CPI: Hungry for Inflation Outliers?

We look at CPI line items above 15%. Most of it's tied to food.

I got some “woke” for your chicken eggs!!

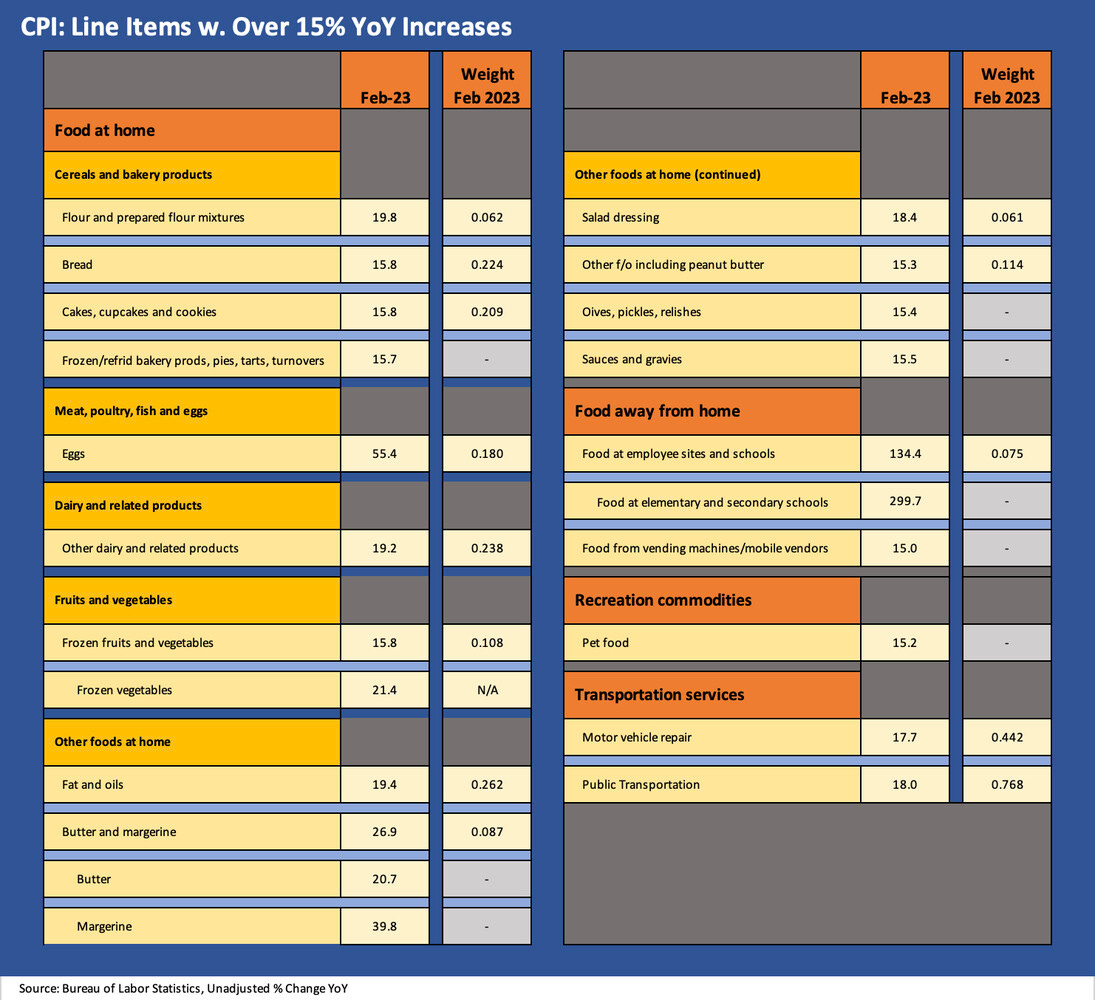

We already looked at the main events in the CPI trend line in Feb 2023 (see CPI: Feb 2023 Big 5 and Add-Ons 3-14-23). Just for an exercise, we tried to pull out anything that shows unadjusted YoY increases of 15% or more. It should not be much of a surprise that most of these line items are in the food buckets (mostly Food At Home) with that category’s 9.5% for Food All and 10.2% for Food At Home.

The chart screens line items for being in excess of 15% year over year unadjusted. The heavy mix of food is a reminder why there is so much political risk in the CPI trends with so much of it taking place at the grocery store. The list sure lands on a lot of shopping lists as you peruse the line items. Eggs have been a major story line in the CPI trend given the fallout from avian influenza (someone will blame woke roosters for being lazy). Egg inflation is now down to 55%.

We see bread and flour, cereals, dairy related broadly, butter/margarine, and fats and oils. In a troubling trend for most of us, cakes, cookies, and bakery product are part of a list with a lot of downstream effects from the eggs and flour inflation.

In the Food Away From Home category, the rise in food inflation at employee sites and schools clocked in at triple digits (134%) with the subcategory of food at elementary schools an eye-opening 299%. From what we could find out, the spike in school costs included effects from an expiration of pandemic era aid to schools and many incidents where supplier related force majeure actions allowed repricing above contractual terms. Food spikes, commodity moves, labor costs and freight inflation all get passed along. When in doubt, mark up the food that goes to kids at school.

The food piece of the CPI puzzle remains pretty bad. That is never good for polling.