Credit Crib Notes: United Airlines (UAL)

We summarize the financial and operating trends for UAL in bullets and charts.

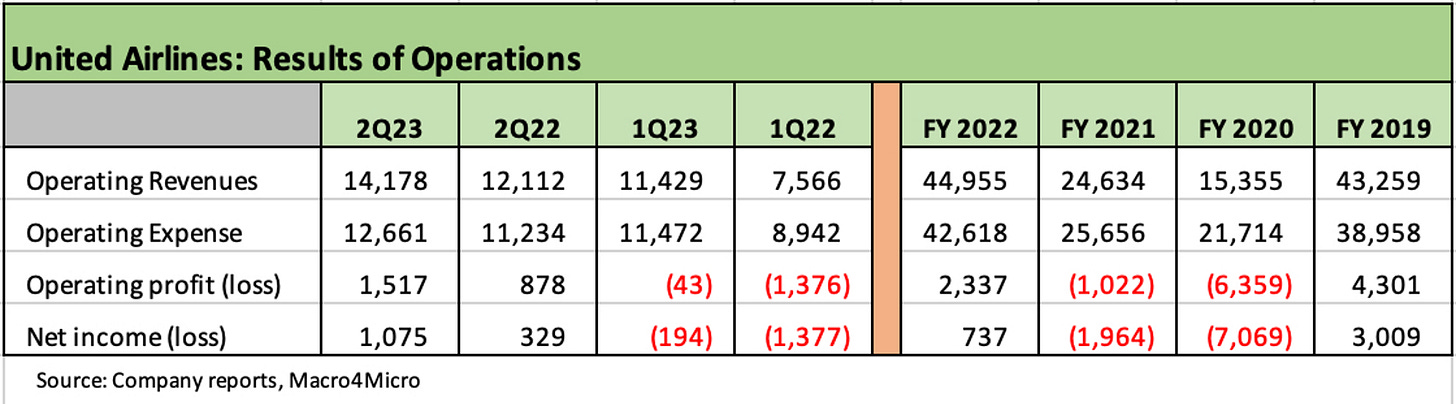

Credit quality trend: Positive. Lower leverage, record revenues, soaring profitability, a strong core business (notably international), and sustainable traffic growth on capacity expansion support credit trends.

Operating results: Demonstrated pricing power, a comprehensive fleet makeover/upgrade in process, the shift to more mainline aircraft vs. regional, and healthy unit revenue vs. cost trend supports cash flow.

