Boeing: Different Scales, Different Magnitude

We look at the latest 737 MAX SNAFU in balance sheet context with a disproportionate mix of BA long bonds raising potential volatility risk.

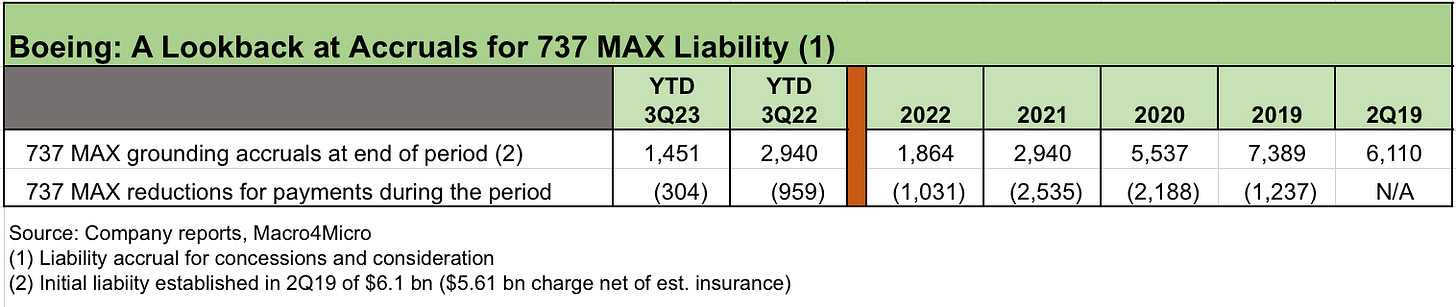

As Boeing wrestles with its latest bad set of headlines, we look back at some of the running 737 MAX liability balances and the demands on cash flow that came with the payments since 2019.

The latest MAX problem pales in comparison with the crisis that sent Boeing into a storm of financial pressures starting in spring 2019, but the incremental costs in 2024 from this latest SNAFU will not be minimal given the potential for lost customer revenue and uncertainty around what this means for future certifications and plane orders in the 737 MAX family (MAX-7, MAX-10).

We recap the balance sheet trends (i.e. soaring debt since 2018) as we look back across the timeline with Boeing a rare entity posting around $137 bn in market value in equity (down $13 bn in a few days) framed against -$17 bn in negative book equity.

The credit metric trends have been ugly along the way, but the rating agencies and market give BA a lot of room to maneuver as a member of the commercial aircraft global duopoly with its role in the top tier of the Pentagon’s prime contractors.

The relative value challenge…

From our vantage point, we see Boeing as overpriced relative to the mix of risk factors at this point. We have been watching the price action (BondCliQ, 7-Chord, ICE). BA bond levels have not been complacent around the recent setback, but the symmetry remains unfavorable. Long-dated paper appears in line with 15+ year BBB composites, but Boeing is not a median BBB risk at this point.

