Homebuilding: KB Homes November FY Starts Clock on Orders and Cancellation Trends

Excerpt from Footnotes and Flashbacks: Week ended January 13, 2023

We get a fresh batch of housing macro metrics this week, but a builder reporting always adds some sea level color. KB Homes posted results this past week that highlight the exposure of the builders to materially declining orders with net orders down 80% and gross orders down 47%. The KBH commentary offered some insights into the need for creative strategies around how to manage the price declines in existing communities without driving even more cancellations and lost backlog.

Protecting the revenue line by getting existing contracts to the finish line and funded have a balancing act with moving remaining unsold properties. The transition to an all-new pricing backdrop needs to be managed carefully to avoid bringing the hammer down on the quarters ahead and the backlog in place.

KBH is a November 30 fiscal year, so from here it is going to be a steady phase-in of color commentary on navigation strategies and managing around order declines, cancellations and the mix of incentive game plans in a sliding market. The discussion points from the December 31 fiscal earnings reporters will be heard in coming weeks. Lennar was another Nov 30 fiscal report that already came out in mid-December, but KB has a “bit more hair on it” than Lennar and is much smaller than LEN, who is neck and neck with DR Horton as an industry leader. DHI reports on Jan 24.

KBH posted solid trailing numbers though the November quarter. Under its build-to-order model, KBH – like Lennar— had to immediately qualify the old numbers as reflecting a very different world. Now the harder part starts. The leading indicators are all over the screen each month in the headlines around sliding home starts, plunging existing home sales, and recurring discussions of how badly mortgage rates are hammering affordability.

On cancellations, KBH cited a measure of 14% of 4Q22 end backlog and framed that number as below the long-term average. As of quarter end, KBH cited 80% of its homes in production as sold. That is in line with its historical target of 80-20. Even though KBH focused on build to order, they have traditionally also offered a mix of move-in ready homes.

Net orders are down again by 72% through the first 5 weeks of fiscal 1Q23 but KBH is targeting net orders to be down by 50% for the quarter. As these builders cite these late 2022 numbers, it is important to note that the comps were vs. the smoking hot 2021 backdrop with low mortgage rates, a rush to buy houses, and a booming headline economy.

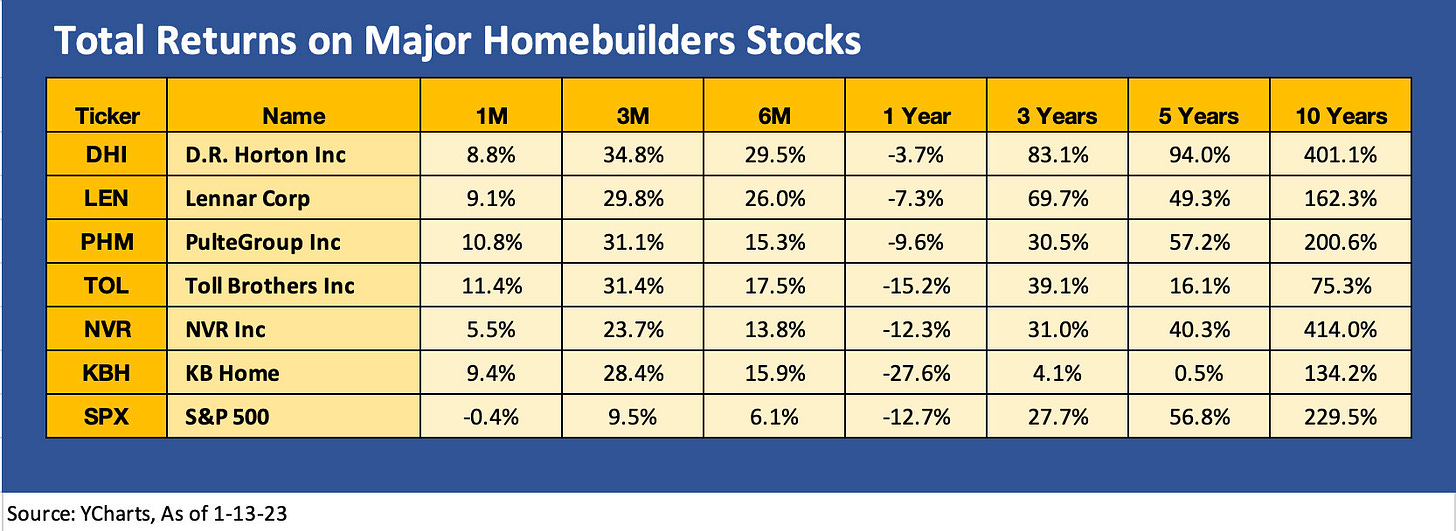

The forward-looking view from the stock market is worth watching, and the pattern of homebuilder equity performance in 2022 and into 2023 tells a story. We highlight some major homebuilder equity returns in the above chart, and the idea that the builders materially outperformed the broader market in rolling 3 months and 6 months might surprise some after the slaughter of early 2022 on mortgage rate panics.

There is no question that the legacy leading homebuilders have a lot of experience in difficult markets. What makes the current backdrop so challenging is the sheer pace of the affordability erosion as mortgages spiked. The ability to navigate wind-downs of communities, managing the contractual backlog and all while planning new communities will be a challenge. There is still a shortage of homes vs. supply, and that helps fortify nerves in these major names. The trick of course is the price mix, the geographic plan and the pace of new community investments when the credit conditions are so unfavorable on mortgage rates for the homebuyer.

Homebuilders know how to frame costs and margin forecasts based on the costs of the land and construction. The problem is gauging what affordability will look like into the next peak selling and building season. If you believe inflation can get down to 4% or less by year end, you need to plan build rates and market segment mix. Mortgage rates are a shock, but 6% handles are hardly new and have seen robust demand in the past. That is a matter of price and how that flows into the monthly payments.