Banks: Leveraged Loans, Classified and Special Mention Mix

We look at the regulators’ Shared National Credit Program report for signs of their views on loan quality and the scale of commitments.

We look at what the most recent Shared National Credit report (“Snick”) issued this month tells us about the quality mix of bank system commitments and outstanding balances.

The regulatory latitude presumably has narrowed with the adverse trend in loan quality, but that has opened up AUM opportunities for the private credit and direct lending markets at just the right time for that growth sector.

The trends in Special Mention and Classified loans turned decidedly negative with COVID and later with inflation fallout with the tightening cycle and myriad supply chain challenges.

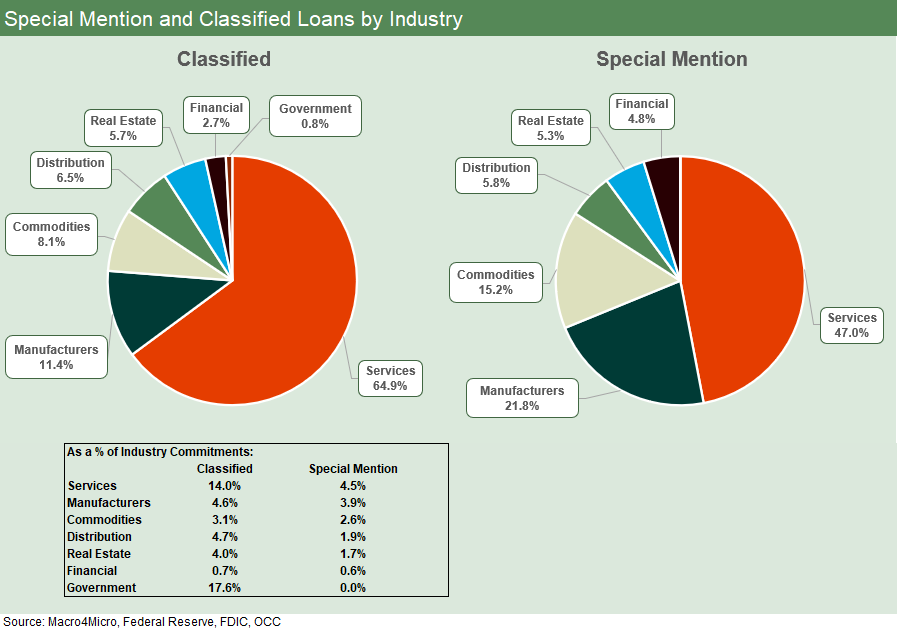

The above chart updates some important information from the Shared National Credit Program (“SNC”) reviews that get published each year under the banner of the Big 3 of the bank regulator triumvirate: the Fed, FDIC, and OCC. While the bank analysts in the investor base and the sell side face the usual need to dive into the bank data and filings with both feet (and for some, up to their torso and then to their necks), these top down vantage points such as the “Snick Report” offer some angles on how bank asset quality is trending from the vantage point of the regulators. Categories such as “Classified” and “Special Mention” operate somewhat as macro watchlist for asset quality (we detail those below).

Credit can drive growth (Econ 101), but there is always the question of how the quality of that loan growth is trending more broadly. The question of how regulators view the directional quality of those loans is always a good macro input given the natural recurring fear across cycles of how excess lending can create quality problems (Reality 101). That is especially the case after so many years of ZIRP that were then buffeted by the most aggressive tightening cycle since Volcker.

Shared national credits as a major subset of loans…

The “shared” part of the title refers to loan commitments shared by a minimum of three banks (raised from a minimum of 2 to 3 in 1998) and a minimum commitment of $100 million (raised from $20 million in 2018). The time series thus has some criteria mix distortions in the longer-term history, but, as with the bond indexes, everything would be much higher regardless. Even just across the years from 2018 the total commitments posted extraordinary growth. Since 2018, the commitments have risen from $4.4 trillion to $6.4 trillion. That is a big jump.

The size cut-off of $100 mn and the criteria of multiple institutions (3 or more) also implies that the total is missing quite a few small cap and midcap borrowers. Those missing could include many borrowers with the profile that might be found in private credit and BDC portfolios (small, mid, or large). That is just one of several caveats around what this population of credit exposures reflects about trends in the longer tail of borrowers in the markets. At the very least, it is safe to say that $6.4 trillion in commitments is a major slice and a very meaningful population of borrowers.

The conclusion of the latest SNC report is pretty clear:

“Overall, SNC credit risk increased but remains moderate.”

That does not change the shape of the colors in the bar chart above at a time when there is an economic expansion underway, and many industries are posting solid enough numbers. For many borrowers, the capital structures include a substantial mix of low coupons on the way to more repricing ahead.

There are also numerous layers for the more leveraged. Stability is the likely near-term trend, but the report gives out broad sector data that shows some already struggling. Only Services jumped out with material risk challenges while Real Estate was mild – so far.

The report specifically calls out TMT and Health Care, and those are not surprising and mirrored in the HY index. Leveraged loans are around half the SNC commitments and a “disproportionate” share of the classified commitments as we detail below.

The larger buckets broken out in the SNC Report include such categories as Real Estate ($561 bn of commitments), Manufacturers ($976 bn in commitments), and the always-murky category of Services ($1.84 trillion) among others.