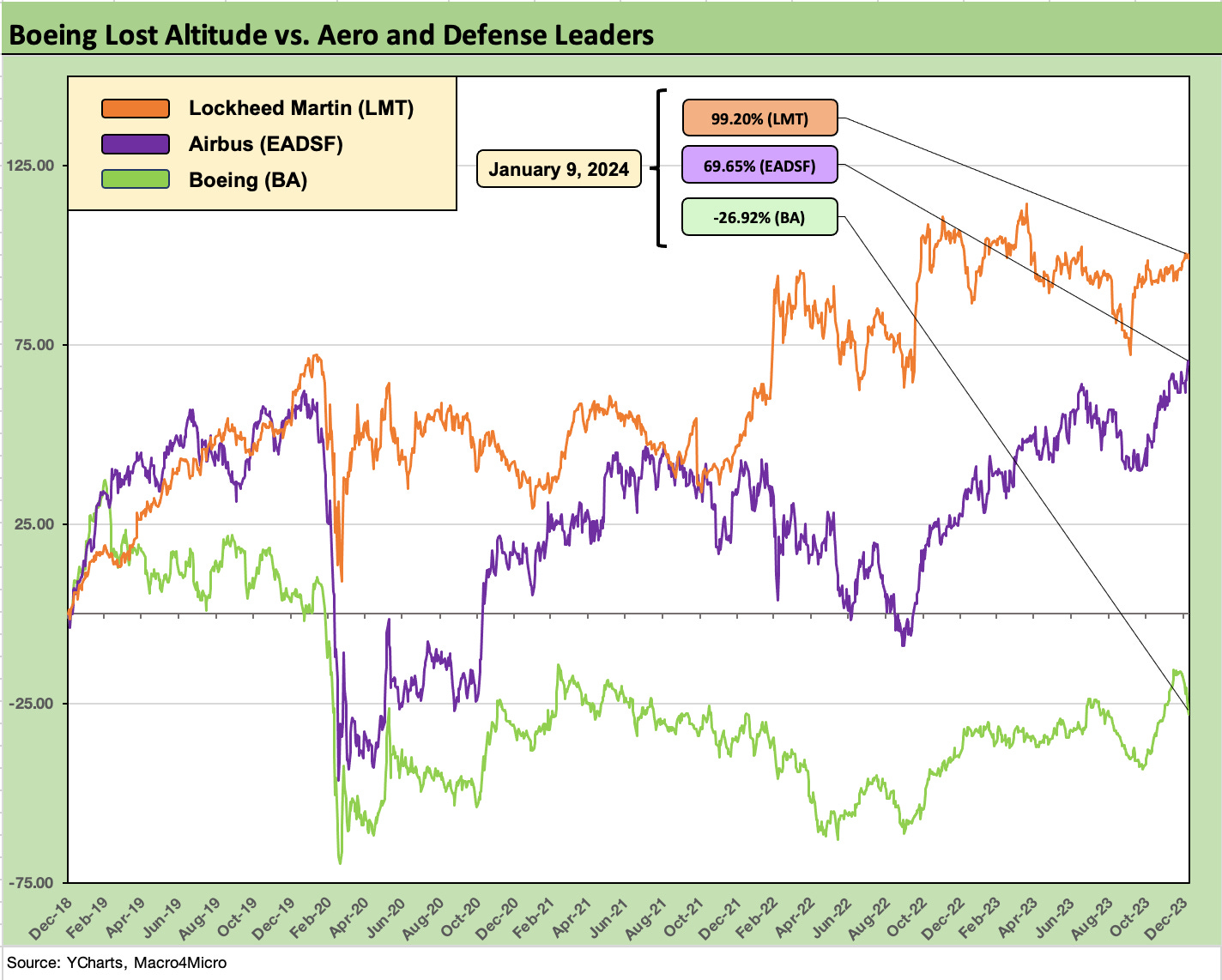

As noted above, Boeing stock had faded on its mix of problems, and BA equity has labored across the 2019 to 2023 timeline. For this latest bout of trouble, BA justifiably sold off, but the credit market has been relatively calm this week based on what we have seen through Tuesday close. With such a heavy mix of long dated bonds in its capital structure, Boeing bondholders are sitting at a low BBB tier composite rating that could see some more volatility if the MAX-9 situation sees even more complications.

After early optimism around getting planes back in the air, the situation is getting more uncertain on the chatter around loose bolts and ties to the supplier chain. Boeing, the airlines, the FAA, and NTSB provided little clarification other than that the full and complete details are not clear at this point.

Below we frame a cross-section of some of the larger Boeing bond issues (priced as of 1/10/24 afternoon) across a representative mix of maturities all the way out to 2060. If one looks at the entire collection of Boeing bonds (smaller partial list shown below), there is a very heavy mix of bonds out past 10+ years and 20+ years.

In the chart below, we included a bigger share of the May 2020 mega-deals around the peak of COVID. That was a period where customer health was a major question, counterparty risk generally was soaring, the CARES Act relieved the worst of the industry liquidity panic, but delivery schedules and commitments were under a cloud. We saw 5% handle coupons in the 2020 bond deal before the monster UST and spread rallies that came later into 2021.

Boeing’s balance sheet strain since their earlier 737 MAX 8 crisis brought a massive supply of long-dated, low BBB composite bonds. With a low BBB tier composite rating, that maturity profile makes for an outsized spread risk and unfavorable symmetry if this current 737 MAX situation moves in the wrong direction. Boeing has $46 billion in index debt with $20.9 bn beyond 10 years and $14 billion of that beyond 20 years. That is a disproportionately high mix of long bonds.

