Fed Action: Roulette or Dominos?

The Fed’s 25 bps met the consensus, but it also gave depositors 25 more bps to move their cash into T-Bills.

The Fed action of a 25 bps hike just keeps the debate on inflation fighting going but now with the added twists of credit contraction and recession fears.

The trade-off of how much of the demand destruction work will be done by the banks pulling in the reins might make life easier for Powell and the FOMC, but there is no exact science here.

As everyone geared up for the news at 2pm today, the broad consensus was for a 25 bps rise after two weeks of regional bank hell. The rationale checklist went something like this:

If he pauses, everyone will assume he is seeing a much worse trend line over the wall on depositor outflows with his store of confidential regulatory information. SELL!

If he goes 50 bps after this, then he is returning to hawk mode to break inflation and dial back employment. SELL!

If he focused on financial stability first, he is subtly promising to call everything systemic and bail out banks. BUY!

If he touches on financial stability while raising 25 bps but is very vague on support, return to a state of confusion and uncertainty. BUY! SELL! HEDGE!

The interesting aspect of the 25 bps increase to a 5% upper target is that you just gave every depositor a good, safe alternative to deposits for cash. All you have to do is point and click those uninsured deposits and move into short T-Bills, pick up yield and ride this out. You can drop in a laddered UST T-Bill portfolio at 4% handles and wait to see if some of the Congressional and Senate talking heads back up their talk on protecting community banks and smaller regionals or even larger regionals by legislation and not just Fed discretion.

Since the Fed has stepped in, you don’t need to run away since liquidity is available to support regional banks. That said, the regional banks equities have been slow to crawl back, the bears are already talking real estate crisis, and consumer credit is supposedly going to see more brakes getting tapped.

Among points of confusion coming out of the call is how the QT program dovetailed with the challenges of the banks to shed MBS and agency paper to better align their securities holdings with the hot money deposit risk.

The stock market delivered a mild negative opinion on Powell’s view of credit contraction with a mid-1% handle decline. Short UST rates were mixed, and futures are not rattled as we go to print. The term “credit contraction” has been making the rounds with a very high frequency, and plenty of banks and finance companies are hearing it. So are investors. So are those who are planning production rates and inventory needs. That sentiment will get tested in coming inflation and employment releases.

The stagflation debate will not pick up steam since fed funds hovering in the same neighborhood as PCE (5.4% Jan 2023) and Core PCE (4.7%) is not the way Volcker wrote the playbook. As much as the market has been shocked and rattled by the hikes, this is the time when the stagflation concern starts in more earnest.

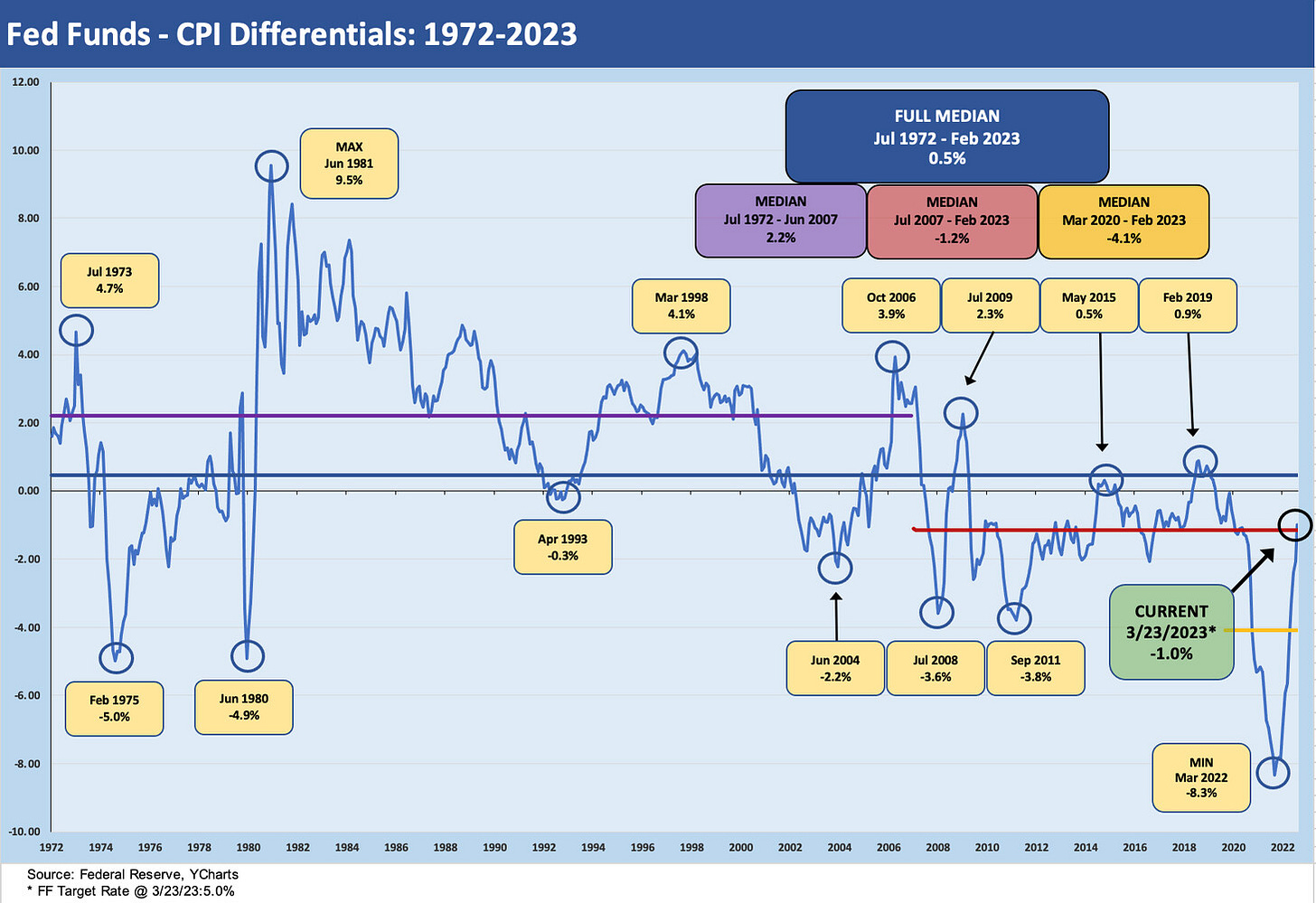

Using CPI (rather than PCE) as the metric, leaves fed funds even more off the category of “real fed funds.” In the charts above and below, we look at CPI vs. fed fund in historical context.

This Fed policy debate means that if you bet on protecting the banks, you might lose on inflation. If you bet on inflation fighting, you might lose on the banks and the expansion. That is the strategy of red vs. black. If you get inflation and a recession and stagflation, you just changed the game from roulette to dominos.