Consumer Finance and Banks: Q&A Gauntlet Begins

Excerpt from Footnotes and Flashbacks: Week Ending April 16, 2023

With regional banks set to run the Q&A gauntlet this coming week and the banks hopefully upping their disclosure and transparency game this reporting season, the consumer finance banks also will be weighing in with a lot of granular details on how consumer credit quality is shaping up. That will get into the question of how the consumer-centric lenders are seeing their appetites to lend shaping up.

Beyond lending standard shifts or the usual array of delinquencies and charge-off data, there will be color on select segments from cards to autos to student loans. That will offer visibility on trends along the services (e.g., leisure and travel) and goods (e.g., auto, home repair, appliances furniture, etc.) chains.

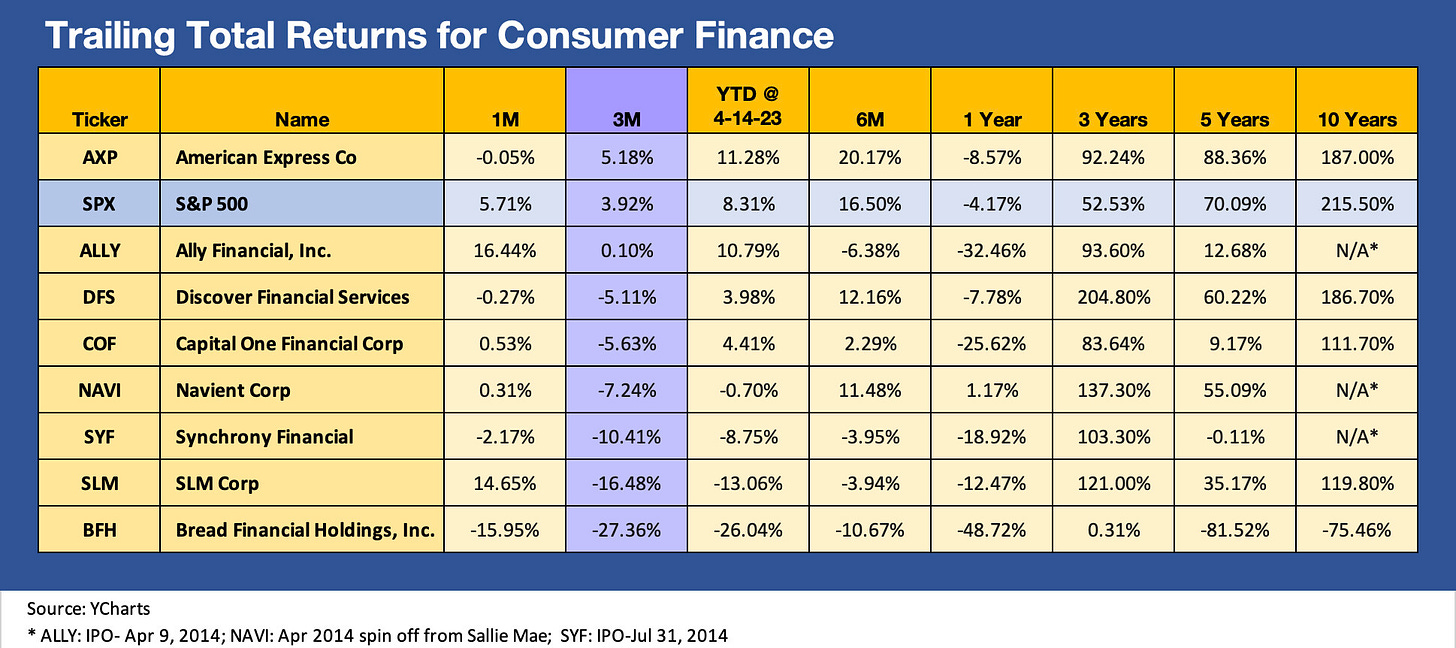

Below we break out the performance of some notable names that get a lot of street scrutiny in the consumer finance space.

The equity markets appear decidedly mixed in how this group’s issuers are trending. The asset categories cut across all aspects of consumer and household finance. Once again, we line them up in descending order of 3-month total returns.

There is a wide range of results in the market but only behemoth American Express is ahead of the S&P 500 over 3 months. Looking back 6 months is similar as cyclical concerns already have been creeping in around asset quality even before the deposit fears set in.

We are not covering these names (Ally is an exception for the auto connection) and we will leave the fine print to the bank gurus, but the theme of household spending (whether via borrowing or from household cash flows) and credit contraction at the consumer level is a critical piece of the puzzle on GDP and industry demand trends. Record high payrolls in the jobs market and a rising population of retirees outside the labor force just don’t suddenly stop spending without more negative catalysts.