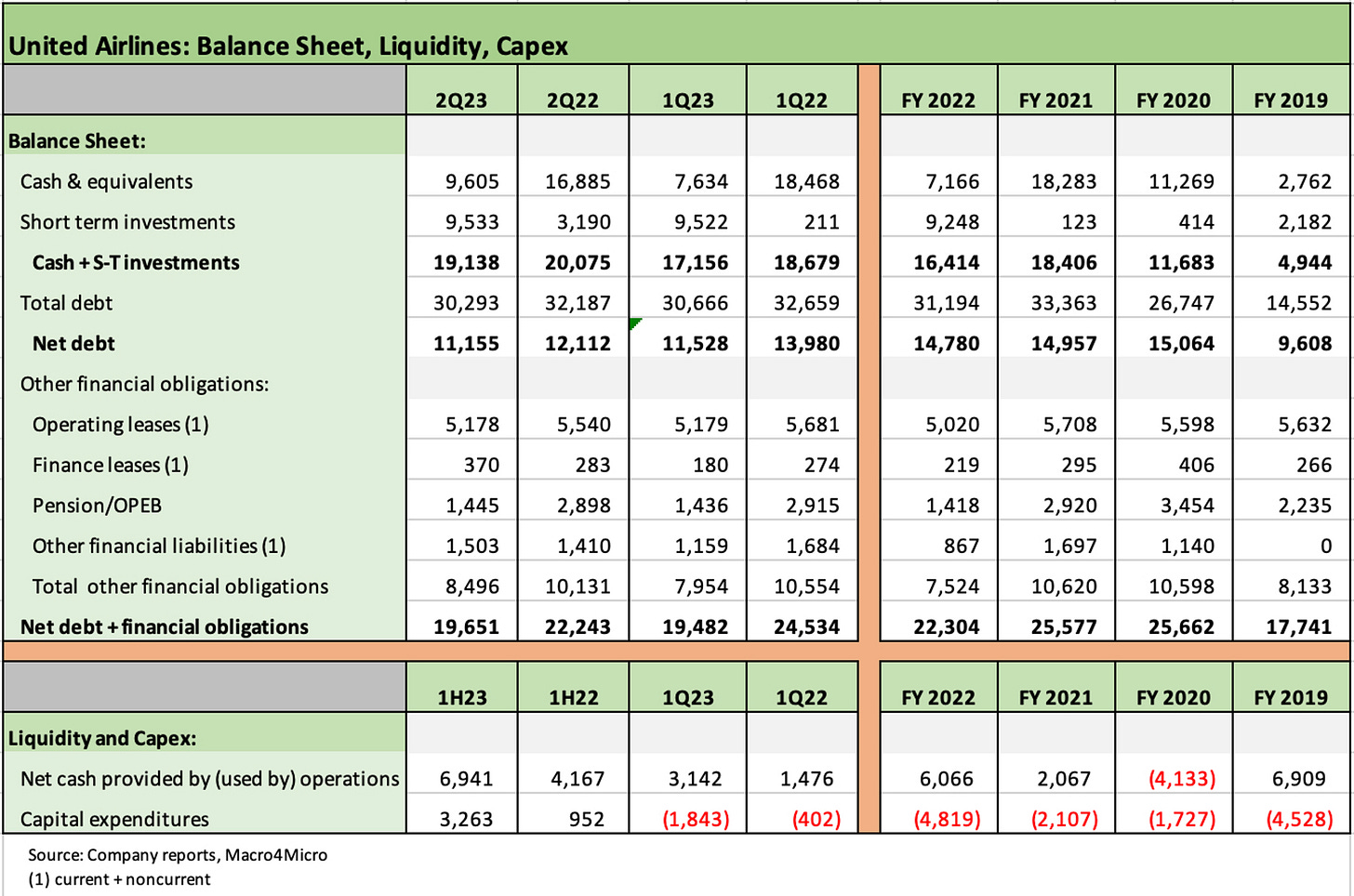

Financial profile: Leverage plunged YoY on soaring earnings with Net adjusted debt/EBITDAR back down to 2.4x with debt reduction running alongside record revenues and profitability.

UAL has posted a mix of record numbers in 2Q23 that saw profitability exceed the peak pre-COVID 2Q19 period with strong support from soaring international profits.

