Credit Crib Notes: Delta Air Lines (DAL)

We summarize the financial and operating trends for DAL in bullets and charts.

Credit quality trend: Positive. Delta plans to reach investment grade metrics in 2024 and that goal looks achievable. DAL securities are currently layered on both sides of the speculative grade divide with secured and unsecured capital structure layers in the BBB and BB tier.

Operating profile: Delta is now positioned as the strongest major airline in execution and has surpassed Southwest as the latter experienced so many operational problems this cycle. Strong international performance, notably in Trans-Atlantic markets, has been a key driver for DAL.

Financial trends: DAL is heavily focused on its rising free cash flow and continuing its steady debt reduction with a return to 2x handle EBITDAR leverage in 2024.

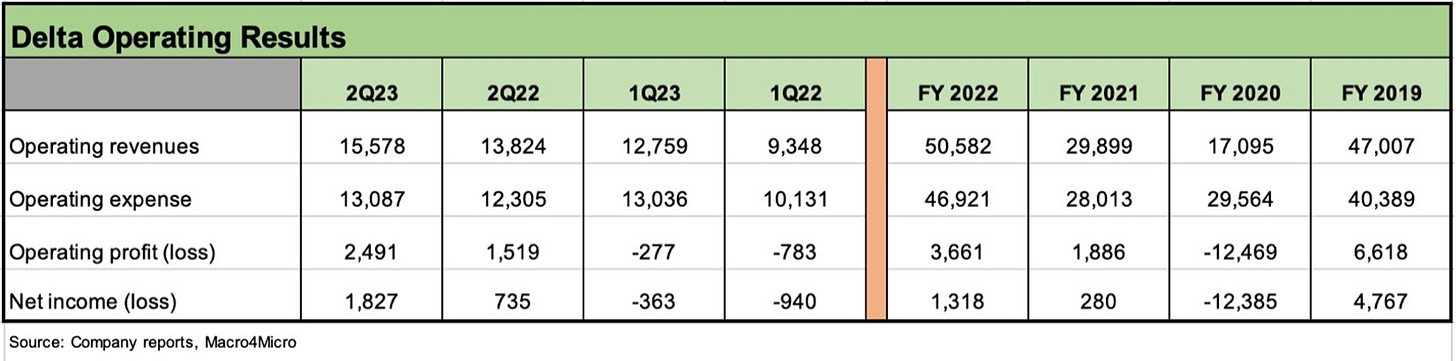

A record quarter in 2Q23 year drove a 17% operating margin (16% unadjusted) which is back in line with 2Q19 and the pre-pandemic period when DAL generated numerous financial and operational records in FY 2019.

The peak seasonal travel periods of 2Q and 3Q are framing up very well for DAL with 2Q23 well ahead of the record 2Q19 quarter in revenue and operating profits.

Net income for just the 2Q23 period beat the entire fiscal year bottom line for 2022, so there is no questioning the pace of the rebound with leverage running lower to 3x on rising EBITDA.

The decline in fuel costs is a major variable cost factor that supports the operating profit rebound in 2023 after the energy sector turmoil of 2022.

The special metrics disclosed by the airlines and by Delta show the combined impact of volume, pricing, and fare structures moving in the right direction relative to unit costs.

The RPMs for 2Q23 are still below 2Q19 as are ASMs, leaving room for upside in historical context with growth continuing into 3Q23.

Fuel is a critical expense line (19% of 2Q23 operating expenses) that heavily influences profitability and fare flexibility with costs or profits easily passed through in this market.

Debt is moving in the right direction as DAL plans to retire $4 bn in debt during 2023 with $3 bn already done YTD 2023.

Free cash flow of $1.1 bn during 2Q23 and just under $3 bn during 1H23 sets DAL on a path to continue its plan to reduce debt while sustaining a high rate of capex.

Unfavorable yield curve migration into 2022-2023 undermines the economics of refinancing and extension in many cases, but DAL is still taking action on higher coupon debt via debt reduction.

The heavy weighting of fixed rate debt (88%) cushions the impact of the Fed tightening.

Liquidity stood at $8.8 bn at 2Q23 including a $2.8 bn undrawn facility.

The increase in total debt across the pandemic year 2020 totaled almost $18 bn above year end 2019 including $9 bn of secured SkyMiles notes/term loans, $5 bn of notes/term loans secured by slots, gates and routes, and unsecured loans from the CARES Act Payroll support program.

Total debt to EBITDAR stood at 1.7x back in 2Q19 and reached 3.2x by 2Q23 with a goal of 3.0x by year end 2023 and less than 2.5x during 2024.

GAAP unfunded pension obligations declined by $1.5 billion in 2022 to $90 million primarily on higher discount rates and a $4.6 billion actuarial gain. That followed a $1.5 billion DAL employer contribution in 2021 that helped whittle the unfunded obligation down from $6.1 bn at the end of 2020.

Highlights and History

Passenger revenue mix for FY 2022 was 75% domestic, 15% Atlantic, 7% LatAm, and 3% Pacific.

DAL materially grew its European and Trans-Atlantic presence with the Pam Am acquisition in 1991 after that legacy carrier filed Chapter 11. The deal also brought the Pan Am Shuttle.

Delta filed for Chapter 11 in 2005 (emerged 2007) and later merged with Northwest Airlines in 2008, substantially broadening its Midwest and Pacific presence and bolstered its Seattle share.