “stockpiling labor” and building “inventory cushions” are challenging the old textbook guidelines on inventory management. (Another topic for another day.)

Sophisticated systems have their limits…

As the world continues to sort out the experience of unprecedented supply chain disruptions, the highly sophisticated and efficient systems developed by freight and logistics masterminds can only go so far. The proper functioning of software depends on functioning supply chains. While those supply chains are being repaired, they are still seriously disjointed at the ground level. Suffice it to say, great software will never be able to move containers from point A to Point B or physically unload them. Great software can’t get operators the supply of chassis they need if the chassis are not available. Great software can’t force the truck to show up if it means protracted delays taking the risk of fees and charges on those delays.

Charges and fees that are inflicted along the freight chain have winners and losers. This aspect of the freight business has traditionally been opaque to many inflation watchers, i.e. hidden in industry jargon. For example, charges under headings such as “demurrage” and “detention” fees are basically overtime fees that hit truckers and cargo owners especially hard. As I understand it, these fees are imposed directly on truckers who then must try to collect from the cargo owners, i.e. upfront fees must get recovered downstream. Some truckers would rather walk away from business than take this kind of risk and impaired asset utilization, especially at the most dysfunctional ports like Los Angeles-Long Beach.

This tense and economically precarious situation includes labor deals that need to be ratified more broadly. Right now, it is a mixed result on ratification. What is unfolding is a shift in the negotiating leverage across the table to labor, which in turn will drive higher wages and benefits. Labor knows that the employers will likely pass it on. Even if they don’t, the higher pay for labor is unchanged. The unions are very well positioned to extract what they are looking for, and that victory will flow into pricing.

This list of problems for the freight sector continues to underscore how hard it is to grasp the challenges ahead when labor is stressed (contract ratification across double-digit separate unions) and China is staying with its approach on COVID shutdowns. Disruptions can come at any time and set off chain reactions. With holidays ahead, the timing is tricky.

A quick look at the “early returns” and color around freight and logistics reporting…

To be clear, I am looking at the color from the rail and truck world more for the focus on pricing and cyclical expectations offered by management teams. This exercise is NOT a drilldown on issuer-level trends or the valuation of Knight-Swift, J.B Hunt, CSX, or Union Pacific. The major rails are “cash machines” while the truckers are more volatile and have a different mix of risk weighting on various operating factors tied to their business (truckload vs. LTL, regional concentrations, driver shortages, exposure to diesel prices, etc.). Those exercises require a separate analysis. Here, I am looking for signals of pricing power, cyclical perspectives, and an update on the bigger supplier chain picture.

That bigger picture includes the state of labor (which management teams are loath to discuss) and relative port congestion challenges (some of those congestion problems were only detoured from the West Coast to the Gulf and East Coasts in what is still a suboptimal backdrop). The state of fluidity in operations has improved but is still well short of the mark (the term “fluidity” is an industry favorite). Industry experts use a long list of metrics and jargon to frame some of these issues, e.g., dwell time, turn times, container ship backlogs, vessel wait time, truck lead time, vessels lead time, vessels at port, etc. There is no shortage of trade websites that offer excellent trend analyses in these areas.

My main takeaway is that conditions and efficiencies are much better now but still very inefficient in historical context. This, of course, can also vary from port to port. Inventories for some end markets are high and some are low. That all implies that a major labor disruption would be a catastrophic setback from a subpar position to start.

Freight pricing, mixed picture on rates (spot vs. contractual), and the inflation story line…

The pricing in freight at the micro level rolls up to the macro level, and that is the main topic here. The Nov-Dec holiday period is an important one in freight, and some of the commentary in the trade press indicates it will be an atypical peak season. Also, “bid season” is coming up for contracts as the rails and motor carriers negotiate with their customers. This will be critical in setting the stage for more cost flowthroughs in 2023, as well as for management teams who’ve promised to generate pricing ahead of inflation. UNP was more talkative on that subject of pricing and CSX less so. For railroads, there is room for more drama as labor battles continues with mixed results on ratification. In freight and logistics broadly, the longshoremen are an X-factor at the port level.

Transport, freight & logistics services, rail, and trucking are all valuable macro indicators…

The world got schooled this past year on the topic of shipping and freight costs and the flowthroughs into CPI. Unfortunately, the learning curve may not include various governmental branches. The constant accusations of price gouging aimed at every industry with rising profits (notably E&P and refining) has resulted in a bad case of “cry wolf” syndrome. So when legitimate claims are lodged—like the price gouging associated with container shipping and ocean carriers—they get tainted and consequences are negligible.

There were also some less daunting lessons from the trade battles of 2018-2019 during the China trade spats, but the learning curve there was drowned out by the “tough on China” value for political point-scoring. The lesson: tariffs are inherently inflationary, and the oft-stated White House view that billions and billions were being collected from China was purely and simply false. The buyer pays – not the seller. By and large, most tariffs from Trump were kept by Biden. Downstream supplier chain effects should have been considered more diligently before sending supplier chains and freight businesses into disarray. This was also a political football that precluded a fair round of policy assessment.

