Ally: Surprise to the Upside in Mixed Consumer Finance Picture

Excerpt from Footnotes and Flashbacks: Week Ending January 20, 2023

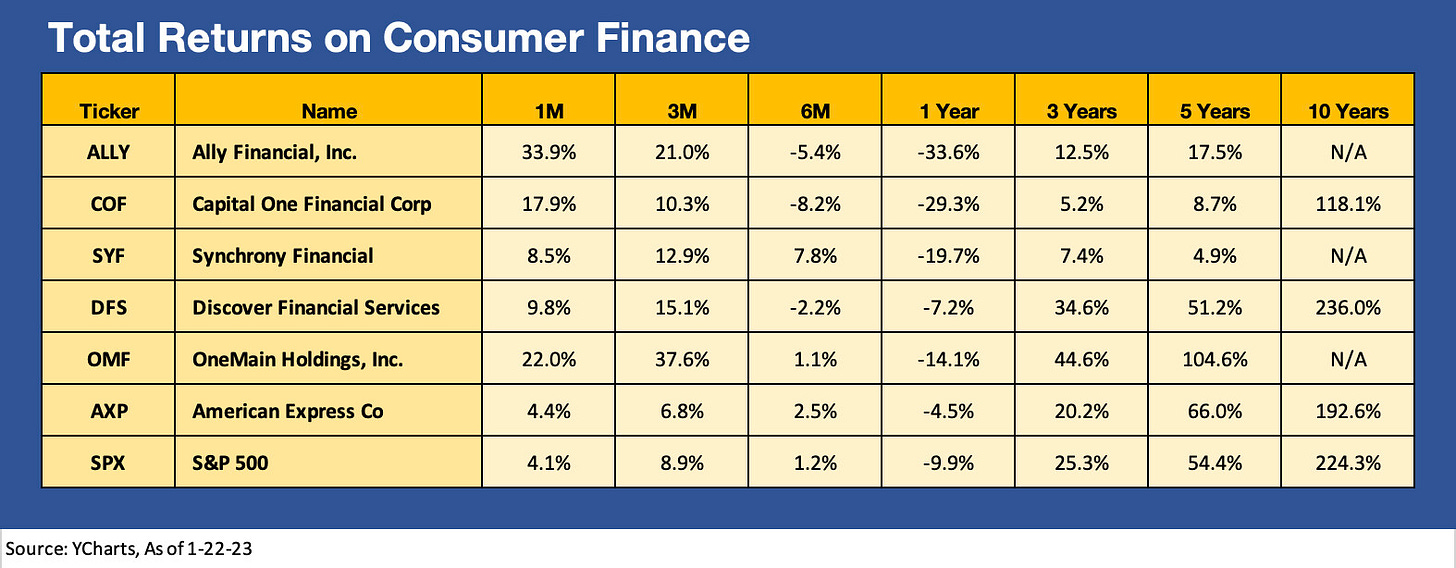

Ally surprised the market with solid numbers and guidance and was rewarded with a +20% stock move on Friday. The street flavor was pretty guarded on the name, and the results caught some on the wrong side of being bearish – at least for the short term. The idea that consumer credit quality will deteriorate, and net interest margins will get squeezed on funding costs is a common problem in the financial space. Declining used car prices also raise risks of loss exposure on repossession. The stock return table below shows Ally part of a consumer finance peer group with a broad range of results but Ally getting some favorable traction in more recent periods even as the used car market is faltering. That comes after Ally was one of the worst LTM performers.

Consumer finance is on everyone’s radar screen as the cyclical debates go back and forth and handicapping the health of the consumer sector continues. With savings rates low and consumption high and credit cards in heavy use, the asset quality cycle will remain under a microscope. With rates rising and recession chatter loud, the 50-year lows in unemployment will have to move a lot higher from here to really rattle consumer finance to a rate that would be in line with a steep downturn.

In the meantime, asset yields on their books are high as Ally generated record net interest margin. Net charge-offs for retail were relatively low for the full year but are trending higher later in the year and credit quality “normalizes” (as in gets worse). The expectation is that the 2020-2021 vintage retail assets will drive higher losses in 2023. Provisioning will be important to watch in a higher rate environment with uncertain recession risks in looming. While the waters for auto retail are not untested in a stagflation environment for auto receivables, such a macro backdrop has not been tested for a long time. The guidance for 2024 was very measured and constructive with Retail net charge-offs only forecasted in the high 1% range and total charge-offs in the low 1% range.