Autos: Suppliers, Volume Wildcards, and Capex Demands

Excerpt from Footnotes and Flashbacks: Week Ending Feb 10, 2023

With Magna (MGA) and BorgWarner (BWA) reporting this past week, we looked at their results for cyclical color. The guidance they offer on what lies ahead is balanced even if MGA has some earnings baggage right now. If we exclude Cummins from the OE supplier peer group as a somewhat distinct animal and truck market supplier (CMI has a market cap of almost $35 billion), MGA and BWA would rank #2 and #3 in market caps among the biggest US-centric auto suppliers we watch (see chart below). Aptiv would rank #1 in that group among US operators.

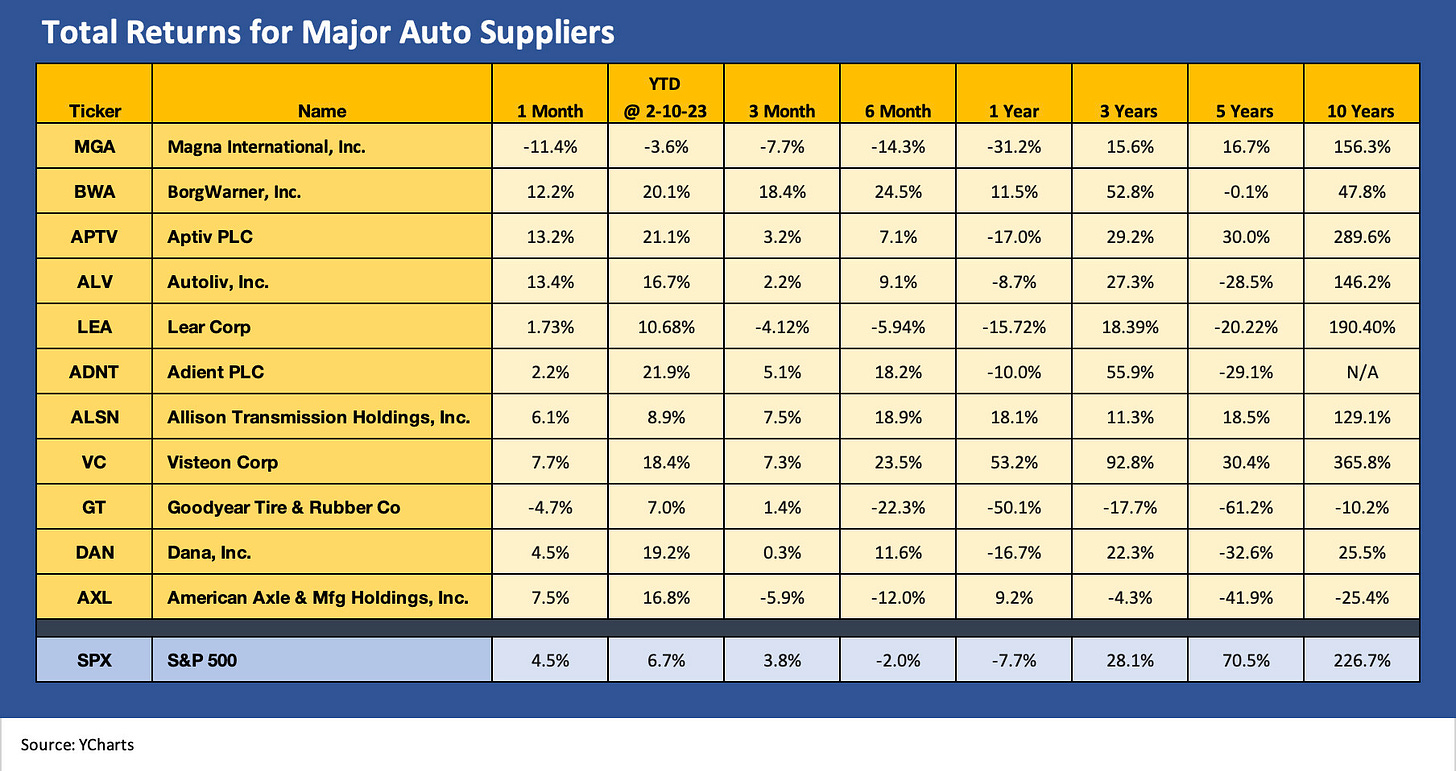

We break out the stock returns in the table below, and the recent trends are not showing much anxiety after the recession level production rates of the past two years on supplier chain issuers leaves production volumes biased to the upside. We had detailed the SAAR rates earlier in the Macro section above (note: SAAR is retail sales while production is the key driver of the supplier revenues).

The 14.3 median from Feb 2020 to Jan 2023 leaves ample room for higher production rates in 2023 even with a stall in the broader economy (if that in fact unfolds). The consensus estimates that we see for the US and North America are calling for higher production rates than the past two years as well as higher sales for the key US market. Production drives the OE suppliers, but SAAR and production are intertwined.

Interestingly, the stock performance results of Magna and BWA are very different even with each one of them making their way onto various top pick lists in recent years. We will need to look at the two in separate commentaries given the constraints in this weekly note, but both are investing heavily to expand their electric vehicle supplier offerings and offer emissions advances that can support the valuation of their equities.

BWA has guided to higher revenue and earnings and is a free cash flow generator, so that supports the theme of cyclical strength. MGA is calling for sales to grow in 2023 but preferred to talk about margins and 2025 rather than 2023. The equity markets reacted accordingly. MGA has an acquisition underway (Veoneer) that complicates guidance. Sales guidance from MGA calls for 6% to 8% growth per year and improving free cash flow, so the investment themes are intact. Significant investments are emphasized by MGA, who is clearly playing the long game on profitability and not the short-term margin pitch. That will likely catch on as more EV related investment gets made that are not accretive near term but will be to valuation in time.

In contrast to the cyclical indicators one can get from the major Capital Goods or Auto OEM, the suppliers are literally all “over the place” in their strategies, relative competitive advantages in product mix and technology positions, and certainty in their financial risk profiles and ability to sustain very high rates of investment required to meet the demands in the EV race.

Looking back to the 3 to 5 year time horizons one gets an idea of who is getting it done, but the recent years have made it tougher on some names such as Magna in holding onto the valuation excitement of their “EV buzz” and getting their earnings and cash flow to match their valuation parameters.

Both Magna and BorgWarner are considered stellar operators in the space who have fought through all the years of customer crises, financial systemic turmoil, and COVID to be well positioned for the intermediate term rise of EVs. In other words, they are good names to track for cyclical signals and how the EV vs. ICE war is playing out in investment planning.