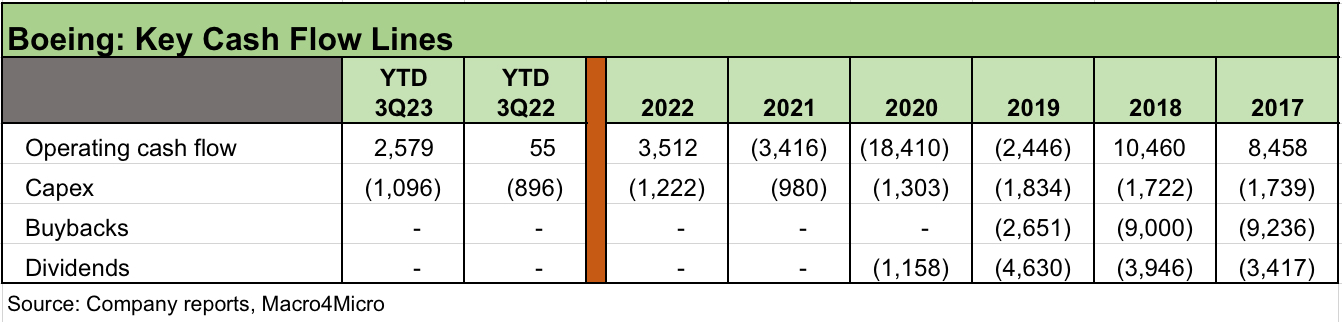

Boeing long-dated paper trades in line with the BBB tier composite where 15+ year BBBs are around +147 bps as of Tuesday close with the overall BBB tier at +130 bps. In Boeing’s case, bondholders are looking at a balance sheet that saw total debt rise from $13.2 billion in 2018 to over $52 bn at 3Q23. That size and rate of growth in both total and net debt is not one you see very often. Net debt (net of cash) rose from $2.3 bn in 2017 to over $45 bn as of 3Q23.

Those borderline ratings are on the cusp of speculative grade, so the need to deploy cash flow to reduce debt holds significance on the equity side as well. Dividends were omitted in early 2020 and buybacks had ended, so the cash flow has a long way to go to get back to a place where dividends and buybacks can begin again.

The flight to a better valuation for stockholders needs certification, deliveries, quality control, FAA satisfaction, and for the cost structure to move in the right direction in commercial airplane operations. In addition, the equity and credit valuations need defense to be profitable (or the market to believe it will happen soon).

Balance sheet weak and cash flow better but hardly reassuring…

We look at the history of the balance sheet and some key cash flow lines further below. Both bondholders and stockholders have plenty to worry about given the need for debt to be materially lower. That is especially the case given the poor run rate on earnings in both commercial and defense operations.

With around $137 bn in market value of equity as of last night’s close, the book value has little to do with reality. The more challenging issue is how Boeing can get back to rewarding shareholders, as it did in the old days of 2018, when there is so much debt now to start scaling down. Below we look at the dividend and buyback history.

The free cash flow guidance is for $10 billion by 2025 and 2026 as restated with the 3Q23 earnings call, but that debt level is not going away any time soon relative to Boeing’s weak run rate on earnings (core operating loss of $1.9 bn YTD 3Q23 as defined by Boeing).

The debate over cash flows could heat up if fears pick up around delivery schedules. Boeing will get pressed on its 4Q23 earnings call, but the company cannot step in front of the FAA (especially against this latest backdrop) and get too specific on certification.

The credit rating agencies have been kind this year with the upward revisions in ratings outlooks as BA’s operational and cash flow performance improved. Boeing free cash flow had been finally turning the corner, but that is relative to a seriously damaged balance sheet.

Boeing can easily absorb more financial pressures, but volatility lurks…

Boeing’s ability to absorb the financial demands of another grounding and delays in deliveries is not something we question given their financial flexibility to tap credit sources in size, its negligible default risk, and its deep base of asset protection. That said, a deterioration of the 737 situation would not bode well for market volatility with such a crowded mix of bonds maturing in 2040 and beyond.

We don’t see downgrades as a major risk at this point, but time will tell on the scale of the disruptions. The trading levels strike us as tight in the face of yet another MAX problem. That last MAX grounding drove Congressional legislation in 2020 (Aircraft Safety and Certification Reform Act) and heightened certification demands, so the uncertainty around FAA caution will get a test here. After all, it gets political in a hurry.

The sequence of events will need to avoid creating any perception of new ratings risk, and the agencies have posted some fresh upward revisions of ratings outlooks in 2023 based on sustained improvement in cash flows and operational performance. Reversing the recent supportive outlook changes would be a major shift for the agencies, but then again stranger things have happened. The market is used to swings in credit spreads for BBBs with an outsized supply of bonds that could “cross under” but that has not happened so far. We caution that the risks of such volatility just increased.