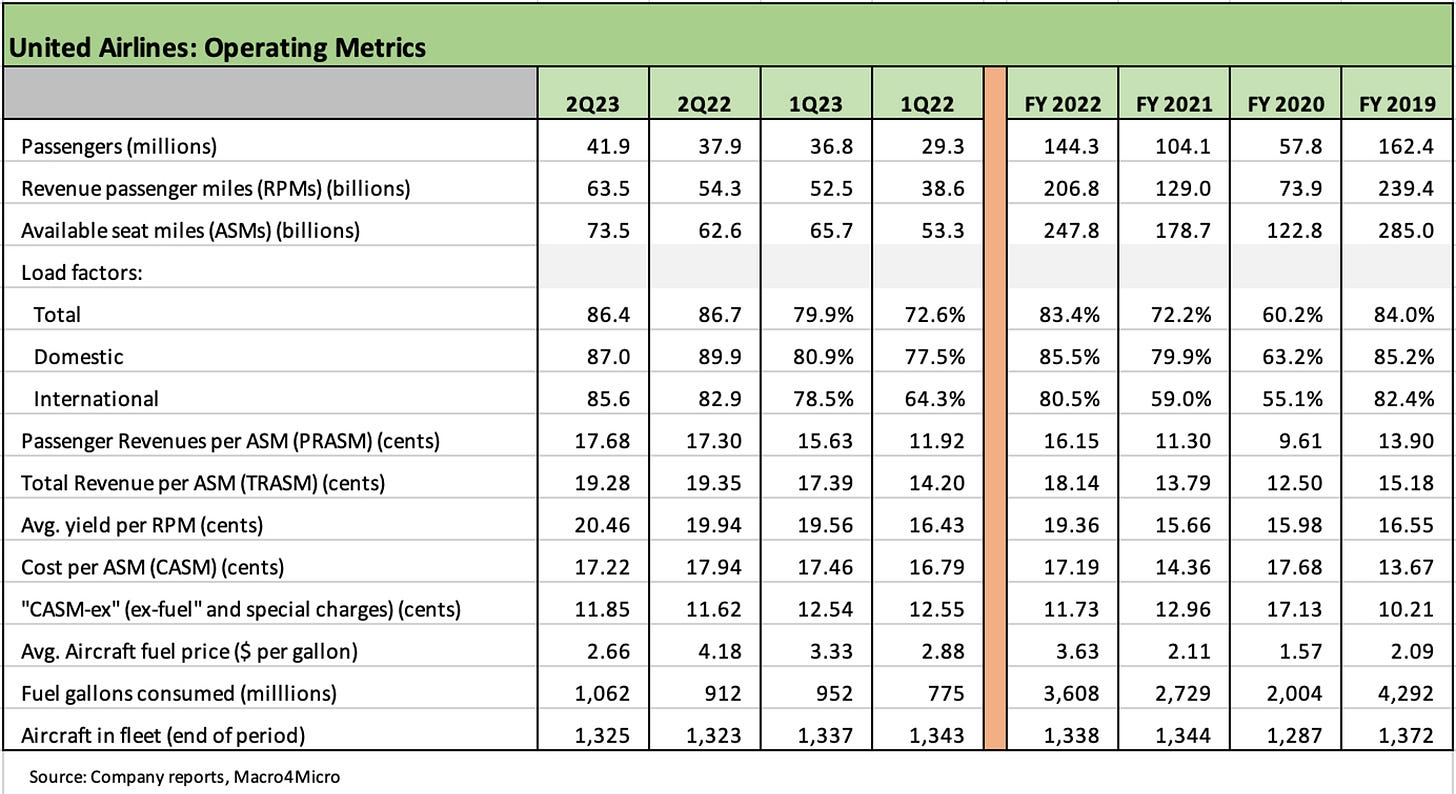

Volume and capacity drive the story and the fleet upgrades will sustain growth into 2024.

Free cash flow of $3 bn in 2023 support steady flexibility of cash flow deployment across debt reduction and reinvestment.

Operating metrics show the benefits of improved unit revenue, unit costs, and most importantly a dramatic improvement in fuel costs in 2023 after the 2022 spike.

Capacity expansion on international will drive higher profits and cash flow and solidify UAL’s position as the leading international carrier with core strengths in the Pacific and Atlantic markets.

Total debt is still dramatically above 2019 level, but net debt a more muted increase at this point with the cash hoard over $19 bn providing a healthy cushion against cyclical risks and operational disruptions.

An overriding priority will be to sustain debt reduction, increase the base of unencumbered assets, and take leverage metrics and credit quality back into unsecured investment grade quality.

High rates of free cash flow make steady debt reduction and more secured to unsecured refi and extension financing realistic and achievable across 2H23 and into 2024.

High interest rates in 2023 will promote patience in the timing and scale of refinancing actions.

UALs capex programs and fleet replacement cycle calls for more mainline fleet additions and expansion of next generation widebodies (787s, A 350s) to press it competitive advantages in international markets where it is the Pacific and Atlantic leader.

Highlights and History

Passenger revenue mix for 2Q23 was 59% domestic, 20% Europe, 9% LatAm, 9% Pacific, and 3% Middle East/India/Africa, but the leaders in incremental passenger revenue growth in 2Q23 were Europe and the Pacific regions.

United filed Chapter 11 in Dec 2002 and did not emerge until the start of Feb 2006.

UAL merged with Continental in 2010, which bolstered UAL’s presence in Houston and Newark hubs to go with hubs in Chicago O’Hare, San Francisco, LAX, Denver, and Washington-Dulles.