Business Development Companies: A Rapidly Growing High Income Sector

Excerpt from Footnotes and Flashbacks Week Ending Feb 17, 2023

The BDC market has been a growing area of focus for more investors in both debt and equity markets, and the earnings trends and dividend actions have not disappointed. Whether it is the secular rise of private credit, or pension and personal accounts looking for cash income as well as yield, the BDCs are seeing expansion initiatives from most of the top dogs in credit AUM. The longstanding leading legacy players in the space (the Golub Brothers et al) have been joined by a slew of private equity brand names (e.g. Carlyle, Ares, KKR, Apollo) and HY and loan players (e.g. Oaktree, Barings, BlackRock, GSAM) among others. As a reminder, BDCs have been around for quite a while (1980 legislation gave them a big lift). The current market offers a multiplier effect growth opportunity.

Many BDCs have been active in the unsecured bond markets and preferred stock markets as well as issuing new common equity as part of their growth plans. We will be looking at various single names in more detail in future commentaries. These names have a lot going on across the peer group with respect to industry and portfolio mix “flavor” and in terms of how they have configured their balance sheets. There have been more than a few roll-ups of smaller players into bigger players.

I already disclosed that I have been a buyer and occasional seller (for some long term holds and income generators) in late 2021 and earlier 2022 as I rebalanced a retirement portfolio. I prefer to hold the BDCs longer term with so many double-digit dividend yields, but sometimes when you want to build cash on market uncertainty, you let go of some good positions.