There is every reason to expect tariffs to get worse and not better since China is almost a systemic part of the US supplier chain. The whole trade policy issue is heading for a lot of major developments in 2023-2024. That is a topic for another day.

The significance of the global (container shipping) and national (ports, truck, rail, warehousing, last mile services, etc.) freight and logistics networks and operational efficiency need a lot of focus in a high-inflation environment. While the trade war disruptions of 2018 and 2019 brought an occasional flesh wound, COVID brought an extended stay in the ICU.

Some signals from 3Q22:

The record revenue and rapid growth of revenues across a range of freight and logistics subsectors hammer home the lingering inflationary threat. The container shipping and port economics were the ugliest factor, but those problems radiated back to the supplier and downstream to the customer. The scale of the cost that pressured pricing was underscored by the extraordinary revenue and earnings growth for leading container shipping operators.

According to the Journal of Commerce, the container shipping peer group will see more than a 30-fold increase in operating income in 2022 vs. pre-pandemic 2019. That is some serious pricing power. From another angle, the growth cited from the Top 50 Transportation providers tacked on another $310 billion in revenue from 2020 to 2021. That means another $310 billion in expense for somebody’s price tag or expense line.

NOTABLE QUOTABLES FROM RECENT FREIGHT/LOGISTICS AND TRANSPORT EARNINGS:

Knight-Swift Transportation: KNX operates the largest full truckload fleet in North America, and they reported earnings this past week. The company has been growing via acquisition since the Knight-Swift deal and is looking to smooth its cyclicality with more services business lines and expansion in more asset-lite offerings.

“These muted trends have continued into October as supply chains appear to be catching up and adjusting for uncertainty in consumer demand.”

“We continue to experience inflationary pressures in driver-related costs, maintenance, and insurance that offset the improvements in revenue per tractor.”

“Inflationary pressure in most cost areas including driver pay, maintenance, equipment, and non-driving labor…”

Our driver wages have gone up materially over the time frame…”

“For the fourth quarter, we expect a muted seasonal freight environment combined with significantly fewer spot market opportunities.”

"It’s rare that you go into a fourth quarter and not see some type of seasonal uplift in projects and spot opportunities …we got into the fourth quarter and realize none of that stuff materialized…”

JB Hunt Transport Services: JBH is a fully integrated freight and logistics provider with a major presence in intermodal. They reported earnings this past week.

“…we continue to experience inflationary pressures across most areas of our business but primarily around labor, equipment, including both parts and labor and in the area of claims.”

“…customer inventory levels are higher. And that’s certainly influencing some of the demand and ability to process and speed up asset utilization.

“…there is still a lot of noise in the system related to getting cargo out of containers, into warehouses, on shelves, to your home, all of those aspects…”

“…the biggest factor to me right now is just inventories are elevated, and so customers are working hard to find a place to put inventory…”

Union Pacific: UNP is a close #2 to #1 BNSF as a Class I railroad and well ahead of a distant #3 CSX based on freight revenues. UNP and BNSF (owned by Berkshire Hathaway) are the dominant railroads of the West and serving the Port of LA-LB, which made them ground zero in the worst of the supplier chain challenges. Looking at Union Pacific helps in the West. We have CSX below, which is big in the East.

“Inflationary pressures and operational inefficiencies continued to challenge us.”

UNP affirmed “pricing gains in excess of inflation” for FY 2022.

“Third quarter volume was up 3%...freight revenue was up 18% driven by higher fuel surcharges and strong pricing gains.”

“…we are storing excess international intermodal well cars as the expected levels of volume did not materialize.”

“…higher fuel prices are the primary contributor to higher operating expenses, which increased 22%...excluding the impact of higher fuel prices, our expenses were up 10% in the quarter.”

“…we are confident that we will yield price dollars that exceed inflation dollars even with a higher inflationary hurdle than expected at the start of the year.”

“…the environment has changed…with higher inflation and weaker economic outlook…”

Markets that are up: “markets we full very bullish on…coal is one of them…biofuel markets, it’s an emerging market for us…rock shipments are still relatively strong…rebar goes into construction materials for highways and roads, so that is encouraging…automotive is up…dealer supply at their facilities are low.”

“…we’re encouraged by the movement of international boxes between ports and inland.”

On pricing uncertainty in some businesses: “…there is a headwind there through the bid season and we’ll just have to wee how it plays out.”

On pricing outlook into 2023: “…as we look at rolling up a budget and starting – or really at the tail end of putting our plan together, for sure, we are confident we can get pricing above inflation.”

CSX: CSX is a distant #3 behind Union Pacific and BNSF, but it one of the two major US players east of the Mississippi with Norfolk Southern.

“…pricing has been very, very good and continues to remain that way.”

“a market like housing that are seeing slower signals…but there’s other areas like coal and some of the ag products that are seeing great signs there.”

“It’s the whole supply chain catching up and we’re one part of that. So where demand ultimately settles out, I think is somewhat of a question.”

“…on the auto side…there’s a lot going on…number of significant investment announcements in –especially the Southeast…whether its on EV batteries or whether it’s on new manufacturing assembly plants.”

“I’m not going to comment on the chip shortage, but you are hearing from the autos that production is picking up…and longer term there’s significant investment going in electrification…”