BDCs: Comparative Returns, Private Credit Exposure Chatter, and Silicon Valley Bank

Excerpt from Footnotes and Flashbacks: Week Ending April 2, 2023

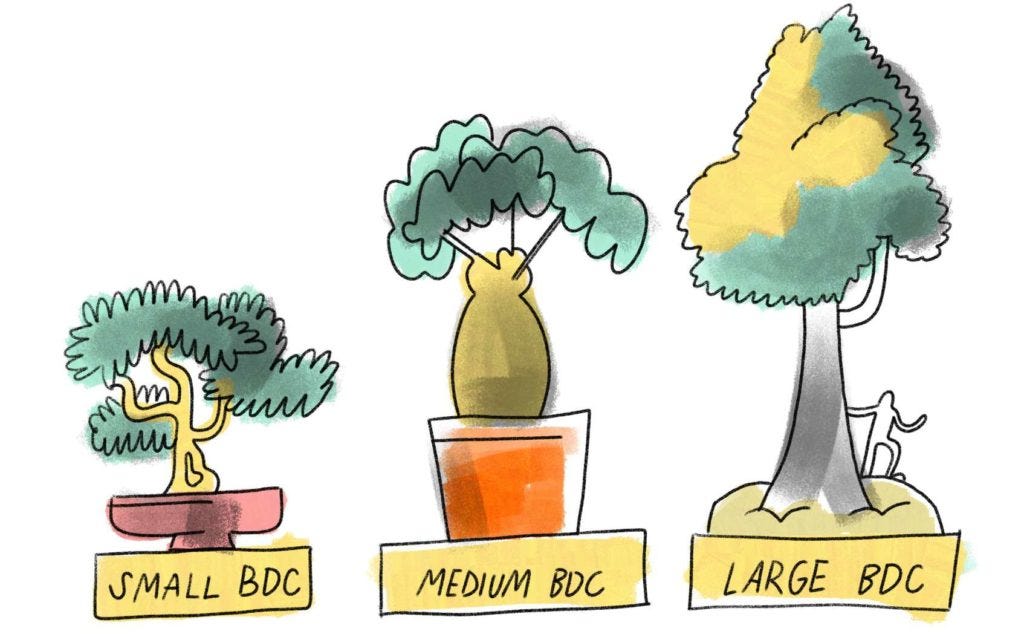

The chart below breaks out BDC equity returns. We line up the companies in the descending order of total return for 1Q23. The list shows a mix of some of the largest BDCs in the equity markets (most with a growing bond market presence as well), and we see a wide range of returns from high to low. These names have a median range of dividend yields in the 10% area. The majority underperformed the S&P 500 over 3 months as the weakness in regional banks and small caps spread to BDCs, which have some commonality with the regionals in small cap and microcap credit exposure.

The market is also hearing chatter that the larger private credit players were circling around “SVB shrapnel” before last week’s acquisition news on the SVB loan portfolio sale to First Citizens (see Silicon Valley Bank: Loans and Haircuts 3-23-23). The BDC managers are some of the best credit players in the market. They have a vested interest in loan performance and expanding their reputation in private credit for asset gathering, so they have more skin in the game beyond the fees on the BDC. That helps the confidence factor beyond just the earnings reports and quarterly results and disclosure. Performance in earnings and asset quality has been solid enough through the December 2022 quarter. The March quarter results will be interesting.