Kinder Morgan: Free Cash Flow Machine

Excerpt from Footnotes and Flashbacks: Week Ending January 20, 2023

Kinder Morgan (KMI) turned in strong numbers in 4Q22 and continues to generate substantial free cash flow for expansion and new investment initiatives. The company exceeded its planned DCF and EBITDA targets. KMI is cash flow rich, asset deep, and not overleveraged for its asset protection and cash flow fundamentals even if it ticks above peers. The peer group held up very well in a rough market and materially outperformed broader market benchmarks.

The Midstream sector overall has been a safe place to be in equities since it brings the merit of good fundamentals, high dividend yields, and healthy free cash flow. Most of that major midstream universe sees capex well down from the peaks with cash flow deployed by the MLPs and C-Corps in the space to a mix of shareholder enhancement, expansion programs, or acquisitions large or small. We also have seen some of the upstream players that have split these assets off buying back in some or all of the equity stakes in some operations. The heyday of capex binging and breakneck expansion is behind the sector in general and that makes for great free cash flow stories. The LNG buildouts still have a role to play in applying multiple add-ons to valuations for some, but the industry has matured with regulations making that an unavoidable reality on challenges to numerous major projects.

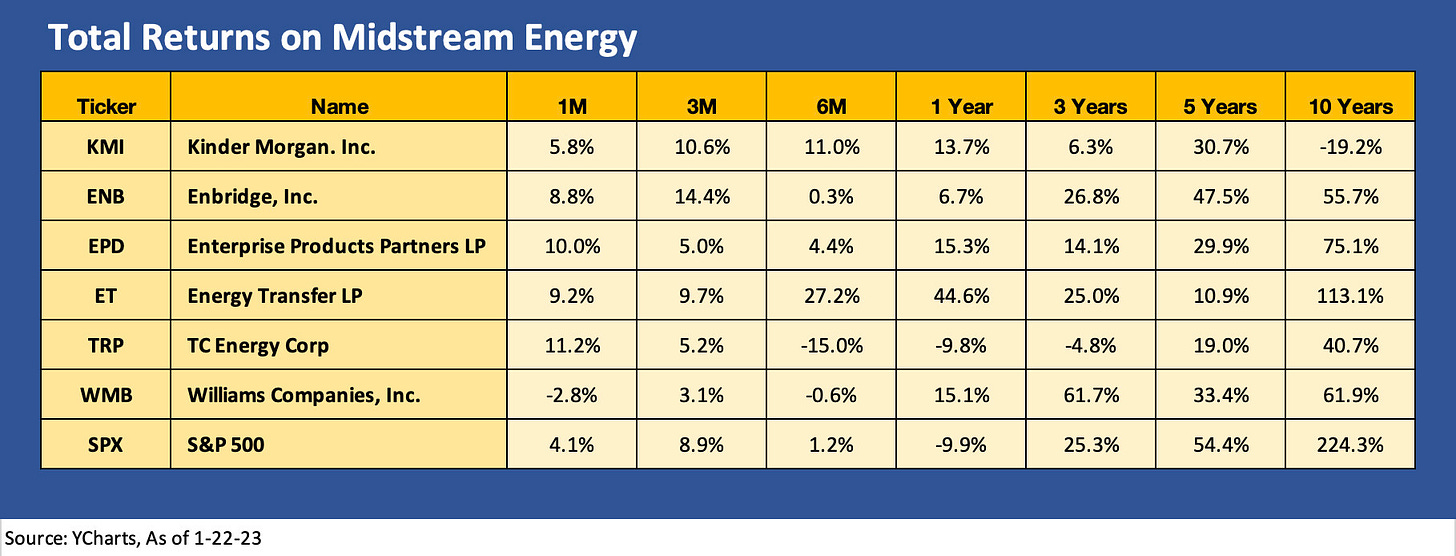

The above chart breaks out a group of major midstream players with KMI doing well against the broad S&P benchmark but a more mixed performance vs. direct peers. The longer-term comparison is unfavorable. Looking back past a year, we see ET and WMB as winners. Enterprise (EPD) offers a very distinctive asset base and notably in the NGL space. EPD has been a very consistent performer with a better set of financial metrics than most.