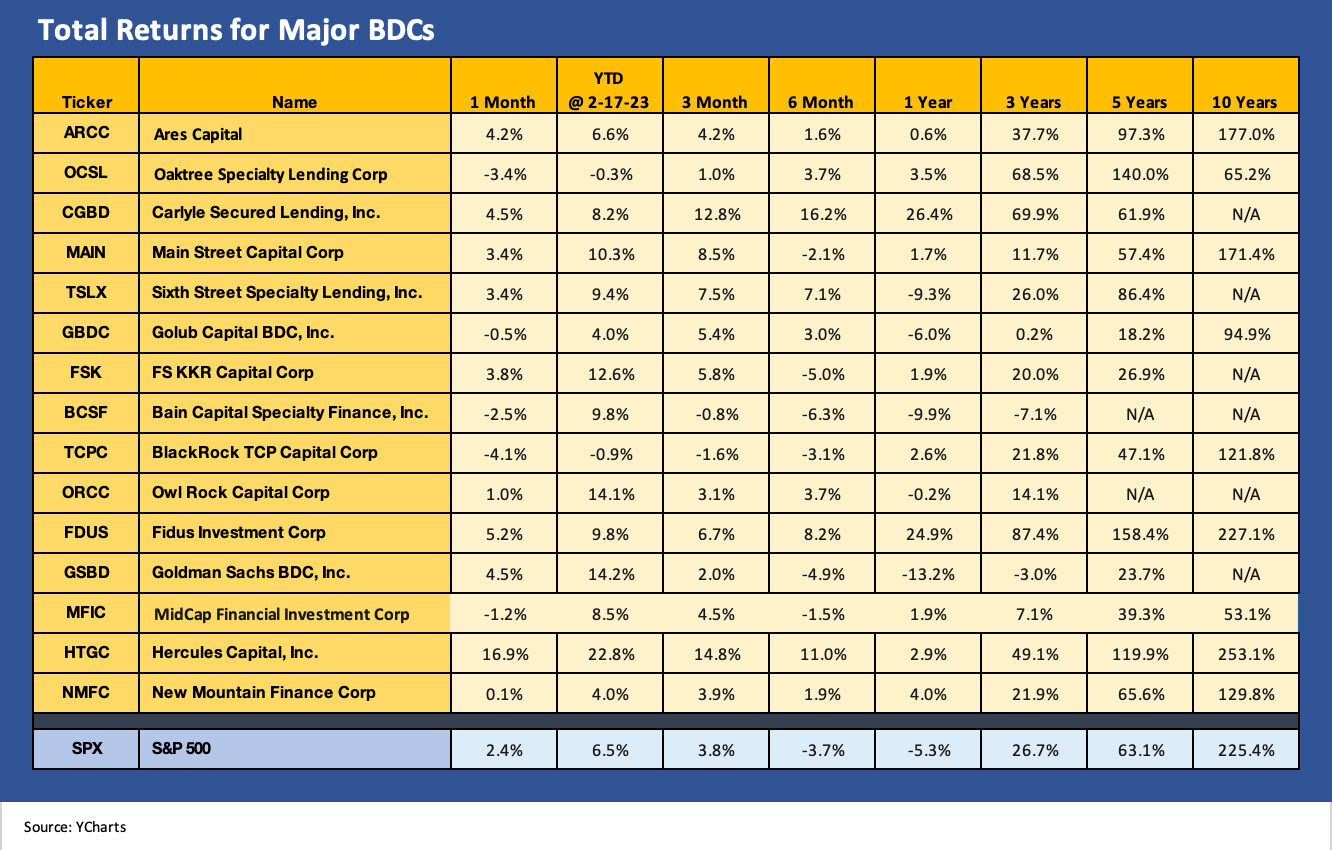

The names in the chart below average around 10% dividend yields that are possible from their loan holdings income. The interest margins generate income flows that are still strong even when compared to a materially repriced HY market and loan fund alternatives. The assets are risky by definition, but the value proposition of secured and structurally senior loans still get us back to the same old relative value debate on loans, the credit cycles, and fixed vs. floating relative risk and value.

As an investment, BDCs and their equities are part of legally distinctive structures supported by US legislation back in 1980. The structure is one of those “pass through” vehicles that sends income and gains through to the shareholder (thus the high dividend yields). There is no shortage of primers on the subject floating around the web.

The above cross-section of names highlights the income generating attractions of BDCs during a period of protracted ZIRP and low absolute all-in yields for fixed income. The range on the dividend yields above run from a high 6% handle on Main Street (one of the rare monthly pay major BDCs) to 13% handles on FS KKR. The history of special dividends is one aspect of these investments that cater to those who want income but also are comfortable with leveraged loans and buyout related credit exposure.

These are high risk assets, but so are equities with no earnings and no free cash flow. Income is a prime component of total returns, so it makes for a complex set of variables. Our view on the BDC equities is that we see many correlate highly with the stock market on the price side (some less so) given the buyer profile, but the earnings and income trends behave as one might expect in a market with rising floating rates in a resilient (or soft landing) economic backdrop. The asset generates higher income on the floating rate assets. In a market where the Fed is fighting inflation (but not going to the Volcker Doomsday Device), the coupon is biased to the upside in 2023. The run rate in earnings is tied to asset growth, net interest margins, and prudent management and reserving of loss exposure for the loan book.

The trick for owning such stocks or their unsecured bonds or preferred stock is fine-tuning the monitoring process by watching the numbers and having some faith (trust but verify, etc.) in the managers. Those managers are in the high end (in some cases the highest) of their trade and they have a vested interest in performing well via fees. They also need to watch the expectations of a lot more asset gathering across their families of funds from the retail (stock buyers of their BDCs) to the institutional level (committed AUM to loan investing outside the BDCs). In some cases, it is easier to have them on your side than blowing up IG holdings with leverage LBO deals. To be clear, many BDCs include some equity and equity linked holdings that feed the special dividend flows.

Low dividend yields in equity markets also made this sector a hot one for the wealth management crowd and self-directed investors. The natural evolution of the balance sheet of the BDC was for more layers (unsecured bonds and preferred stock), and that is just what unfolded. For those BDCs that could get their story told to the rating agencies and win some BBB tier ratings (from enough of the NRSOs to generate demand from IG bond investors), BDCs such as ARCC had been able to layer in unsecured bonds at interest costs you will not see again any time soon after the dramatic UST yield curve shifts of 2022. As an example of a nice capital structure carry, Ares has a range of 2%, 3% and 4% handle unsecured bonds in their capital structure at low BBB tier ratings. That is corporate term debt stacking up to an average below short term UST.

We will be looking in more detail at the individual names in future commentaries.