Delta: Earnings Offer Signs of Consumer Strength and Industry Rebound

Excerpt from Footnotes and Flashbacks: Week ended January 13, 2023

The Delta earnings report and analysts call failed to impress the market (DAL sold off -3.5%) despite very strong numbers. The problem was the forward guidance and quantification of most (not all) of the pilot contract costs. Revenue and EBITDAR forecasts remain bullish, and the credit trends for Delta especially remain solid. The expectation for full investment grade ratings was downplayed by management on some cable interviews as a 2024 timeframe. There are more than a few highly sensitive variables in this volatile sector that could make that an earlier event.

The expectation of debt reduction and higher earnings is not a bad combination regardless. Airlines have been on the short list of easy examples to push back on the idea of a sharp erosion in the PCE accounts of GDP. The fares people are willing to pay may be a function of pandemic blues, but it does not show low consumer confidence. We don’t set our sundial by consumer confidence metrics, but Friday (1-13) did post a solid one.

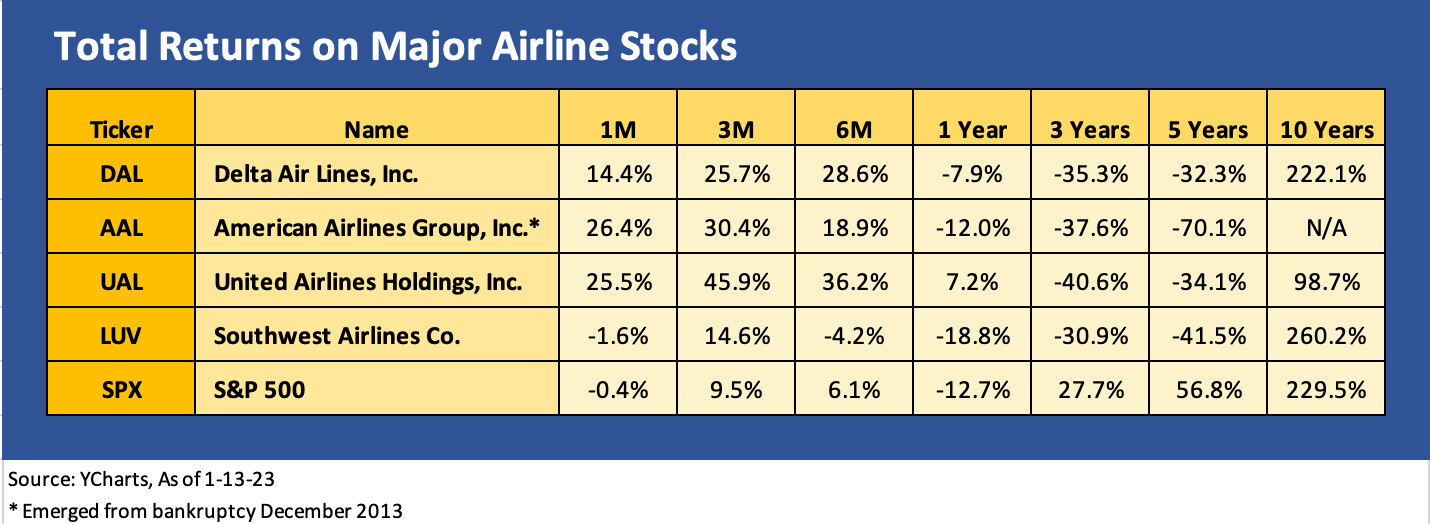

The chart above frames the total returns for select major airline equities over various trailing time horizons. We post the “Big Three” in revenues and capacity followed by Southwest with its very distinct operating model. LUV generates less than half the revenue run rate of DAL, AAL, and UAL. That said, LUV has a disproportionately large market cap relative to the revenue comparison.

The trailing total returns highlight how well airlines held in during a rough market stretch and especially in the peak travel quarters. We see the effects of COVID over the trailing 3-year period. We also see some of the effects of operational turmoil and notably with Southwest, where the low cost model has boomeranged a bit in recent weeks.

The 2022 and recent outperformance make a statement for an industry that needed Federal aid back during COVID. The airlines have been big winners in the post-COVID period on the demand side, and demand has helped the airlines push through the shattering effects of a spike in fuel in 2022 and the wage demands in the ranks – notably the pilots.

Airlines have been “feast or famine” across cycles with a long list of financial stress stories across the decades. The longer time horizons underscore the sector’s jaded and volatile history. Those of us who followed the sector in prior lives remember the bankruptcies, mergers, the mad scrambles to buy assets and grab slots/gates from the broken (e.g., Pan Am, TWA) or bankrupt (note: most of the mainline carriers at one point or another with Southwest being a rare healthy credit story across the cycles). The rise of regional jets, less hub-and-spoke domination, more point-to-point service, and the steady rise of low-cost carriers (LCCs) and “ultra” LCCs (“ULCC” was a nice ticker for Frontier) will always keep this sector interesting.

The tight labor story is going to be heard across more than the airlines, but the major carriers are facing overwhelming demand that has stretched the system to the limit. Pilots are in short supply and their pricing power is clearly quite strong. The roaring travel markets has given employees ample pricing power to make demands from pilots to machinists to flight attendants. That has been true at mainline carriers and regionals alike. Despite cost pressures, a solid name like Delta will be in a position to roll into sustained balance sheet improvement on rising earnings.

The CEO was on the cable circuit to end the week after earnings giving interviews, and he was pitching the march to investment grade. For credit quality, management framed 2024 as a year where investment grade metrics were achievable for Delta, which is remarkable given the crisis as COVID was first unfolding. The consumer and business travel outlook stories are part of framing where the consumer sector is headed in 2023-2024. That is for another day.

Airlines costs and airfare inflation is a topic unto itself. The critical variable of jet fuel prices has been volatile in recent years for obvious reasons while the spike in travel has left many carriers struggling to keep up from a manpower standpoint. The breakdown between non-fuel CASM (cost per available seat mile) and fuel costs will remain a challenge to handicap since both see very different dynamics. Jet fuel costs used to be easier to map from swings in oil, but the distorting constraints of refined product supply-demand by product category and the severe disruptions in Europe do not make generalizations very reliable. That is especially the case after such a wild year in upstream and downstream markets.

Airfare will run higher with fuel costs, but the company will not get to keep all the benefits if oil is running in the other direction. When economists write about consumer demand and elasticity, they will have a very hard time framing the ability of the carriers to do this well during such inflationary spirals for fares.