The Services group ranks at the top of the list for a high share of Classified loan commitments at this point with $257 billion or a 14% share in Classified. Commodities was #2 at $1.0 trillion in commitments with 4.8% Classified. It was not long ago when commodities faced a raft of problems back in 2016. We would highlight that Real Estate has a very low Classified mix at only 4.0%, but we have seen the needle can move quickly there (think NYCB).

The above chart offers some details on the mix of Special Mention and Classified credit exposure for the $6.4 trillion in commitments. The categories are chosen by the regulators for the report.

Fun with definitions…

The categories and terms are part of the arcane world of regulator-speak with “Special Mention” translated as “potential weakness that deserve management’s close attention” and “Classified” as an adverse rating that cuts across three buckets of flags: Substandard, Doubtful and Loss. When the OCC looks at bank exposures, they can flag it as either “Pass” or “Non-pass.” Pass means not rated Special Mention or one of the three deadly sin buckets of Classified.

In some past conversations with bank loan professionals, the impression was given that the tag of “non-pass” was being used as a reign of terror. The story line was that the then-new Leveraged Loan Guidelines were an attempt to materially reduce risk in the bank system. Those guidelines were seen as a major P&L threat before Congress put a dagger in the rule.

Congress was upset by the process and believed that such guidelines were in fact a rule that needed to be put in front of Congress, and the regulators failed to do that. According to the GAO, the 2013 Interagency Guidance on Leveraged Lending was in fact a “rule” under the Congressional Review Act and thus needed to be approved by Congress. It was killed.

In terms of the classified buckets, “Substandard” is basically that commitments are “inadequately protected.” Doubtful means collection is “highly questionable and improbable.” At the bottom of the food chain, “Loss” gets the word “uncollectible” in the definition with the phrase “should be promptly charged off.”

The significance of these labels is more daunting than just “sticks and stones” nametags since they get into the adequacy of reserves and oversight, as well as offering audit trail ammo to outside auditors looking at details and opining on reserves. These categories thus have teeth and take aim at the income statement and balance sheet.

The time series at the top of this commentary shows that the gross numbers are rising for Special Mention plus Classified. The total is up sequentially as a % of total commitments to just under 9% even if still below the COVID 2020 ratio of 12.4%. We see total Classified at $396 billion or up by $105 bn or 35% higher than 2022. We see Special Mention at $177 bn in commitments or up by over 45% in 2023 vs. 2022. That is clearly a negative trend. Within Classified, we see Substandard commitments up by $96 bn or by 36%. “Doubtful” only totals just under $26 bn and “Loss” only slightly above $5 bn.

As investors/lenders with higher risk appetites look for higher returns, it is no wonder there is an opportunity for private credit and direct lending to step into the picture in a bigger way.

While AUM spikes often led to excesses in the past, the potential for successful credit risk managers to hang out their shingle and ramp up their pitchbook presentations has been ongoing and is not likely to slow down. There is no need for asset allocators to rush at the peak of a credit cycle, but the credit allocation shift is ongoing, and the headlines drive that home.

Opportunity for the new product wave…

Asset allocation runs the full gamut of risk vs. expected returns with widely varied secondary liquidity needs. Whether duration risk or floating rate risk, credit risk or equity risk, structurally senior risk and trade-offs on loss given default exposure, there is always an alternative – including cash these days as a viable allocation for the hesitant or patient.

There will be lots of questions on due diligence, track records, quality of marks, etc., but that still gets back to income needs, risk appetites, and return expectations over a time horizon that works for the investor.

In a market with tight spreads and uncertain yield curve dynamics and too many debates on when the recession will (inevitably) come home to roost, the grown-ups will still need to make their call on how much risk they can accept and at what price. They don’t have to spend it all at once. There will inevitably be “gap risk” in pricing when things go wrong and questions on valuations, but that is not a new challenge for bank books or for insurance private placement portfolios going back to the early 1980s and 1970s.

The growth in commitments above tells a story with $6.4 trillion in commitments and (not shown) $3.14 trillion of that outstanding as of the most recent SNC Report date (from 1Q23 and 3Q23 reviews, report released this month Feb 2024).

The trajectory of those numbers with regional banks under a cloud, and after a long period of major bank and broker consolidation, underscores why more sources of credit are needed for a wider range of borrowers in the middle market and small cap market as well as for the higher risk deals that private equity is so well known for.

This was one of those “food for thought” commentaries, and the increased visibility of private credit will bring a lot more conversation on these topics. Disintermediation has been a topic since the 1980s as the corporate bond market and HY bond market was born. Back in the 1980s, 3-piece private placement insurance types started moving over to the public corporate bond trading bond desks to join the hoi polloi. The creation of new vehicles for credit risk never slowed down.

The private credit market is ironically a return to the private placement model with more floating rates and a lot more history in modeling credit risk and framing returns. The main similarity will be opaque valuation and many tailored structures that fit the needs of lender and borrower.

A note on leveraged lending…

We are only doing a summary recap of the SNC report, but leveraged loans get much of the attention in the sample review. The report cites 35% of the “agent-identified” leverage loan commitment and 28% of the borrowers were part of the sample. That included $1.0 trillion on leveraged lending commitments sampled. Banks held 61% of the identified loan commitments. Around 85% of the Classified commitments were leveraged loans. Transportation Services was among the focus industries with over 22% Special Mention and Classified followed by TMT at over 19% and Healthcare and Pharma at over 14%. That is not a surprising mix given the issues in the bond markets for those subjects.

In the end, the SNC report drove home that the quality is vulnerable and numbers very large. The cyclical questions are the same ones we all face every day.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com