JOLTs: Debt Ceiling Threat Did Not Derail Postings

Despite the threats of default in debt ceiling rhetoric, the job postings held strong and moved higher in April.

"Employers predicting bad aim by the fans of default?"

Set against the backdrop of a debt ceiling battle over whether the US economy should default and collapse in a self-induced liquidity crisis, the news comes out that Job Openings just climbed again back to a run rate of over 10 million.

The Fed’s pause button may move back out of reach, so the market could end the week with a tighter labor market and more fears of inflation instead of a widespread panic on UST default and all the side-effect handicapping that would dominate the headlines.

The above chart plots Job Openings across the years from 2007 through April 2023. The total rose to 10.1 million from a revised 9.75 million in March. The 10.1 million is a healthy rebound but below the prior year’s 11.8 million in April 2022 just as the market saw ZIRP end the prior month. The leaderboard has Retail, Health Care and Social Assistance and Transportation, Warehousing, and Utilities totaling almost 550K in new postings.

The tally of Job Openings is 1.8x the post-2007 median. The takeaway by the Fed is likely to be that tight labor still rules and faces a diminished threat from the debt ceiling default unless the Senate can come up with a way to destroy the economy with its rules-based committee shenanigans. That will be more about posturing at that point than real action to make a ticking bomb go off. Then again, the Paul family has a default-friendly family tradition back to 2011.