The main threats for the events unfolding would be any new production disruptions or working capital challenges that cause Boeing to possibly revisit the “produce and park” strategy that it was forced to embrace the first time around on the MAX program as BA defended the financial health of its supplier chain.

The chart above is to provide a memory jogger detailing the direct financial impact from the liabilities that were accrued back in 2019 on the first major 737 MAX disruptions (MAX 8). As noted in the chart, that accrual was being paid down along the way with some fine tuning of the estimates across the years. The reduction for payments totaled $7.3 bn since the 2Q19 initial accrual. If you consider the billions lost on a few defense programs, you get a sense of the sheer scale of the numbers when execution veers off course at Boeing.

The current problem brings back bad memories of the last MAX nightmare, but the theoretical costs and numbers associated with this current mess would be much less than the last meltdown with a smaller (but important) base of customers led by United and Alaska. With Southwest holding a major order on the 737 MAX-7 to start in 2024, the customer stakes are high and Boeing needs to keep making progress.

Some questions on the MAX fallout…

How will the loose bolt headlines and supplier chain comments of the last 24 hours play with the FAA on timing?

What kind of charge will the company need to take to reflect potential customer consideration requirements?

How will the market handicap the risks of manufacturing or structural problems as opposed to just enhancing inspection requirements?

When can more damaging scenarios be ruled out?

What will it mean for order books and risks of delays on certification on 737 MAX-7 and 737 MAX-10?

Will Washington and politics complicate the timeline even more given the jaded history of the MAX?

We added the stock chart below with a shorter timeline as a reminder of how much Boeing stock has whipped around across 2023 relative to peer Airbus and vs. the equal weighted S&P. That was true even before this latest set of headlines.

Some defense program blow-ups add to a rough multiyear stretch for Boeing…

As the 737 MAX-9 headlines exploded this week, Defense News just happened to run a story yesterday of how Boeing had experienced crushing losses on its fixed price contract on the KC-46 Refueling Tanker (a derivative of the 767). The estimate of the loss on the program was $7 bn on a program that was valued at $4.9 bn with losses and cost overruns now in excess of that number.

The KC-46 problems are not new to the BA story, but it is another reminder of how the potential for losses, cash draining events, and bad headlines around execution are on a different level at Boeing. They get forgiven for “big numbers” when they go wrong, but they also generated quite a few “big number” problems. The fact is that the company has been able to absorb such hits, but it has come at the expense of the balance sheet debt levels and cash available for shareholders.

The words “Defense” tends to reassure investors since budgets are viewed as guaranteed to rise. That faith ignores the political situation in Washington and budget chaos that will remain a recurring annual state of affairs.

There are also some programs beyond the KC-46 that are hammering results in Defense, Space, and Security operations (e.g. the VC-25 Air Force One program, the MQ-25 unmanned aircraft, and some troubled satellite projects.) The Boeing Defense, Space, and Security segment is running well in the red with negative margins as of 3Q23 with the hope for high single digit positive margins by 2026.

Overall, finding good news has been an infrequent experience at Boeing, and 3Q23 offered some items to grasp onto as did some big bang order books across the year. The questions will be day-to-day for a while until the FAA and NTSB and Boeing offer more granular details on the process. Boeing has been in front of this one over the last 24 hours with apologies and taking responsibility and doing the right things. They learned from the MAX 8 mess. Among the risks from here are what it all means for threats in deliveries, production rates broadly, and how concessions and consideration might flow into new charges and cash liabilities.

I used to cover Aerospace and Defense as well as Airlines and Aircraft Leasing companies (GPA was a doozy) in prior lives (including ILFC before it was bought by AIG). The aircraft finance world and airline fleet management planning process has always been very complex and very sensitive to mishaps at the OEMs. For its part, Boeing has seen a lot of misery in recent years given its setbacks in the single aisle competition vs. Airbus. Airbus has basically won that fight and some loyal customers switched over to ‘the enemy.”

On a macro note, Boeing is an important bellwether for the economy with its tens of thousands of suppliers wagged by the BA supplier-to-OEM chain. BA’s major role in the export markets is also well documented.

Boeing is now a Top 10 BBB issuer in the bond markets wedged between GM and Ford in index face value. Unfortunately for Boeing, the company shares some of the same cusp rating anxiety as those two OEMs. Boeing has a lot more long dated bonds than the auto OEMs, so that is a problem for price exposure for bondholders and market makers. In the end, however, a major player in a critical commercial airplane duopoly and a Top 5 Department of Defense prime contractor presents much less business risk and relative cyclicality than an Auto OEM.