Deere and Capital Goods: Earnings Another Vote Against Recession

Excerpt from Footnotes and Flashbacks Week Ending Feb 17, 2023

Agricultural equipment stays solid with strong numbers from Deere…

We have been keeping an eye on the major cap goods companies during earnings season for signs of cyclical guidance. Companies such as CAT and DE are bellwethers in any market. They are also major OEM factors downstream just given their scale and how CAT and Deere serve as a buyer from a wide range of suppliers. The tonnage significance of the cap goods sector for freight and logistics providers is a major driver of revenue for many related services subsectors. Similarly, Deere’s financial services operations provide critical credit services that run deep into the farm community and beyond just the equipment sold by Deere.

We had earlier reviewed CAT, CNHI, and CMI in our weeklies over the prior two weeks. The guidance on balance has been steady with more business segments offering outlooks for growth than contraction. The capex planning and adjustments to order books in key end market (notably in construction and mining) come at a lag, and there are more than a few signs that demand will remain strong.

The most common top-down variables cited included oil and gas investment, the expectation of solid metals markets on China recovery, the energy transition capex programs tied to climate initiatives, the infrastructure bill, and the IRA for clean energy investment incentives. The ag sector has its own distinct set of cyclical dynamics, and DE just reaffirmed those are looking good.

Revenue growth, margin improvement and favorable guidance from DE…

Deere posted its fiscal year results at the end of October (10-30 for FY 2022) with favorable guidance. Now with F1Q23 results, DE has raised earnings guidance for FY 2023. DE saw margins expansion in its main segments in F1Q23 on a combination of favorable volume and price variances. For segment 2023 guidance, the color provided was strong with the largest segment (Production and Precision Ag) calling for +20% in revenue and material operating margin expansion from just under 20% to a range of 23.5% to 24.5%. The two smaller segments are also looking at better numbers for 2023. Construction and Forestry is looking at +10% to +15% higher sales and wider margins from 16% to 17%-18%. Small Ag and Turf is looking at flat to up 5% with minor moves in margins in a 14.5% to 15.5% range provided.

We break out the fine details to clarify that Deere is one more major equipment maker voting against recession for its core business lines. Of the recent major cap goods companies that reported, Deere has more in common with CNHI than CAT, but Cummins serves the highly volatile US Class 8 markets and medium duty commercial vehicle markets. For its part, PACCAR (considered the leader in the premium heavy duty truck market) reported record revenue and earnings in late January. PCAR posted a favorable forecast for US Class 8 markets, which is a common indicator of cyclical trends. PCAR indicated Class 8 volumes will be up modestly in low single digit % to a midpoint of 290K units from the 2022 actual of 283.5K. PCAR also cited a capex and R&D program that nears $1 bn on the high end of the range.

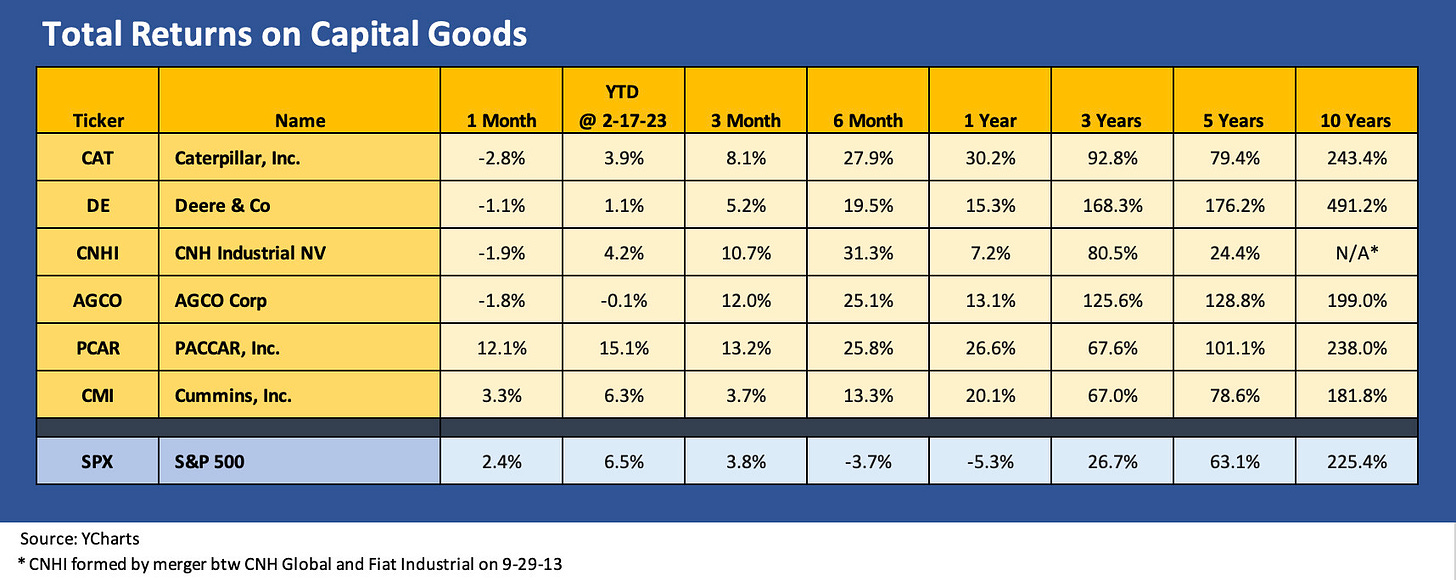

The above chart updates equity returns in the peer group, and Deere’s F1Q23 earnings report and guidance put it right back in the game with bullish numbers and guidance after DE lagged YTD. The +7.5% bounce in its stock Friday pulled DE back into positive territory with the other bellwethers.

PACCAR is the performance leader with its strong position in commercial vehicles and Class 8 trucks specifically. Freight and logistics had gained a lot more focus this past cycle than it usually would get, and truck markets are a big part of that story. The investment by all players to keep pace with the propulsion revolution (for PCAR, EV and AV investment) is a self-fulfilling prophecy in economic activity and planning.

The commodity end markets broadly have kept investors focused on what investments will need to be made in Machinery and Equipment for energy, agriculture, and mining. There are also investments to be made around clean energy and climate initiatives that are supposed to mitigate recession risks on the equipment line of GDP. For DE, it is more narrowly about the ag sector as the key driver since they are the unequivocal global leader.