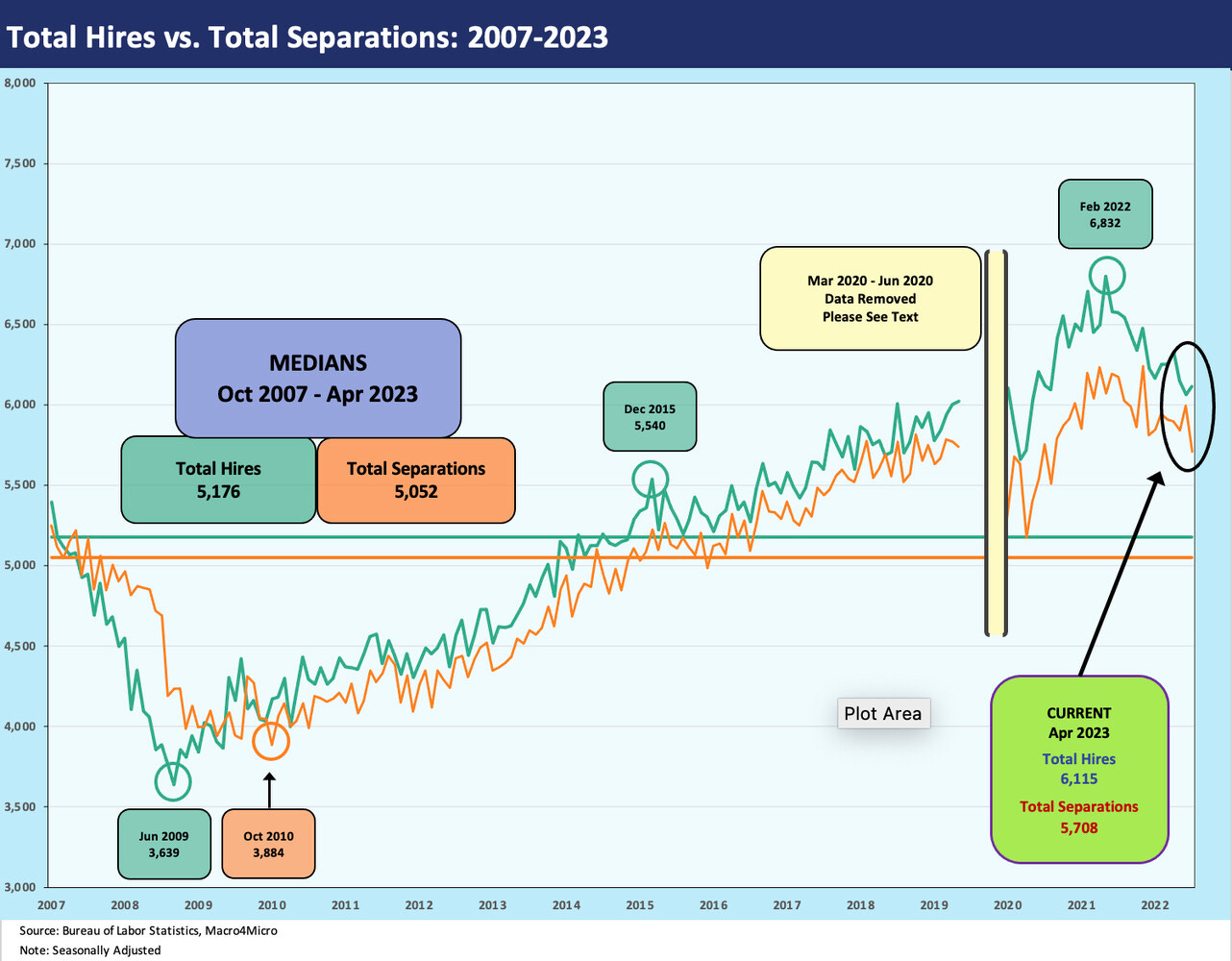

The above chart plots Hires vs. Separations from 2007 through 2023 periods. We remove some of the COVID data points as noted below in the boxed text since we wanted to keep the chart visuals useful for the “normal” periods. An increase in Hires to 6.15 mn in April 2023 from 6.07 mn in March 2023 is good news when paired with a decrease in Separations from 5.99 mn to 5.71 mn.

The comments in the box below are an excerpt from an earlier JOLTS note (see Jobs and the Fed: JOLTS Gets Heavy Powell Focus 11-30-22). The text discusses the COVID distortions in Hires vs. Separations during the COVID crisis:

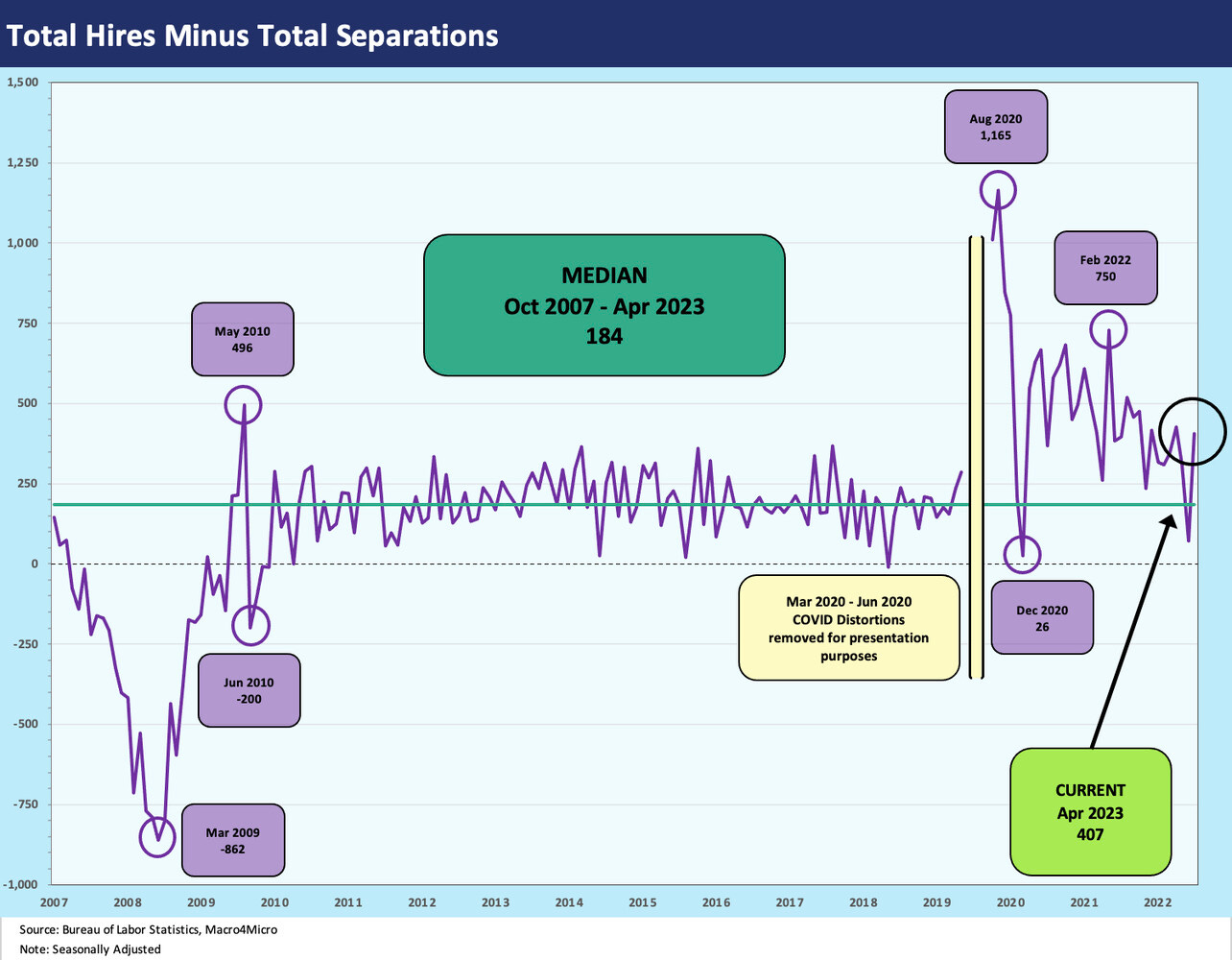

The above chart plots the “Hires minus Separations” differential of 407K, more than double the long term median of 184.

