Goldman-Morgan Stanley Diverge

Excerpt from Footnotes and Flashbacks: Week Ending January 20, 2023

We look back at a few notable events in the week as earnings blitzes out. There has been so much to read in the financial sector that it is hard to keep up with the trends. There were some notable winners and losers this past week (Morgan Stanley won, Goldman Sachs lost). As we laid out last week (see Footnotes and Flashbacks: Week Ending Jan 13, 2023), our core conviction on hard landings is that it takes a weak banking system, severe credit contraction and major asset quality stress or some sort of external shock to get us there. That is especially the case if we use the past cyclical downturns as the metaphorical “curve” to grade against. The inflation threat has been real but not in a league with the Volcker stagflation years.

We saw the health of the bank system supported in the numbers of the first wave of earnings from 4 of the Big 6 last week with JPM, BAC, Citi, and Wells weighing in first. This week saw Goldman and Morgan Stanley go in very different directions on earnings day. Then the range of big and small regionals were weighing in with some benchmark consumer finance operations such as Ally (which we look at below).

There is plenty to watch around the potential squeeze in net interest margins and cyclical erosion in consumer and corporate credit quality, but that is not on the level of oil patch stress or a severe setback in commercial real estate seen in the past. We covered some of the longer tailed risks that can change this constructive view in Risk Trends: The Neurotic’s Checklist 12-11-22. The handicapping of event risk and systemic shocks is never easy and often you don’t see it coming in pace and/or magnitude (e.g., COVID, the oil meltdown in late 2014 on Saudi actions, the sheer scale of undisclosed counterparty risk in 2008).

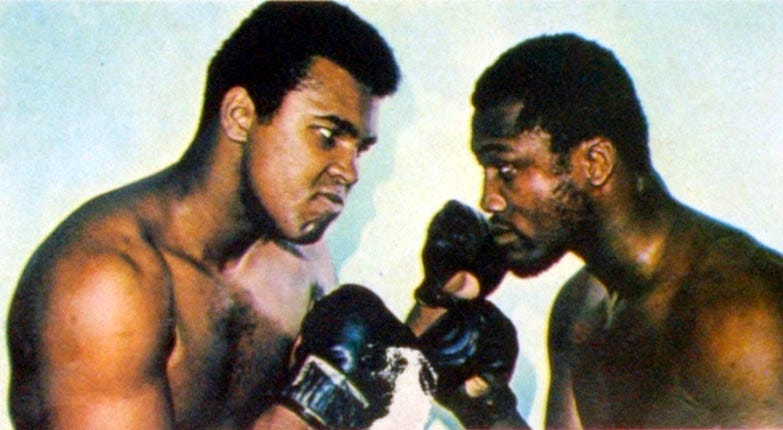

Goldman Sachs vs. Morgan Stanley: The headlines are always bigger when Mighty Casey strikes out (No Joy in Mudville, etc.,) but the good news for the market in the bad news at Goldman was that the losses were not reflective of a broad market turmoil issue or asset quality problem that could easily be mapped to others among the financial leaders. Loans and credit card quality problems at Goldman had many peers in the generic space across bank names that did not see those kinds of numbers. It was a company-specific business line failure and major execution problem.

While the generic bucket of “consumer lending” can be mapped onto others, there were some special mistakes unfolding at Goldman. The financial reporting details the outsized reserve on both loan growth and asset quality weakness. The fact that the week ended with the news that the Federal Reserve is looking into their oversight of the business did not help. The earnings reporting day saw one stock plunge and one spiked for a 12.3 point return gap on reporting day. Goldman as slammed on the financial cable shows for its high noncomp expense ratio and massive losses in its headline growth initiative. Goldman’s full year provisions for credit losses of $1.7 bn in the Platform Solutions segment ran off the charts and generated a $2 bn pretax loss in that segment. The Goldman team will be getting grilled at its Investor Day on Feb 28, 2023.

When I came to NYC in 1980 and started working in finance in the bull market 1980s, Goldman and Morgan Stanley were the kings of the bulge. First Boston took a shot at it during the 1980s but lost its chance during the hung bridge years and the need to get bailed out by the Swiss. Lehman was out of contention after the banker vs. trader wars of the 1980s and the merger into Shearson under American Express (later the shell of EF Hutton jointed the party). Morgan Stanley struggled during the Dean Witter wars. Goldman and Merrill were the leaders with Goldman getting the edge on investment banking prowess.

The 1994 period had some rough headlines for Goldman in the bond turmoil of that year, but the last of the great ancestral partnerships went public in the spring of 1999. Goldman has held the top dog role since, but this latest setback hands the badge to Morgan Stanley until Goldman cleans up Dodge.

Merrill was rolled into BAC over Lehman’s crisis weekend. Lehman was dead and Bear already a distant memory of March 2008. That left Morgan Stanley vs. Goldman among the legacy major brokers who had to switch to Bank Holding Company status with the 2008 crisis.

We see the solid performance in MS equity above vs. the peer group. Goldman is no slouch either and will get back on track. Morgan Stanley had overhauled its business models after the crisis and has become a major success story in Wealth Management and Asset Management. With a lower exposure to balance sheet intensive loan operations and consistently high fee generation, MS has been a relative winner across a tough year for financial services. Goldman still runs a distinctive business mix relative to Morgan Stanley even without the platform solutions fiasco. We expect most will see the Goldman mess as an anomaly, heads will roll, and Goldman will get to fighting it out for top dog again.