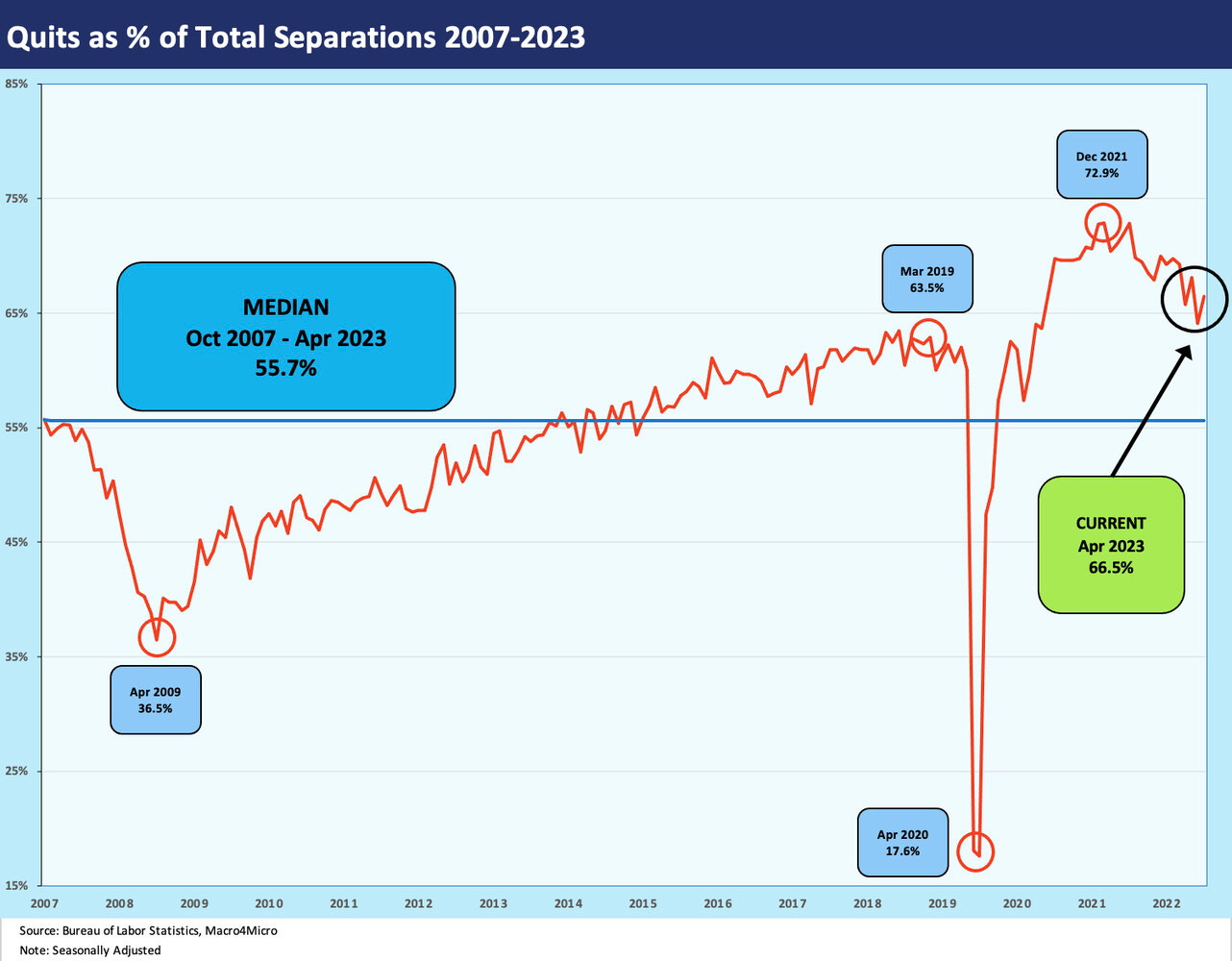

The Quits % Separations ratio is considered a measure of confidence in finding a job even if there are various reasons for quitting a job. The 66.5% rate ticked up on the month from 64.9% and is still well ahead of the long-term median of 55.7%. Layoffs and Discharges declined on the month by 264K.

See also:

Employment April 2023: Post-COVID Deep Dive by Occupation 5-5-23

JOLTS March 2023: Inclement…but Surf’s Up 5-2-23

March Jobs: Head Scratcher 4-7-23